As the percentage of consumers who classify as financially unhealthy continues to increase, it becomes increasingly difficult for lenders to create strong levels of customer satisfaction, reports JD Power.

Nearly three-quarters (73%) of US consumer loan customers now categorise themselves as financially unhealthy. This is up from 67% in 2023. Lenders have their work cut out to deliver products that meet customer needs in a persistently high interest rate environment. Customer satisfaction with consumer loans is highest among those with the highest levels of financial health. It is significantly lower among those who are overextended or financially vulnerable.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The findings are revealed within the JD Power 2024 US Consumer Lending Satisfaction Study.

“Consumer loans are primarily used to consolidate higher-cost debts at a lower rate. But that’s a tough proposition when interest rates have remained so high for so long,” said Bruce Gehrke, senior director, wealth and lending intelligence, JD Power.

“As a result, we’re seeing significantly lower levels of customer satisfaction among those who are most at-risk financially. And arguably could benefit most from products that help them consolidate or reduce debts.”

JD Power 2024 US Consumer Lending Satisfaction Study key findings

-

Returning to same lender correlated with financial health and satisfaction

More than three-quarters (79%) of customers who are financially healthy are likely to return for their next loan. This compares with only 55% of financially unhealthy customers. Overall satisfaction for financially healthy customers is 797 (on a 1,000-point scale) vs. 668 for unhealthy customers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHowever, financially unhealthy customers are more likely to need another loan. They are also a crucial source of new business. By delivering an experience that drives increased satisfaction for unhealthy customers, lenders will greatly increase their chances of continuing business.

-

Satisfaction higher for customers with multiple products

On average, overall customer satisfaction scores are 68 points higher when consumer loan customers have multiple products. Examples include credit cards, savings accounts and other types of loans. However, the type of product does matter to the overall impression of the lender’s brand. Credit card customers see the lender as more profit focused. Customers with other loans and accounts view the lender as more customer focused.

-

Data security is critical for delivering high satisfaction

On average, overall customer satisfaction scores are 176 points higher when consumer loan customers believe that their lender has a secure lending process that protects their personal information.

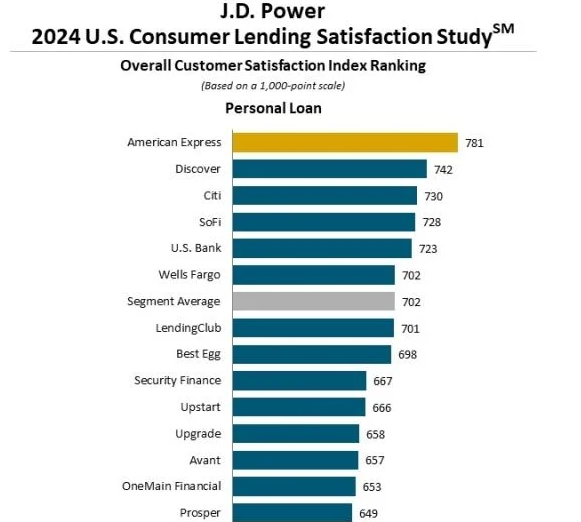

Study Ranking

American Express ranks highest among personal loan lenders in overall customer satisfaction for a second consecutive year. It scores 781 on the 1,000-point scale. Discover with a score of 742 and Citi with 730 rank second and third respectively. SoFi and US Bank rank fourth and fifth ahead of Wells Fargo.

The US Consumer Lending Satisfaction Study measures overall customer satisfaction based on performance in seven core dimensions.

Individual dimensions measured are (in order of importance): loan met borrowing needs; level of trust; experience obtaining loan; makes it easy to do business with; people; digital channels; and kept informed about loan.