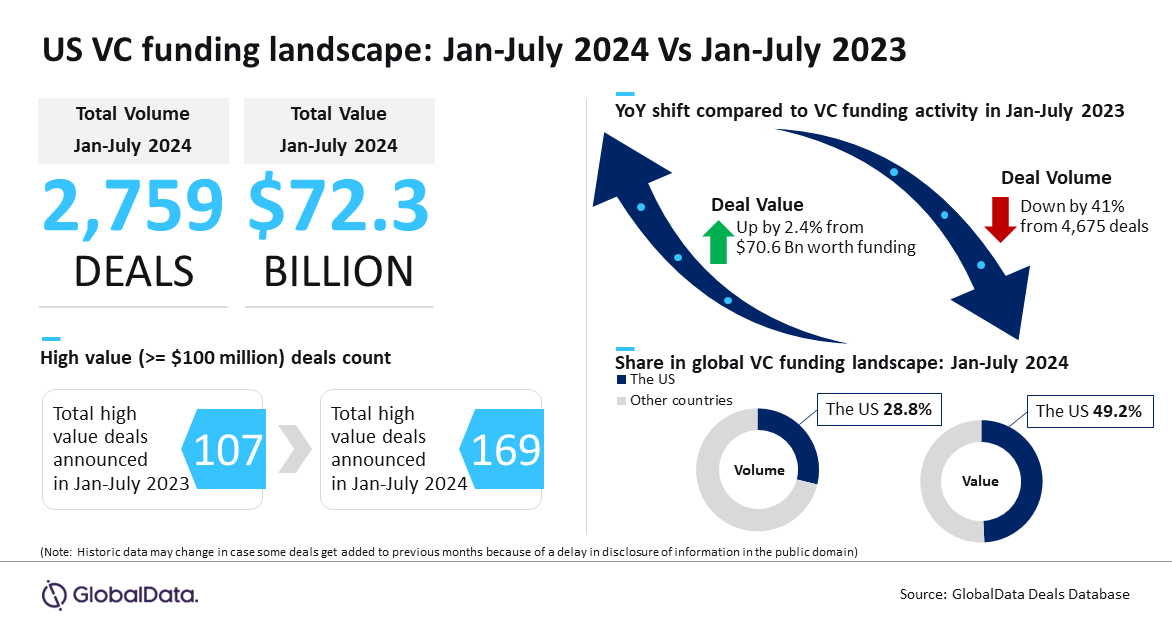

The total venture capital (VC) funding raised by the US-based startups improved by 2.4% year-on-year (YoY) during January-July 2024 despite a 41% decline in VC deal volume. The country continues to lead the global VC landscape with a significant gap over its peers, leading both in deal count and funding value, driven by a surge in ≥ $100m deals, reveals GlobalData, publishers of RBI.

An analysis of GlobalData’s Deals Database revealed that the US saw the announcement of a total of 4,675 VC deals of worth $70.6bn during January-July 2023 compared to 2,759 VC deals of worth $72.3bn during January-July 2024.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Aurojyoti Bose, Lead Analyst at GlobalData, said: “While the 2.4% increase might seem modest, the US remains a dominant force in the VC landscape, far outpacing any other market. This single-digit growth further amplifies the already substantial lead, solidifying the US’ position as the global frontrunner in VC funding activity.

“The huge size and dominance of the US can also be understood from the fact that it is distantly followed by China and the difference in total funding value between the two countries stands over $50bn.”

The US accounted for 28.8% of the total number of VC deals announced globally while capturing an impressive 49.2% of the total disclosed funding value during the review period. Meanwhile, the number of VC deals valued more than or equal to $100m took a major leap from 107 to 169.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData2024 year to date notable deals

Some of the notable VC funding deals announced in the US during January-July 2024 include the $6bn worth funding raised by X.AI, $1.1bn raised by CoreWeave, $1bn raised by Scale AI, $1 billion raised by Wiz and $1bn raised by Xaira Therapeutics.

Bose concluded: “The continued dominance of the US in venture capital activity is a testament to its resilient startup ecosystem and robust funding landscape. The growth in high-value deals, despite a drop in overall deal volume, highlights the confidence investors have in the market’s long-term potential and innovation capacity.”