Fears surrounding the impact of Covid-19 have plagued the global economy, with many experts predicting the potential onset of a global recession. As well as this, Australia’s retail banking sector is set to take a hit. Evie Rusman writes

In today’s current economic climate, banks across Australia have been adapting to a new form of operating – a number of them have introduced new online and digital services. However, the pressure ensued by Covid-19 has been significant and in many ways has left banks feeling vulnerable as they are forced to drop interest rates and defer payments.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

GlobalData’s recent report, Coronavirus (Covid-19) Sector Impact: Retail Banking – Australia, highlights the key trends expected to arise in Australia’s banking sector over the next few months.

Bank profits

As the pandemic continues to grow in Australia, banks’ quarterly profits are expected to drop. According to GlobalData, the most dramatic drop will come from the largest banks but there will be a more enduring squeeze on smaller authorised deposit-taking institutions (ADI). The report suggests that this will result in the long-term consolidation of the market.

In addition, a rise in ADIs, fuelled by the launch of digital challengers and neo-banks, appears set to reverse. GlobalData predicts that, within the next five years, a quarter of ADIs may exit the market via sales or mergers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

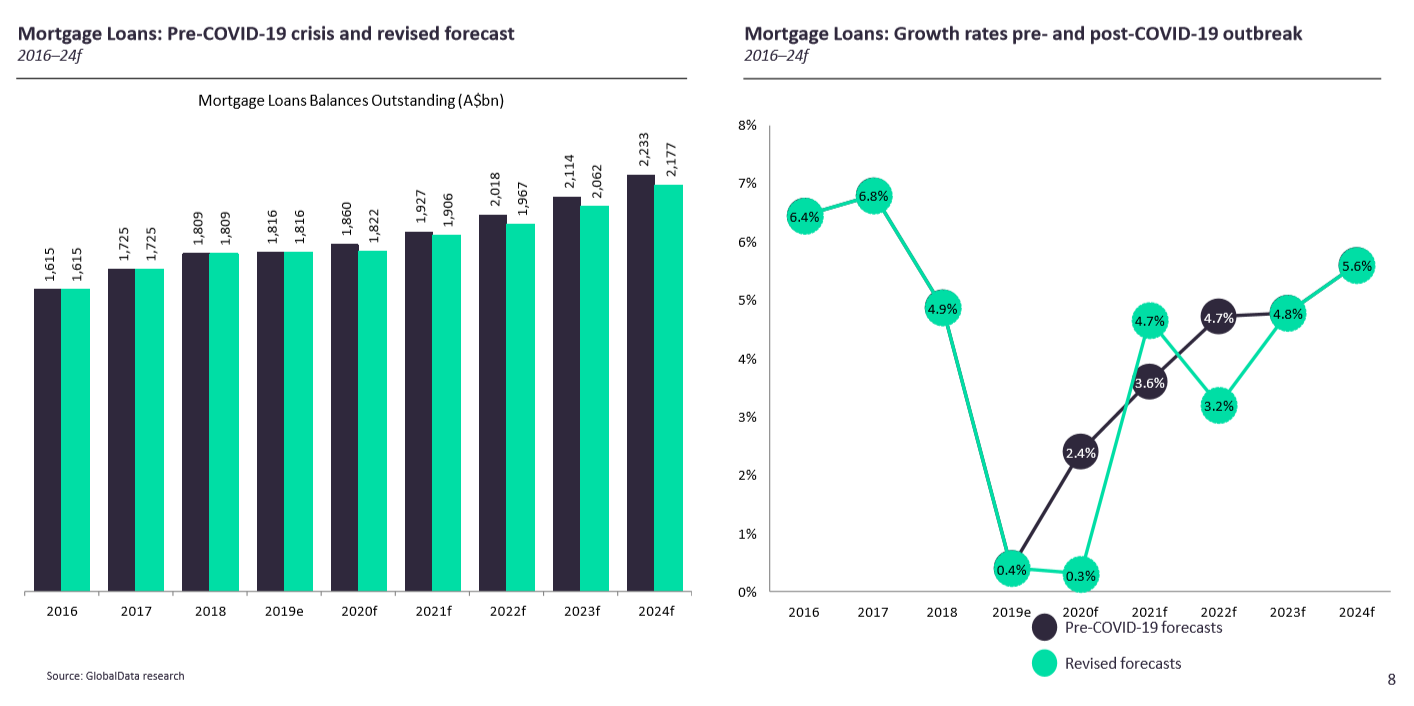

By GlobalDataLoan growth

Loan growth is also set to take a hit, despite efforts to continue business lending at attractive rates. GlobalData states that the RBA and government funding to lenders will help, but it is highly uncertain whether there will be sufficient appetite for credit to drive anything more than marginal increases in 2020.

