Scotiabank sees its Canadian branches as a key channel for customer advice and sales, and for brand reinforcement. Robin Arnfield discusses channel strategy with James Popalis, Toronto based vice-president of omnichannel development

As part of its plan to drive in-branch transactions to under 10% of total transactions, Scotiabank uses its branch channel to encourage digital banking adoption.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“My role is to look at our physical footprint in terms of where we open, close and relocate branches,” James Popalis, vice-president of omnichannel development, tells RBI.

“I consider what makes a good market for us and where we should allocate capital. Another area is the modelling of branch staffing for specific locations.”

Popalis is responsible for overall management and future strategy for Scotiabank’s Canadian ATM fleet. “Another area I look after is digital adoption and migration and strategy for our mobile app,” he says. “I also oversee our contact centres to figure out the reasons for call volumes and spikes, and what the customer irritants are. A priority is creating more self-service opportunities for clients, and to empower them to use mobile or desktop banking for enquiries.”

Canada generates 52% of all Scotiabank’s revenues in geographic terms. In a recent investor presentation, Scotiabank said its Canadian retail banking revenues had grown by 3% year on year to C$1.95bn in the third quarter of 2018.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Digital transformation

Scotiabank has set five key priorities for its Canadian and international banking businesses: customer focus, structural costs transformation, business mix alignment, leadership and digital transformation.

In 2017, Scotiabank said its objective was to improve its all-bank productivity ratio to under 50%, to achieve at least 70% digital adoption by its customers by 2021, at least 50% of products being sold digitally, and inbranch financial transactions accounting for under 10% of total transactions by 2021.

In its 2018 Investor Day presentation, Scotiabank said it is making good progress towards these goals. Across its Canadian and Latin American businesses, in-branch financial transactions are down to 20% in fiscal 2018 ending 31 October, from 22% in fiscal 2017. Digital adoption has risen to 35% in fiscal 2018 from 29% in fiscal 2017, and digital retail sales to 20% from 15% in fiscal 2017.

Scotiabank branches

Popalis says Scotiabank’s strategy is not a forced migration to digital. “The branch is important, as it’s a pillar of the community and will remain a cornerstone,” he says.

“But simple transactions will migrate to digital channels and contact centres. We don’t say to clients that we don’t want them to use branches. But we explain that digital is more convenient, which means our branch staff can focus on deep conversations with clients when they come in with a problem or need advice.”

Popalis says Scotiabank focuses on being emotionally engaged with clients in order to help them with their needs. “Our branch staff decide as to whether the client can be assisted in the branch or needs to be referred to a specialist,” he says.

“We align all our resources and bring the bank to our customers. We’re agnostic by channel and by department, and aim to have seamless interactions with clients.”

Another strategy is community engagement. Scotiabank has a national brand image and brand story, but wants to ensure that its branches have a connection with the local community and a local component.

“This is a huge focus for us,” Popalis explains. “We want to resonate with the communities we serve, for example via hockey, marathons, other sporting events and arts programmes.”

Scotiabank has deployed digital screens in its Canadian branches. “We leverage in-branch digital screens to advertise what is happening in a branch or a community event,” says Popalis. “We also use digital screens for national branding purposes if we have something going on nationally.”

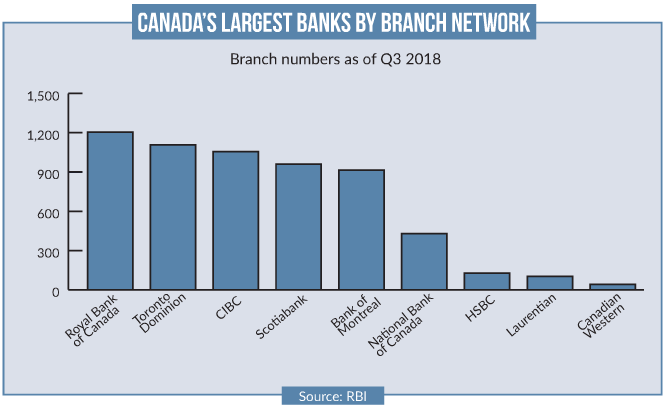

In contrast to major retail banks in the UK and across much of Europe, Scotiabank’s branch network has only inched down in recent years. It ended the third quarter of 2018 with 960 branches in Canada, down from 1,010 three years ago.

ATM

“There’s a lot of debate on the future of ATMs,” says Popalis. “We think people will always need quick access to cash, so ATMs will remain ubiquitous. Scotiabank will continue to have ATMs in our branches, and use Scotiabank-branded ATMs supplied by third parties.”

Outsourced ATMs are surcharge-free for Scotiabank customers. Scotiabank has a partnership with Stanley Security, a subsidiary of Black & Decker, to provide ATMs in Couche Tard supermarkets in Quebec and in the community hockey areas the bank sponsors in Canada. It also has a contract with Cardtronics for ATMs in Canadian 7-Eleven stores.

“We have a thin network in Western Canada compared to some of our competitors,” says Popalis. “So we partnered with Cardtronics to get our ATMs and our brand into 7-Eleven stores. The importance of ATMs for us is cash accessibility and branding. They give the perceived notion that a bank is a lot bigger than it actually is, if people see its ATMs.”

In Western Canada, Coast Capital Savings Federal Credit Union and Vancity are significant players in the Vancouver area, while ATB is a key banking provider in Alberta.

“We’re not going to open up a ton of branches in Western Canada, but we use relationships with third-party ATM deployers to get our brand out there,” says Popalis. “For us, cash accessibility and brand awareness are important.

