With the rise of the digital age, social media has become hugely important for businesses when promoting their brands. Evie Rusman ranks the world’s top financial institutions on Instagram, and speaks to experts on the importance of social media

Every day, more and more banks are making Instagram a priority and are producing digital content that allows them to engage as well as get instant feedback from their clientele.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Even though digital platforms appear to have been around for almost forever, it was only recently that the financial sector decided to make the leap and grow their social following.

This transition from traditional banking practices to newer, more tech savvy methods has become essential as bank branches continue to close their doors for good.

Over the last year, the world’s biggest banks have been developing their digital strategy in order to bring their brand to life and encourage customers to connect.

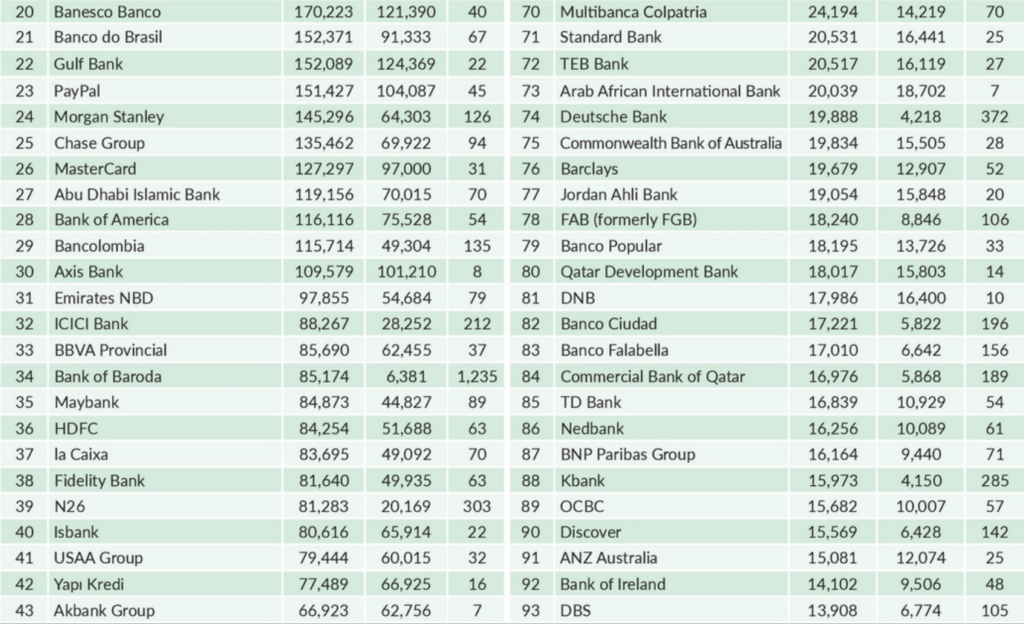

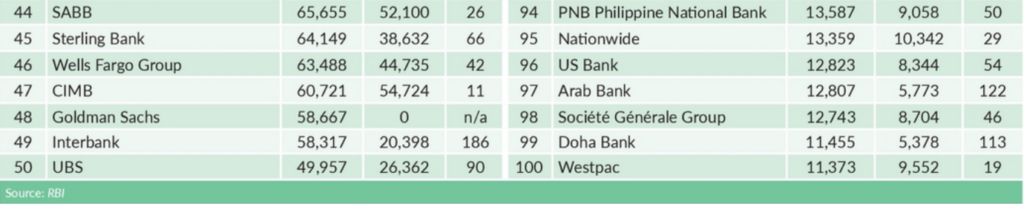

As a result, the top banks, which feature in RBI’s list of the Top 100 financial institutions on Instagram, have rapidly expanded their Instagram followers, and in many cases the number of followers has more than quadrupled.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe results are in

The two frontrunners in RBI’s list are the State Bank of India and First Bank of Nigeria.

Moving into the top spot, the State Bank of India (SBI) has more than doubled its following this year from 514,466 to 1,237,342, and as it stands SBI is the only bank to hit one million followers.

SBI previously held second place in the table but this year by passed India’s Yes Bank, who was one of the very few institutions to actually lose followers, moving from 619,911 to 536,991.

Another big change comes as the First Bank of Nigeria, climbs up the ranks from 16th to second in RBI’s list.

The Nigerian bank boasts one of the biggest increases in its number of Instagram followers in comparison to any other financial institution, and since 2018 FirstBank’s following has increased by over 500% from 121,456 to 731,908.

Why such a rapid increase? Speaking to RBI, Chinwe Bode-Akinwande, Head of Digital Marketing & Innovations, FirstBank, explains how the company has made online engagement a priority.

She says: “We are indeed proud of this achievement and look forward to meeting more milestones with the passion and partnership of our engaged online community and ultimately hope to become number one.

“Our strategy is ensuring we are putting out relevant content to our followers and prospects, as well as driving aggressive acquisition and engagements using an always-on approach. This has seen us make investment in digital marketing activities that continuously drive and meet changing demand while consistently engaging the online community.”

This rapid influx of followers demonstrates the growing importance of social media and shows how financial institutions are investing an extensive amount of time into creating a more definite social media presence.

