Interest rates and inflation have started to trend downward. But many bank customers in Canada are still feeling the economic squeeze. And the majority of them express interest in receiving financial advice from their bank, according to the JD Power 2024 Canada Retail Banking Advice Satisfaction Study.

Specifically, nearly two-thirds (65%) of Canadian bank customers are experiencing some level of financial distress. Some 80% indicate interest in receiving advice from their financial institution.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“Bank customers’ appetites for financial advice is high. An increase in quality advice will only increase their customer satisfaction,” said Jennifer White, senior director for banking and payments intelligence at JD Power.

“Therefore, providing personalised advice is mutually beneficial as customers who receive it are taking actions and benefitting financially, while banks are experiencing strong engagement and brand advocacy.”

JD Power Canada Retail Banking Advice Satisfaction report: key findings

- Advice recall is high, especially among new immigrants and younger customers. More than half (52%) of all bank customers remember receiving financial advice from their bank. Specifically, immigrants who have lived in Canada for less than two years are more inclined to recall receiving financial advice from their bank (79%) than those who have lived in Canada longer (51%). Additionally, customers under the age of 40 also remember getting financial advice from their bank at a higher rate (61%) than do those in older age groups (47%).

- Most bank customers act on advice. More than three-quarter (77%) of customers who receive financial advice follow through and act on it. The most frequent actions taken in response to advice include shifting funds between accounts (29%); updating account settings (21%); downloading the mobile app (20%); and scheduling a meeting with a bank rep (20%).

- Satisfaction increases when customers take action. Overall satisfaction with retail banking advice increases 142 points (on a 1,000-point scale) when customers act based on specific advice from their bank.

Banks still miss the mark on advice topics

The study finds gaps exist in nearly every category and topic when it comes to the advice delivered by the bank and the advice that customers are most interested in. The widest gap exists in the financial planning category, as the difference between those who are currently receiving that type of advice and those who want more is 16 percentage points, specifically, looking for more advice around tax reduction.

Study ranking

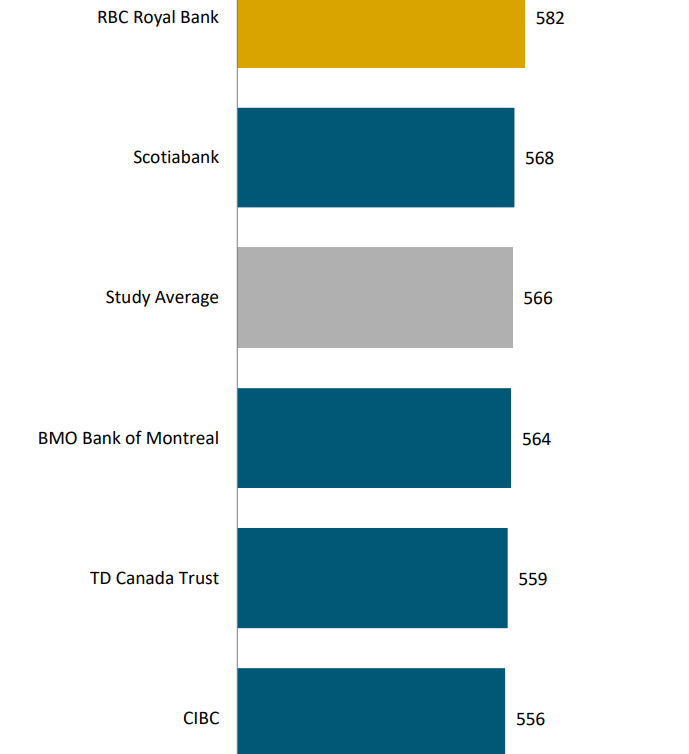

RBC ranks highest in customer satisfaction for a fourth consecutive year, scoring 582 points. Scotiabank (568) ranks second ahead of BMO (564). The study also provides financial health support index benchmarking data. This evaluates proficiency of banks and credit card issuers in delivering financial support to customers doing such things as helping customers make better financial decisions or help customers meet savings, creditworthiness, or budgeting goals. The study also captures responses from customers about their satisfaction with the financial health support provided by their financial partners. Top-performing banks in the banking financial health support index are (in alphabetical order): BMO Bank of Montreal and RBC. Top-performing credit card providers in the credit card financial support index are (in alphabetical order): Desjardins, RBC and Scotiabank.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataJD Power 2024 Canada Retail Banking Advice Satisfaction Study Overall Customer Satisfaction Index Ranking