“When we optimise our footprint, we may close a number of branches if there isn’t a return on investment there, as customers are banking more online so don’t need advisory capabilities in those branches. But we leave an ATM behind, so local people can continue to do banking and have access to cash.”

Popalis notes that Scotiabank is currently rolling out its new ATMs across Canada. “We’ll have envelope-free deposits across our ATM network,” he says. “Each branch will have multi-denomination ATMs where you can select your choice of bank note denominations: fives, tens, twenties, fifties and hundreds. Next Spring, we’ll change our ATM transaction screen flow so the mobile app and ATM screen will be identical.”

Market strategy

Scotiabank has migrated to a market-based approach to branch network planning.

“Depending on our footprint coverage coupled with certain market characteristics, we determine how we orient our branches and deploy different types of format,” says Popalis.

Globally, Scotiabank has used design agency Ideo for its new branch formats. “We have different branch formats depending on the transactions or services that are needed in a specific area,” says Popalis.

Popalis says Scotiabank examines what individual markets need. “We ask: ‘Does this market need tellers?’” he says. “If we have an existing full-service branch in close proximity, it doesn’t make sense to have tellers in the new branch, as clients can have access to an ATM.”

Scotiabank’s strategy in large urban markets such as Montreal, Vancouver or Toronto is to infill. “In these markets, we have a lot of branches in the downtown area, as it’s very important for our branding to have a strong presence there,” Popalis says.

Scotiabank has “solution centres”, which are branches with no tellers. “If you have a problem, you can go to the solutions centre for help,” he says. “The staff are also focused on providing advice, for example for mortgages or investments.”

In Canada’s major cities, Scotiabank operates what it terms “showcase” branches. It also deploys full-service branches where it houses experts in different services such as wealth management, commercial and small business banking, and retail banking. In addition, Scotiabank is piloting express branches across Canada targeted at millennials.

“Our express branches let you open accounts and get access to cash,” explains Popalis. “They are intended to help millennials to get started with us. We answer their questions or co-pilot them using a universal banker on how to onboard quickly digitally or to use digital banking.”

Popalis says Scotiabank has found that express branches are a format that works. “Our express branches in Quebec are very successful,” he explains. “But, rather than focus on specific formats, we prefer to think about what are the needs of a local community such as tellers or ATMs.”

Universal bankers

Popalis notes that Scotiabank has more universal bankers than its competition. “Around 80% of our Canadian branches have universal bankers,” he says. “The universal bankers have tablets where they can do digital demonstrations and onboard simple products with clients. Our branch advisors are encouraged to show their screens to clients, so they can see how to download apps and bank online.”

When Scotiabank opens a new branch, the clients are a mix of all age groups, from students, recent graduates, new immigrants to retired or established people.

“People have a need to have a branch in close proximity,” Popalis says. “Even if they never enter the branch, they feel more confident engaging with their bank if it has ATMs and branches.”

Scotiabank has a huge focus on newcomers to Canada. “There are five big banks dominating Canada, so we have to get new customers from the new-to-Canada market,” Popalis says.

“We have a new arrival programme and engage with new immigrants to win new customers. We want to make the bank account-application process seamless for them, as they have major challenges to worry about when moving to Canada. They just want an easy experience with banking.

“Once immigrants are our customers, we want to stay continuously engaged with them, so they don’t go to another bank. We don’t just want to sign them up with Scotiabank accounts and say: ‘Goodbye, we won’t be in touch.’ Digital banking makes it much easier to have frequent contacts with new customers, rather than traditional methods such as phoning them or sending letters.”

Data optimisation

“Scotiabank’s CEO, Brian Porter, has a big focus on making sure we have sound data when we make business decisions, such as investing capital to fund projects,” says Popalis.

“We need to make sure we understand the problem we’re trying to solve, based on accurate data. Instead of saying: ‘I have a feeling that clients want this product,’ we use data to get the right answer on what products to offer. We’re trying to analyse the copious amounts of data we collect into order to understand how customers bank, and how they save and invest money for the future.”

Scotiabank’s management team attend data analytics courses that include AI and machine learning and modelling. “Data analytics is a core competency for anyone joining Scotiabank,” Popalis says.

Scotiabank has created fintech factories in Toronto and four Latin America cities, which feed into the bank’s data analytics. “Our fintech factories focus on how to digitise the banking experience,” explains Popalis. “We’re big on customer journey-mapping, on understanding how customers onboard and how they engage with us.”

Popalis says Scotiabank learns a lot from Tangerine, its Canadian standalone digital bank. “We learn from it how a virtual bank operates and how to leverage Tangerine to get better market penetration,” he says.

While declining to comment on Quebec based Desjardins’ decision to close its virtual-only subsidiary, Zag Bank, Popalis says banks need a physical brand presence for customers to feel comfortable banking with it. “Tangerine is backed by Scotiabank’s brand,” he notes. “With a thin branch network, it’s very hard to win a customer base. While digital-only banks can offer higher rates than traditional banks, this is only a short-term play to attract customers.

“We don’t want to get into a pricing war – we’re about offering sound advice to our customers and understanding them, instead of being like a car dealer who gives you the deal of the day. We want to be there for the client when their short-term deposit matures a year later, and advise them on what to do with the funds.”

Popalis says Scotiabank spends a lot of time educating branch staff so they know how to respond to customers’ needs. “Branch staff can’t be expert on every one of our products,” he says. “So staff need to be able to refer clients to the right channel or right expert.”