The company also predicts that mortgage lending will suffer significantly during the coming weeks, or even months, of lockdown and mandatory social distancing as viewing a property safely becomes an unrealistic challenge.

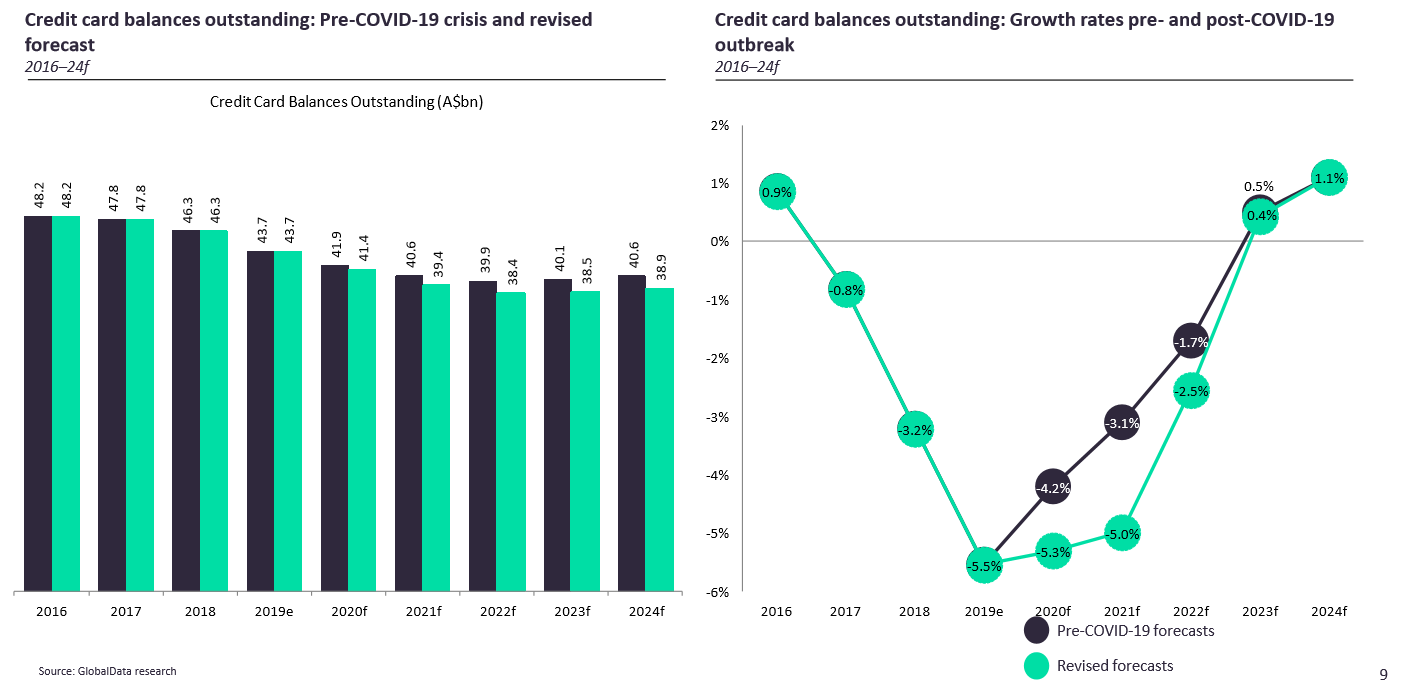

Furthermore, GlobalData outlines that spending will decline, making businesses hesitant to take out loans even when they have no income.

Vulnerability

Retail customers and small businesses are much more vulnerable as a result of Covid-19. Therefore, GlobalData predicts that banks could see a rise in delinquency rate, resulting in higher non-performing assets.

This comes as more and more banks across the country are reducing interest rates and deferring payments. In April, Commenwealth Bank announced it would reduce its interest rates on credit cards and postpone home loan repayment for six months.

What bank loans are Australian banks offering?

ANZ

ANZ’s home loan customers are able to put their repayments on hold for up to six months – the bank says it will “check in with you after three months” if you do so. In addition, interest run up during the period is capitalised.

Commonwealth Bank

Like ANZ, home loan customers can defer payments for up to six months. Interest is capitalised.

NAB

Repayments can also be deferred for up to six months. Furthermore, payments can also be reduced during the pandemic.

Westpac

Westpac is offering a three-month home loan payment holiday, with another three months available after review.