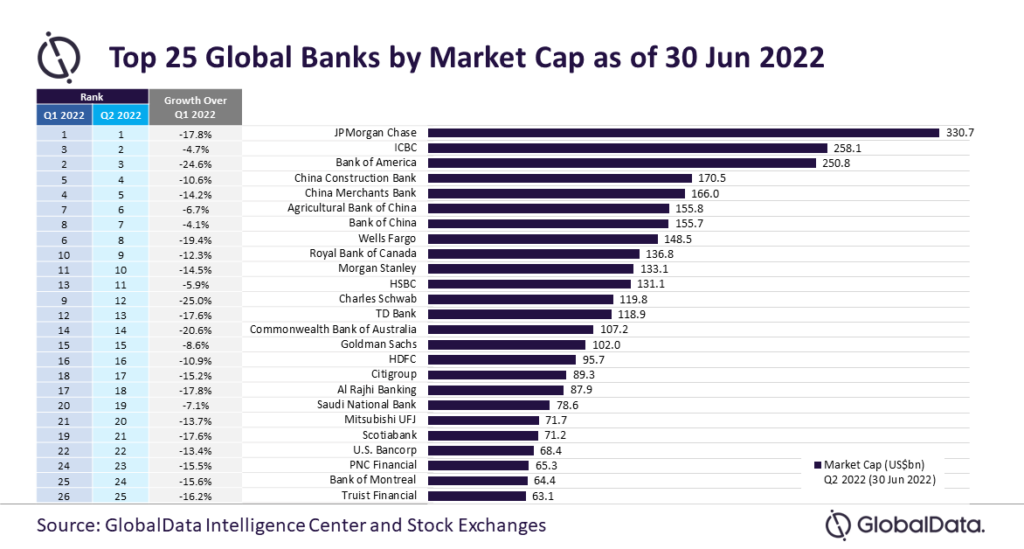

The total market value of the top 25 global banks by market capitalisation (MCap) fell by 14.4% to $3.2tn over 31 March 2022 (Q1 2022), finds GlobalData, a leading data analytics and research company.

This fall comes amid growing inflation in the US and tense geopolitical landscape.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

GlobalData company profiles analyst Parth Vala said: “The companies that declined the most included Charles Schwab, Bank of America, Commonwealth Bank of Australia, Wells Fargo, and JPMorgan Chase.”

Besides the macro-economic and geopolitical unrest, the decline in market value of Charles Schwab was further fuelled by its tepid Q1 2022 results. It posted lower revenue and net profit than that of the consensus estimates.

The Fed’s interest rate increases this year to control inflation also weighed on the firm’s trading revenues, which dropped to $963m in first quarter, posting a fall of around 21% over the same period last year.

Beating analysts’ expectation, Bank of America posted revenue and net earnings of $23.2bn and $6.6bn in Q1 2022, over $22.8bn and $7.6bn in the same quarter of 2021, respectively.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe profitability of the bank was impacted because of a higher provision for credit losses.

Furthermore, the trading division of the bank recorded a 15% fall in sales & trading activities on account of lower FICC trading revenues, which was caused due to the policy revision of the Fed.

Commonwealth Bank of Australia saw its market value drop by 20.6% quarter-on-quarter (QoQ). A series of tough rate hikes to control inflation by Reserve Bank of Australia could lead to an increase in bad loans. This move not only impacted the stock of Commonwealth Bank of Australia but also of all other major banks in Australia.

Wells Fargo posted a net profit of $3.4bn in the first quarter of this year, as against $4.3bn in the same period of 2021 on the back of a lower provision for credit losses. However, the bank fell short on revenue estimates and recorded $17.6bn in Q1 2022, as against $18.5bn in the Q1 2021. Its mortgage lending business was affected by growing mortgage rates because of the Fed’s hikes in interest rates.

JPMorgan Chase’s market value fell 17.8% QoQ as it missed its earnings estimates in the first quarter of this year. It posted net profit of $7.8bn as against $13.9b in the same period of last year due to higher credit loss provisions. It built a credit loss reserve of $1.4bn, which was in line with the rise in interest rates, geopolitical tension, and a potential global recession. Furthermore, the bank suspended its share-repurchase programmes to meet regulatory capital requirements amid increasing global uncertainties.

China’s Big Four banks—ICBC, Bank of China, Agricultural Bank of China, and China Construction Bank—seem to have done well against interest rate hikes by central banks across the globe.

Vala concludes: “The second half of 2022 will bring more challenges to the global banking sector as further interest rate hikes are almost imminent to curb the spiraling inflation, which would in turn render a potential global recession.”