American investment manager Fidelity is reportedly in advanced talks to pick a £100m stake in UK-based challenger bank Starling Bank.

Fidelity Management & Research (FMR) is in advanced discussions with Starling to lead a £200m funding round for the UK digital bank, Sky News reported.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The Massachusetts-based investment giant will invest in Starling despite the scepticism about valuations in the sector, noted the report.

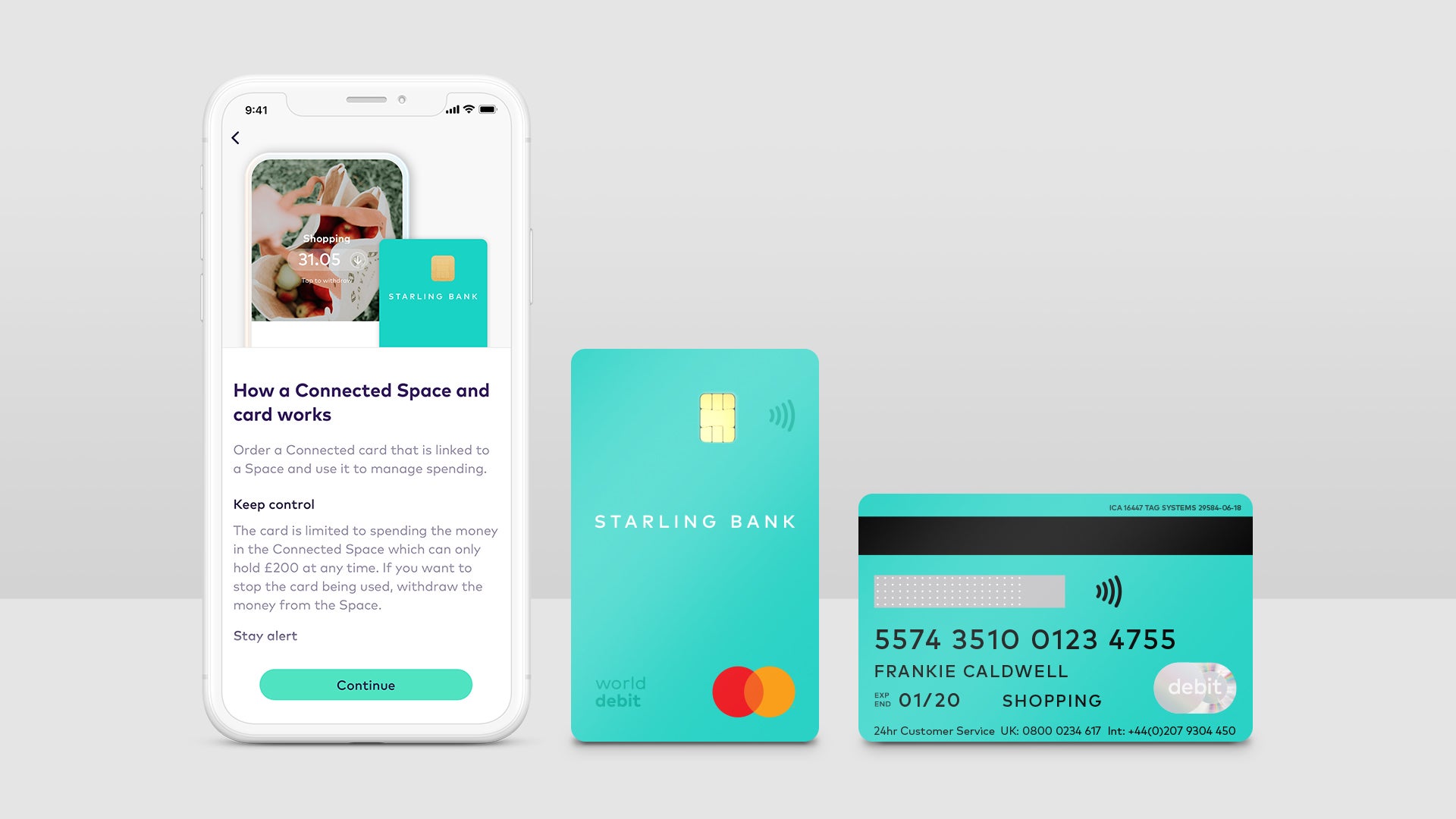

Founded in 2014 by former Allied Irish Banks executive Anne Boden, Starling Bank has secured £323m in investment to date. The bank offers four types of accounts including personal, business, joint, Euro and a child card.

At the end of last year, the challenger bank hired Rothschild with the aim of securing fresh investment of £200m.

The Bank of England have been critical of challenger banks such as Starling, Monzo and Revolut for failing to register profit. Notably, Starling hit break even last October.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWhile other challenger banks have been making losses, Starling Bank reported an operating profit of £0.8m for October 2020 or £10m on an annualised basis.

Last October, the bank earned revenue of £9m, representing annualised run rate of £108m. The amount included £5.5m in net interest income and £3.5m in gross fees and commissions income.

Currently, the bank is said to be over two million accounts, £4.7bn in deposits and a lending book of just below £2bn.

Last year, Starling also introduced a new range of fees for its British pound/GBP and Euro bank account services to lower costs and continue operating.