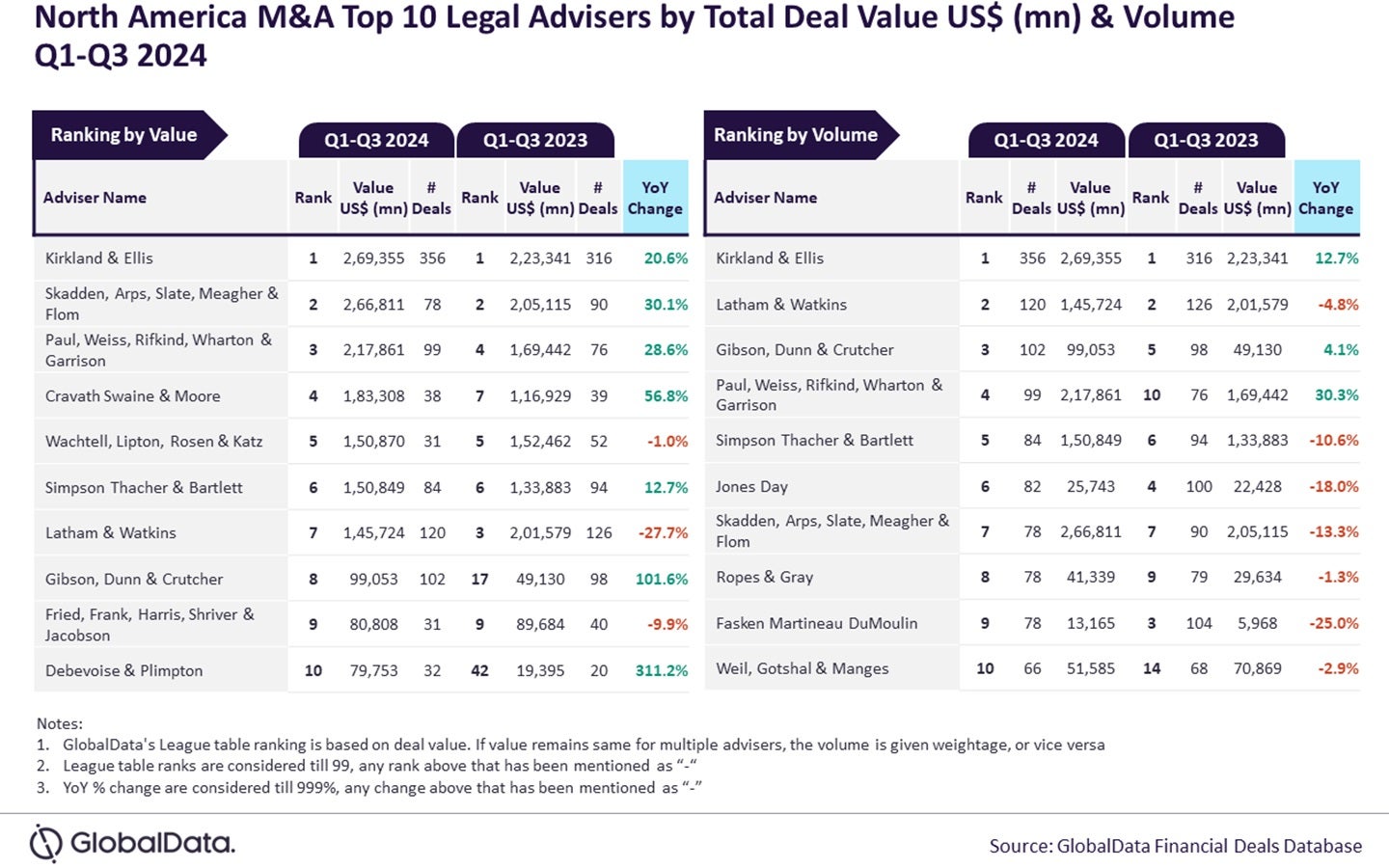

Kirkland & Ellis has emerged as the top legal adviser for mergers and acquisitions (M&A) in North America during the first three quarters of 2024, both in terms of deal value and volume, according to the latest financial advisers league table by GlobalData.

According to GlobalData’s Deals Database, which assesses financial advisers based on the M&A deals they have facilitated, Kirkland & Ellis’ advisory on 356 deals, valued at $269.4bn, has secured its leading position in the competitive M&A landscape.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Skadden, Arps, Slate, Meagher & Flom followed closely in the second position by value, through advisory on deals worth $266.8bn.

They are followed by Paul, Weiss, Rifkind, Wharton & Garrison, with deals totalling $217.9bn; Cravath Swaine & Moore with $183.3bn; and Wachtell, Lipton, Rosen & Katz with $150.9bn.

GlobalData lead analyst Aurojyoti Bose said: “Kirkland & Ellis was also the top adviser by both value and volume during Q1-Q3 2023 and managed to retain the top position during Q1-Q3 2024 as well. In terms of volume, it outpaced its peers by a significant margin but faced close competition from Skadden, Arps, Slate, Meagher & Flom for the top position by value.”

In terms of deal volume, Latham & Watkins claimed the second spot with 120 deals.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIt was followed by Gibson, Dunn & Crutcher with 102 deals, Paul, Weiss, Rifkind, Wharton & Garrison with 99 deals, and Simpson Thacher & Bartlett with 84 deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory company websites and other reliable sources available in the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness of the data, the company also seeks deal submissions from leading advisers.

………………………..

PR/image