At the height of the pandemic, consumer behaviour began to outpace the channel capabilities of slow-moving incumbent banks, reinvigorating providers around digital transformation imperatives. However, there are clear tensions between tactical time-to-market priorities and the longer-term tech changes required to emancipate providers from legacy, reports Douglas Blakey

Financial Institutions that focus on knowing their customer – not just from a regulatory perspective, but in terms of financial impact, behaviours, and prospects – will be best placed to succeed under conditions of expedited change. This will require the operational agility to recalibrate customer personas, risk models, and channel propositions.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

A report from GlobalData’s Thematic Research unit looks specifically at whether incumbent banks can digitise at sufficient pace and scale to protect existing customer numbers and revenue pools. In addition, the report entitled ‘Digital transformation in banking’ assesses the prospects of independent digital banks and niche fintech providers.

Some banks are prioritising innovation, some user experience, some cost-cutting, and some a combination of all three. There are also different ways of implementing such strategies. Incremental changes can be adopted system by system and process by process within the “mothership,” or banks can do it wholesale (the so-called “big bang” approach, eg AIB). Alternatively, it can be done from a separate entity – a “digital speedboat” – and operated as a segmented proposition.

Both approaches have proven to work (eg BRE Bank’s mBank) and not work (e.g. RBS’s Bó, JPMorgan Chase’s Finn). Regardless of approach, the key challenge amid Covid-19 is digitising at sufficient pace and scale so as to protect the most at-risk customers while not impairing the ability to make more long-term strategic changes around underlying technology capabilities. Just digitising existing analogue processes, while enabling a mobile app or a new online feature, digitises those same legacy processes that constrain operational agility.

Only by building new capabilities – around cloud, API, big data, etc. – can banks emancipate themselves from legacy. Building those digital capabilities takes time – it’s an organisation-wide, multi-year technology change. While Covid-19 has removed some cultural barriers to this change – everyone now understands “why?” and “why now?” – it has also increased cost constraints and created new pressures around the overall speed and pace of change.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis in turn exacerbates a variety of risks inherent in that change (such as cybersecurity, operational risk, and reputational risk).

Financial services provider selection

Consumers value convenience and transparency. GlobalData’s most recent survey data suggests the most important criteria when selecting a financial services provider are ease of use and transparency. Insofar as digital can reduce friction with day-to-day banking activities and help customers better understand their financial situation, we can interpret this as digital advocacy.

However, in most markets a great digital service reputation trails both a nearby branch and a great customer service reputation. This highlights the importance of performing well in all areas, not just one. That said, with physical channels now less accessible amid Covid-19, providers must double down on digital to influence these surveyed attributes (and already in the Nordics, digital reputation is more important than customer service reputation).

Wholesale migration from online to mobile has not occurred and banks’ channel migration efforts have not yet met expectations. Many commentators expected mobile to quickly displace all other channels, with attendant risks that consumer behaviour could outpace banks’ channel capabilities. But this situation has not transpired. In 2017, online was significantly more popular for a greater range of tasks than mobile is in 2020. Meanwhile, telephone banking – once a forgotten channel amid digitisation – has made gains as branch usage has reduced.

The preference for telephone banking has notably increased for more complex queries such as making a complaint or querying transactions, but it has risen for all other tasks too.

This suggests digital teams at banks have yet to develop processes that effectively simplify complex tasks via mobile channels. In many cases digital teams simply have not prioritised mobile banking pathways for key sales and service tasks.

With a reduction in overall branch footprint, in some cases call centres have become the most accessible human channel. Covid-19 has massively increased this trend, with NatWest reporting a 900% increase in call center volume. However, while channel preferences are shifting away from online towards mobile and telephone, mobile represents the greatest near-term opportunity to reduce costs and increase day-to-day customer engagement.

Yet with the pandemic meaning more people are at home more of the time, individuals may be more inclined to use larger screens (say tablets or laptops) than previous channel patterns would otherwise portend.

Incumbent trusted adviser status

GlobalData’s 2020 consumer survey confirms that traditional banks and building societies are still the preferred option for all types of credit, including the most important mortgage product. This speaks to the enduring role of high-street banks as trusted advisers for the most high-value, high-risk financial decisions.

Mortgages represent the largest share of net interest margin for banks, while also acting as the anchor of the customer relationship. This is not just due to the long term of mortgages, but because the heightened emotional state of customers mid-house purchase is a pivotal moment of truth to offer support and truly understand customers’ need. Banks can monetise this through a lifetime of carefully calibrated product sales

Incumbents are benefiting from a flight to quality

A massive drop-off in account switching and a flight to quality for deposits has seen increased deposit holding at incumbents. In the UK, for example, current account switching statistics produced by Bacs highlight that switching declined by 63.2% in April 2020 (compared to March 2020), while year-on-year declines of 47% in April and 66% in May were also recorded. This trend is likely to be repeated around the world.

