US Bank Q1 2021 earnings highlight ongoing margin pressure and miss revenue forecasts. But the results contain a number of strong metrics and earnings per share beat analyst forecasts.

US Bank Q1 2021 positive metrics

To take the positives first, the bank reports net income of $2.23bn. Average total deposits rise by 17.5% year-on-year.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The net charge-ff ratio moves in the right direction, dropping to 0.31% in the first quarter. This is down from 0.58% in the prior quarter and 0.53% in the year-ago quarter.

Allowance for credit losses declines $1,050 million during the quarter given improving economic outlook and credit trends. And non-performing assets decrease by 7.4% on a linked quarter basis but increase 27.1% year-over year. Meantime, the CET1 capital ratio increases to 9.9% at the end of the quarter from 9.7% in the prior quarter.

Less positive metrics

Margin pressure contributes to a 41 basis point drop in the net interest margin from 2.91% a year ago to 2.50%. The bank’s net interest income falls by 4.8% y-o-y to $3.09bn. And at the same time, the US Bank cost-income ratio takes a hit and moves in the wrong direction. The first quarter efficiency ratio of 62.1% compares with 58.0% in the year ago quarter.

Average total loans are also down but only marginally, compared with sharp drops at a number of its larger peers. Total loans inch down by just 1.2% to $294bn. On the other hand, average total deposits rise by 17.5% to $426.4bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataUS Bank Q1 2021 digital highlights

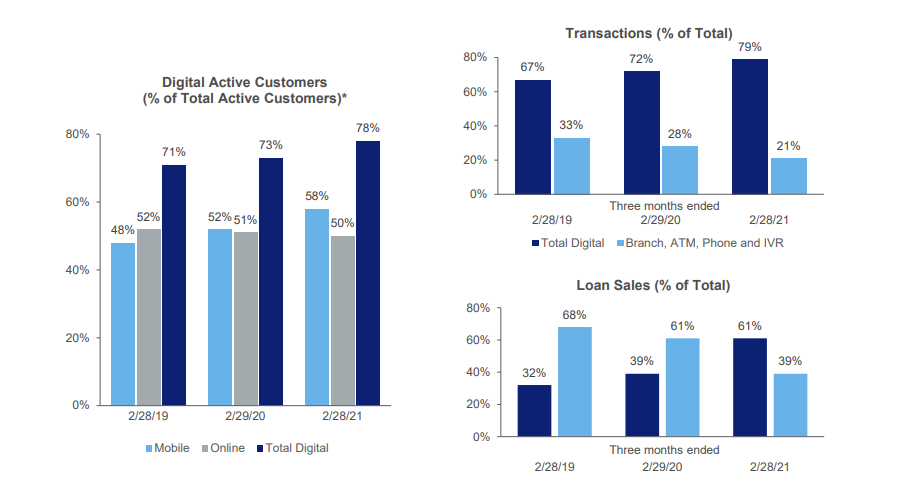

US Bank ends the quarter with 78% of its customers actively using its digital banking channels. This compares with 73% a year ago. Moreover, active mobile banking users increase from 52% to 58% over the same period. And there is a significant rise in the percentage of total loan sales sold digitally. This metric rises from 39% a year ago to 61% in the latest quarter.

The US Bank share price of $57.60 is ahead by 24.9% for the year to date (see graph) for a market cap of $86.5bn.