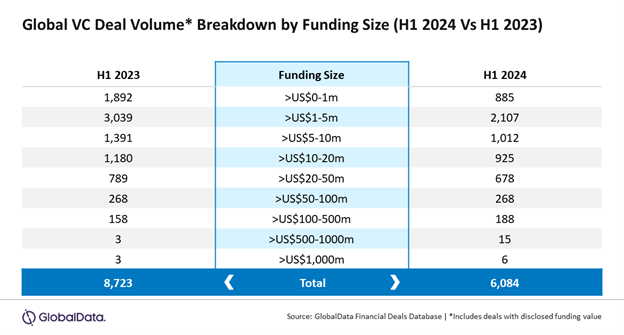

A total of 6,084 venture capital (VC) funding deals with disclosed venture funding value were announced during the first half (H1) of 2024. Meanwhile, the volume of these deals declined by 30.3% year-on-year (YoY) compared to the announcement of 8,723 VC deals with disclosed venture funding value in H1 2023.

Despite this drop, high-value deals (valued > $100m) saw a significant 27.4% YoY growth, indicating a strategic shift towards larger investments. Low-value deals continued to dominate the market, but the improvement in high-impact investments reflects a growing preference for quality over quantity, says GlobalData, publishers of RBI.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Aurojyoti Bose, Lead Analyst at GlobalData, commented: “Low-value deals have continued to dominate the VC funding landscape. However, what stands out is the growth in the volume of high-value VC deals (≥ $100m), even as the volume of low-value deals has declined.”

An analysis of GlobalData’s Deals Database revealed that low-value deals accounted for 65.8% share of the total number of VC deals with disclosed funding value announced globally during the review period. Meanwhile, the volume of low-value VC deals declined by 36.7% YoY from 6,322 to 4,004. In fact, the number of VC deals valued ≤ $1m was down by a massive 53.2% YoY in H1 2024.

High-value VC deals’ volume increased by 27.4% YoY from 164 to 209

These deals accounted for 3.4% share of the total number of VC deals with disclosed funding value announced globally during H1 2024.

Bose added: “The growth in high-value deals volume helped several countries, including China, the UK and India, to register YoY improvement in total VC funding value in H1 2024.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMid-size funding deals (≥ $10m and ≤ $100m) volume declined by 16.4% YoY from 2,237 to 1,871. These deals accounted for around 30.8% share of the total number of VC deals with disclosed funding value announced globally during H1 2024.

Bose concludes: “The contrasting trends in VC funding highlight a period of significant transition. The decline in low-value deals alongside the growth in high-value investments indicates that investors are prioritising substantial opportunities with greater potential returns. This shift could reshape the funding landscape, emphasising quality and strategic impact over sheer volume.”