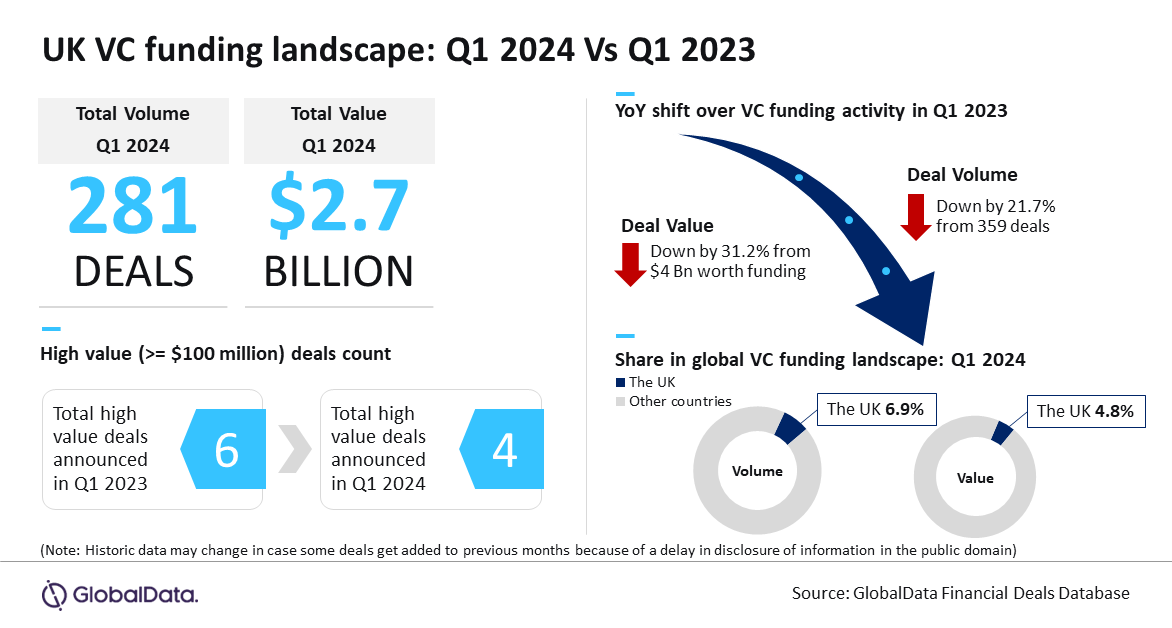

The UK experienced a year-on-year (y-o-y) decline in venture capital (VC) funding deal volume and value during the first quarter of 2024 as investor sentiment remained weak. A total of 281 VC deals of worth $2.7bn were announced during the quarter. This represents a 21.7% y-o-y decline in deals volume and 31.2% fall in funding value, respectively. Despite these challenges, March showed improvement in deal value amidst declining volume, observes GlobalData, publishers of RBI.

GlobalData Deals Database

An analysis of GlobalData’s Deals Database also revealed that a total of 359 VC funding deals were announced in the UK during Q1 2023 while the disclosed funding value of these deals stood at $4bn.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Aurojyoti Bose, Lead Analyst at GlobalData, said: “The dent in investor sentiment can be understood from the fact that the average size of VC funding deals fell from $11.1m in Q1 2023 to $9.7m in Q1 2024. However, despite this decline, we can see some bright spots, particularly in March when there was an improvement in deal value despite month-on-month decline in deal volume.”

“Moreover, the UK, apart from being the top European market for VC funding activity, also continues to be a key global market. It ranked among the top markets globally both in terms of VC funding deal volume and value during Q1 2024.”

Notable UK Q1 2024 deals

The UK accounted for 6.9% share of the total number of VC deals announced globally during Q1 2024. Meanwhile, its share of the corresponding funding value stood at 4.8% during the quarter.

Some of the notable VC funding deals announced in the UK during Q1 2024 include the $430m raised by Monzo, $112m raised by Exohood Labs, $110m raised by Build A Rocket Boy, and $100m raised by Oxford Quantum Circuits.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData