Stress over money is not only causing Gen X, Y and Z to lose sleep. It is also having a negative effect on their mental health and personal relationships.

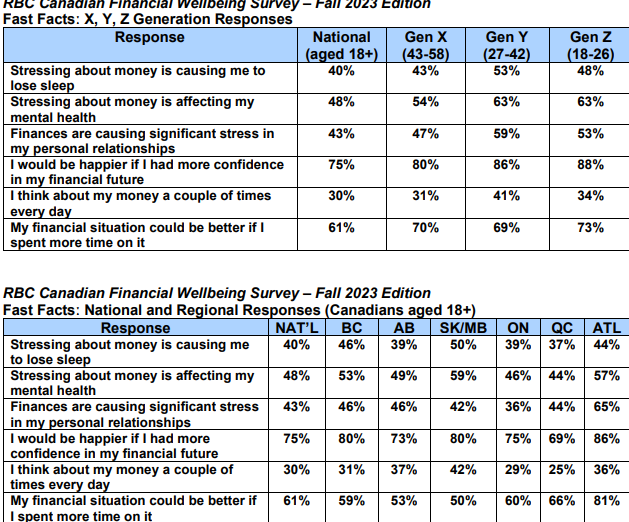

Compared to 40% of all Canadian adults surveyed, Gen Y (millennials) are the most likely to have a difficult time sleeping because they are worried about their finances (53%). They are followed by Gen Z (48%) and Gen X (43%). The data is revealed on the latest version of RBC’s 2023 Canadian Financial Wellbeing Survey.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Just under half (48%) of all respondents report that their mental health is also being negatively affected. This Is true for a much larger proportion of Gen Y and Gen Z (63% each) and Gen X (54%).

‘Personal wellbeing is closely tied to financial wellbeing’: Neil McLaughlin, RBC

Furthermore, 59% of Gen Y, 53% of Gen Z, and 47% of Gen X report having “a significant amount of stress” in their personal relationships related to their finances. This compares to the national average of 43%.

And a big majority in all three generations agree they would be happier if they had more confidence in their financial future (88% Gen Z, 86% Gen Y, 80% Gen X).

“We know personal wellbeing is closely tied to financial wellbeing. This is particularly so for Canadians who are essentially living paycheque to paycheque or are uncertain about what the future holds,” says Neil McLaughlin, group head, Personal & Commercial Banking, RBC.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Many Canadians deal with a lack of confidence when it comes to understanding their finances. This affects their ability to make sound financial decisions.”

The poll findings confirm that money is on the minds of all three generations. Almost a third or more of Gen X (31%), Gen Y (41%) and Gen Z (34%) think about money a couple of times daily. But more than two-thirds respond that their financial situation could be better if they spent more time on it (70%, 69% and 73% respectively).

RBC My Money Matters

A new digital destination – RBC My Money Matters – brings a vast array of financial advice and expertise together in one place. This makes it easier for Canadians to learn about money and take control of their finances.

Available at no cost, the new website is a helpful repository of comprehensive content, resources and tools. RBC says that it supports financial wellbeing and ideally makes thinking about money less stressful.

“We’ve built My Money Matters to provide useful insights and resources to help Canadians make more informed financial decisions and explore related resources. Our hope is that whatever someone’s personal situation might be – trying to save, managing debt, starting a business – they will find some helpful information guidance here,” McLaughlin adds.

“Our ultimate goal is to help Canadians develop the financial knowledge, skills and confidence to build a strong financial foundation with money and take control of their long-term financial wellbeing.”