Ulster Bank vertical banknotes will go into circulation on 27 February.

The new polymer banknotes will last up to 2.5 times longer than traditional cotton notes and feature anti-fraud measures.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

In particular, the Ulster Bank vertical banknotes feature colour shifting ink in the shape of the Ulster Bank logo.

The vertical orientation of the new Ulster Bank notes has been attracting much interest.

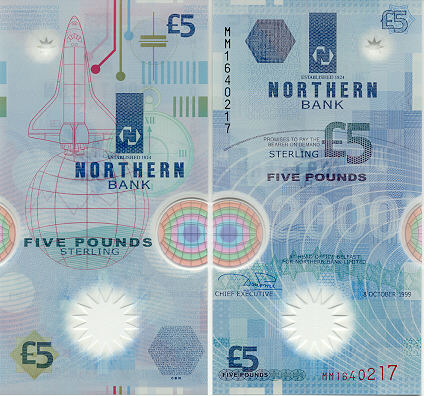

But contrary to much media comment, such a design feature while rare has been used once before in Northern Ireland.

Northern Bank (acquired by Danske in 2005) was the first UK issuer of a polymer banknote. And a vertically-oriented one to boot.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn 1999, Northern Bank took the decision to issue a commemorative note to celebrate the new millennium.

The original vertical notes were produced by the Canadian Bank Note Company, Limited and issued into circulation in early 2000.

Printed on Guardian polymer substrate, these designs were cutting-edge at the time as they represented a significant departure from the contemporary banknote design.

Ulster Bank vertical banknotes: Strangford Lough & Lough Erne

The new Ulster Bank £5 note features images of Strangford Lough and Brent Geese. Meanwhile, the £10 Ulster note despicts Lough Erne, an Irish hare and Guelder rose shrubs.

Local rivals – Bank of Ireland, RBS’ Ulster Bank and Danske – will dispense new polymer notes in Northern Ireland this month.

Ulster Bank local rivals – Bank of Ireland and Danske – will also dispense new polymer notes this month.

But First Trust Bank, the Northern Ireland subsidiary of Allied Irish is to stop printing and dispensing its own banknotes.

In their place, First Trust will dispense Bank of England banknotes.

Ulster Bank: FY2018 profits rise

Ulster Bank, the Irish subsidiary of Royal Bank of Scotland, reported a net profit for fiscal 2018 of £47m (2017:£39m).

2018 highlights include a 12 basis points rise in the net interest margin to 1.35%.

Reducing the Ulster Bank cost-income ratio remains a work in progress but it has improved 6 percentage points to 75%.

Other highlights include a rise from 55% to 61% of Ulster Bank’s digitally active customers.

On the other hand, Ulster Bank scores poorly in the second CMA banking service quality survey, released on 15 February.

Of the nine largest current account providers in Northern Ireland, Ulster ranks 7th for overall service quality.

Nationwide topped the survey ahead of HSBC, Barclays and Danske.

Ulster also ranks 7th out of nine for online and mobile banking and 6th for service in branches.