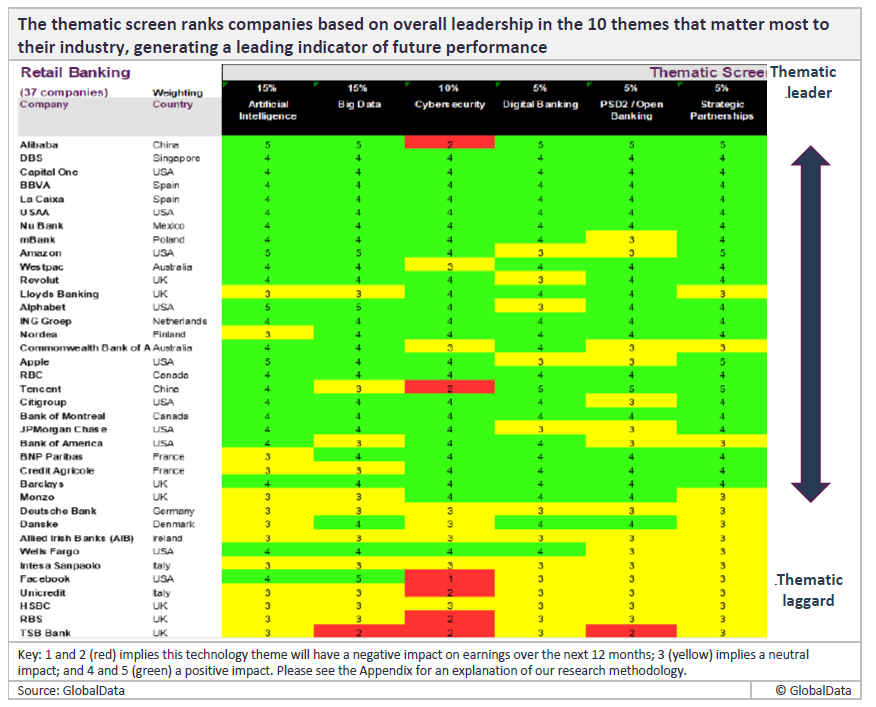

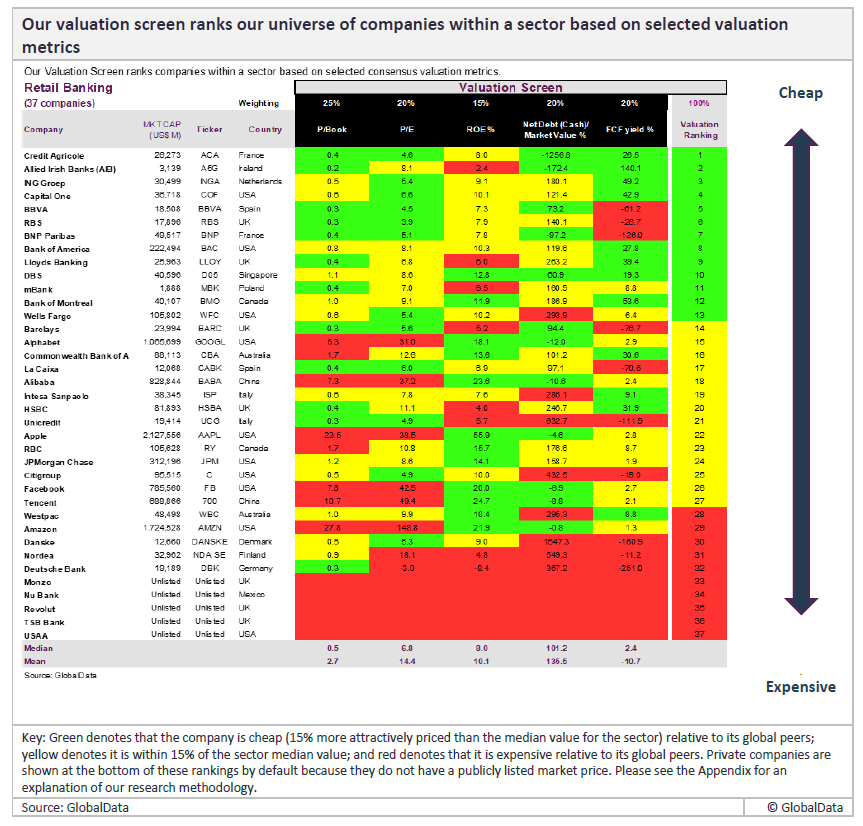

Sector scorecards

GlobalData uses a scorecard approach to predict tomorrow’s leading companies within each sector. The sector scorecards have three screens: a thematic screen, a valuation screen, and a risk screen.

GlobalData Thematic Research

GlobalData has developed a unique thematic methodology for ranking all companies in all sectors based on their relative strength in the big investment themes that are impacting their industries. The thematic engine identifies which companies are best placed to succeed in a future filled with multiple disruptive threats.

To do this, the team rates the performance of the top 1,000 companies against the 50 most important themes impacting those companies, generating 50,000 thematic scores. The algorithms in GlobalData’s thematic engine help to identify the long-term winners and losers within each sector.