In the past few years, companies across all sectors have been under pressure to reduce their carbon footprints – and banks are no exception to this rule. Arguably one of the biggest sectors to fund unsustainable practices, the finance industry must alter its ways. Evie Rusman writes

The finance sector has faced criticism for many years on its sustainability practices, with many of the world’s top banks continuing to invest in projects that are harmful to the environment.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

A 2020 report from the Rainforest Action Network (RAN) shows that since 2016, the world’s biggest investment banks have funnelled $2.7trn towards funding fossil fuels. The biggest investor being JP Morgan Chase, followed by Wells Fargo, Citi and Bank of America.

Adding to this, a report from the Cambridge Institute for Sustainability Leadership (CISL) states that banks often invest in practices resulting in deforestation. These practices involve the farming of commodities such as palm oil, soy, beef and timber products.

Combatting deforestation

This paints a very bleak picture of the banking industry and surely nods to a call for change. But how can this be done?

In 2014, CISL started the ‘Soft Commodities’ Compact in collaboration with the Banking Environment Initiative (BEI) and the Consumer Goods Forum (CGF). The mission was to help achieve zero net deforestation by 2020.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIts main aims were to raise banking standards to encourage anti-deforestation policies and to finance supply chain transformation.

However, deforestation has not yet been halted, and so CISL’s latest report focuses on a new action plan to help banks combat deforestation.

According to the institute, collaboration is key to make progress towards the net zero deforestation goal.

CISL’s director for the centre of sustainable finance Nick Villiers says: “More collaboration is needed between local and global banks and their clients if we are to halt and reverse deforestation. Our Action Plan maps out the unique part banks can play in tackling deforestation and aims to catalyse further action by the banking industry and beyond.

“By acting together, banks can help rewire the economy, mobilising and structuring finance so that it supports deforestation-free and forest restorative soft commodity production.”

The Action Plan

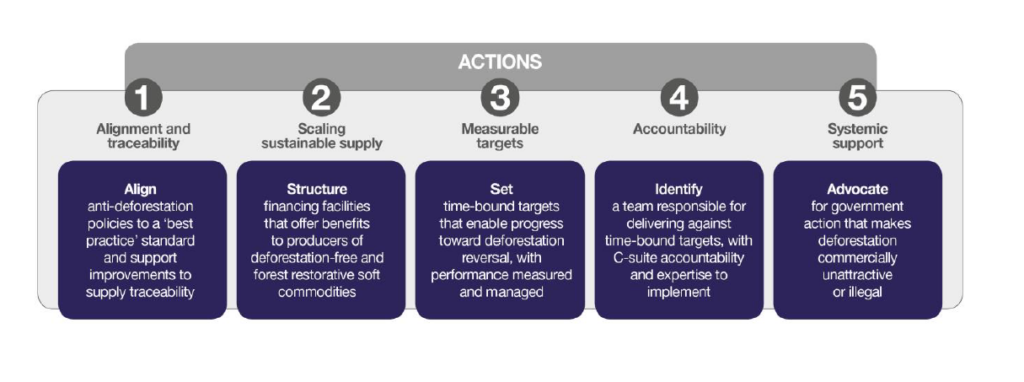

CISL’s action plan maps out banks’ role in advancing policy alignment, scaling sustainable supply, setting measurable targets and accountability. Furthermore, it encourages banks to identify personnel to lead on the delivery of these targets, with links to C-suite.

It also states banks must advocate for government action to make deforestation commercially unattractive or illegal.

CISL developed the action plan as a starting point, and during 2021, the institute aims to seek expressions of interest from the banking industry, corporates, NGOs, policymakers and funders.

Taking action

Some banks are already starting to take action when it comes to sustainability. In 2020, HSBC partnered with Pollination with the aim of creating the world’s largest natural capital asset management company.

The HSBC Pollination Climate Asset Management intends to establish a series of natural capital funds, investing in activities that “preserve, protect and enhance nature over the long-term, and address climate change”.

Speaking at the time of announcement, HSBC’s Global Asset Management Chief Executive Nicholas Moreau, said: “Clients are increasingly focused on environmental matters and this initiative is designed to help them achieve a financial return, while at the same time creating a positive impact on the world’s biodiversity.”

Another market where banks are acting is in Sweden. This month, Swedbank AB became the latest bank to limit lending based on climate criteria.

The Stockholm-based bank announced that it will not provide fresh credit for new oil and gas projects, nor will it provide funds to enable production in the Arctic.

This comes as many banks, despite making sustainability a clear strategy in their asset management units, continue to provide credit to companies that harm the environment.

For instance, notwithstanding its recent pact to reduce its carbon footprint, HSBC is still the second-largest financer of fossil fuels in Europe after Barclays. Since the Paris Climate Change agreement in 2016, the bank has provided at least $87bn (£64bn) to some of the world’s largest fossil fuel firms.

Investors take on HSBC

HSBC may be forced to minimise its investment in fossil fuels after a group of investors filed a shareholder vote urging the bank to ramp up its climate commitments.

Several pension and investment funds are pushing the bank to reduce loans offered to fossil fuel clients within a timeline consistent with the Paris Climate Agreement. The resolution will be put to shareholders in April at HSBC’s AGM, and will become binding if 75% vote in favour.

At the moment, HSBC’s climate plan does not involve turning away clients who undergo harmful environmental practices. So, now would be the perfect time for HSBC to put its money where its mouth is.

It is obvious that there is still a long way to go before banks completely eliminate their longstanding relationship with unsustainability. However, there is hope as more and more banks are seeking out partners to improve their climate change strategy – this, coupled with industry efforts, like those from CISL, allude to a positive future.