Speaking on Instagram, Bode-Akinwande says: “With over 500 million users, Instagram is a marketing channel that FirstBank uses to attract the younger more digitally savvy customers and other stakeholders, while strategically engaging a host of others effectively on other social and traditional media.

“We recognise that the increase in our social media following is a direct signal of Nigerians and our other stakeholders all over the world, celebrating this achievement with us. This makes us feel immensely proud of our business, our heritage and our contributions to national and global development.”

As part of its 125th anniversary, FirstBank has introduced a number of different initiatives to engage with customers both online and offline.

Bode-Akinwande says: “These engagements have greatly influenced the rapid influx of followers across various channels and new customers alongside a turbo-charged digital marketing strategy.”

More than just banks

Banks are not the only financial institutions to feature in RBI’s list. This does not come as a shock as global payments companies PayPal and Mastercard were amongst some of the top performers last year.

Again, Mastercard is one of the only payments companies to feature towards the top end of RBI’s list.

Placing a solid 26th, Mastercard has increased its Instagram following from 97,000 to 127,297. This year, the American-based company has put more focus on business objectives as a means to come up with a strategy when producing social media content.

Jim Issokson, Senior Vice-President of North America Communications & Digital Marketing, Mastercard, tells RBI: “Instagram is a critical channel for us, as we use it to support nearly all of our marketing and communications objectives. We are seeing great success with Instagram Stories, as well as through promoted Instagram posts that help drive traffic to our sites.

“We’re looking at Instagram’s latest commerce-enabled opportunities, and finding ways to integrate that make sense for our merchant partners and bank issuers.”

Speaking on digital strategy, Issokson adds: “In terms of strategy, we don’t think there’s such thing as “an Instagram strategy”. Instead, we look at our business and brand objectives and we determine the right strategy to drive against those priorities.

“Depending on the content type, timing, target audience, and so on, we then determine the right platforms and tactics to give us the best chance at success. This approach is working well for us, and ensures we always evaluate the best options for each unique opportunity.”

Sponsored content

According to industry experts, the strongest performing Instagram content was either sponsored or promoted as these posts drive more traffic to site, allowing followers to grow.

Issokson says: “So much of the benefit we derive extends far beyond our “owned” audience (followers), and instead extends through both discovery and our paid posts into new audiences within passion categories and lifestyle interests.

“By tapping into people’s passions with content that brings them closer to something they want to experience, our content helps give people a digital sampling of the incredible things that they get to experience as a Mastercard cardholder.

“We do see our audience grow within these passions as we have different types of content live. For example, we know that content related to the MLB All-Star Game and our “Tap & Go” activation will increase baseball fans within our audience,” he adds.

Santander has also had plenty of success through sponsored content. The Spanish banking group place 19th on RBI’s Top 100 list, expanding its following from 70,325 to 180,302.

Carlos Relloso, Head of Social Media at Santander group, tells RBI: “We feel very good about our global ranking. Every time you are in the top performing countries you feel good but we are competing to be number one and so we want to be the best.

“Within the last year, we have learnt a lot about what content performs well on this specific platform. Our most popular content is normally sponsored.

“Everything relating to football is performing really well and recently we formed an alliance with the MotoE World Cup in which related content has proven to be very popular.”

Engaging with customers

Since the launch of digital platforms like Instagram, there has been a huge opportunity for banks to not only engage directly with customers but to produce content specifically tailored to them. Additionally, Instagram allows banks to provide quicker, more instant customer service.

Relloso says: “When we look to Instagram, we focus more on customer engagement. As a result, our Instagram and LinkedIn followers have begun to grow faster and Instagram has been an amazing platform for us to discover a new way to interact with customers and new audiences.

“Social media has also provided us with the opportunity for us to listen to our customers. And so, operationally, our customer care team can communicate with our followers instantly.”

One of the ways Santander has been able to create customer-specific content is through testing out different styles of story-telling and learning how to utilise different tools on Instagram in order to see which content gets the most reaction.

Relloso explains: “As part of our strategy this year, we worked on producing content that engages with our audience. Through this we have learnt a lot. On Instagram it is not just about posting images but about using Instagram stories and curating videos specifically for Instagram, which is different to many other networks.”

The Spanish banking branch has also made an attempt at creating a more personal connection with customers by producing content that demonstrates what it is like to work for them.

Relloso says: “This year, we have also explored some financial and location content, where we try to educate people about financial firms in order to make people understand how the finance world operates.

“We have started sharing stories about what goes on behind-the-scenes across our global branches and what it is like to work in a bank. This is good for us as we get to talk to customers about how you can grow as a professional in the company.”

Are banks doing enough?

Even though, banks are continuing to put more time and money into investing in digital content, there is speculation that they are not being active enough on social media.

Daniel Seavers, Content Marketing Officer at Talkwalker, tells RBI: “We have seen a rise in banks investing in digital content, though they need to focus now on being active rather than reactive.

“Many are using social channels effectively as a way to respond to client complaints, but they aren’t working as hard on digital content that will initiate client conversations.

“Consumers want to be engaged, informed, and inspired by their bank just as much as any other brand. But we’re just not seeing the industry leading those types of conversation, yet.”