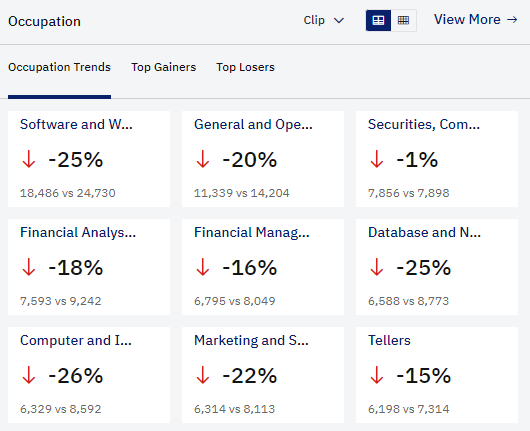

Bank hiring for software related positions is down 25% y-o-y for the first seven months of 2023. Computer and IT related roles are down by 26% y-o-y. Financial analyst roles and accounting positions are down by 18% and 16% respectively. The only occupation standing its ground is securities related roles, down by only 1%.

The figures are disclosed by GlobalData’s Disruptor data, which tracks all major deals, patents, company filings and hiring patterns.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

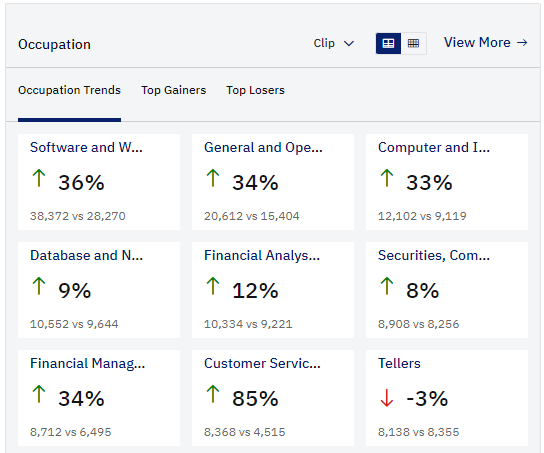

A year ago, the position was altogether more positive. Software and computer/IT roles hiring activity were ahead by 36% and 33% respectively. Bank customer services roles hiring was up by 85% y-o-y. Even bank teller roles were down only modestly, by 3%, despite the continued reduction in branch numbers across all mature banking markets.

Citi remains the most active global FS hirer

One metric has not however changed and that relates to the most active hirer in global banking. A year ago, Citigroup was the most active with almost 60,000 positions closed in the first seven months of the year. Fast forward to the first seven months of 2023 and Citi is again the most active hirer. But for the first seven months of 2023, Citi has closed around 30% fewer roles, with about 42,000 positions closed for the current year to date.

Our signals coverage is powered by GlobalData’s Disruptor data, which tracks all major deals, patents, company filings, hiring patterns and social media buzz across our sectors. These signals help us to uncover key innovation areas in the sector and the themes that drive them. They tell us about the topics on the minds of business leaders and investors, and indicate where leading companies are focusing their investment, deal-making and R&D efforts.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData