Deutsche Bank and Paysafe have formed a partnership facilitating cash withdrawals and deposits at 12,500 locations around Germany with a digitally created barcode within the bank’s mobile app. This feature will be available to Postbank customers in November 2024, with a wider rollout to Deutsche Bank clients planned for the latter half of 2025. This tool represents a timely strategic move by Germany’s largest retail bank to bridge the gap between digital finance and traditional cash usage.

GlobalData’s Payment Market Driver Analytics

GlobalData’s Payment Market Driver Analytics shows that over the past five years in Germany, the number of ATMs has fallen sharply, decreasing from 85,300 to 78,300. This presents a significant barrier to accessing cash for German consumers. Introducing this new capability helps to increase access to cash and outsources a service typically associated with a bank branch, offsetting some of the negatives of the reduction in both types of service point.

Deutsche Bank’s and Postbank’s consumers are some of the most likely to be impacted by the closure of bank branches and reduction in numbers of ATMs.

GlobalData’s 2024 Financial Services Consumer Survey

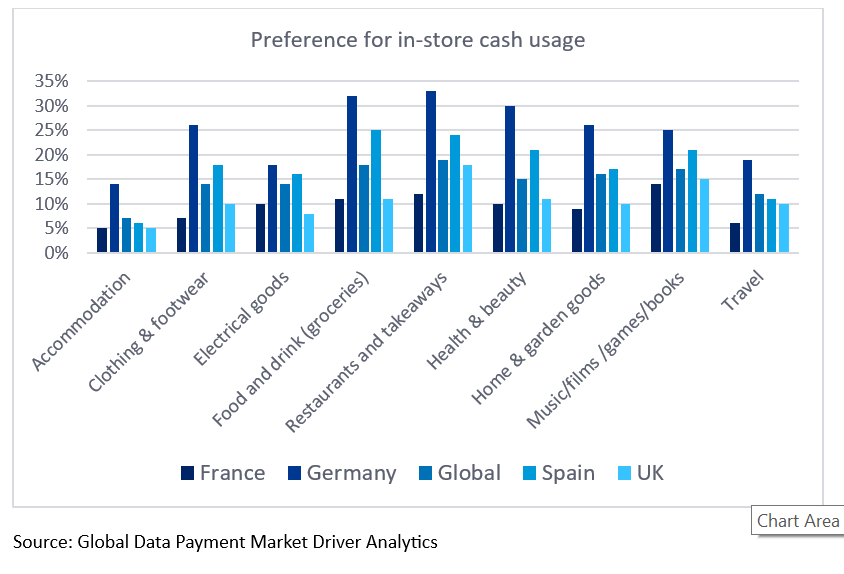

GlobalData’s 2024 Financial Services Consumer Survey reveals that Postbank has the second-highest proportion of users who are Generation X or older. Further research shows that consumers in these age brackets are among the most regular cash users, suggesting a greater reliance on the cash economy than younger consumer groups.

The introduction of digital cash signals a commitment to supporting cash-preferring users, especially their older and long-standing consumers who make up a high proportion of their customer base. In an ever more digital banking environment, ensuring easy and convenient access to cash deposits and withdrawals could improve customer loyalty and reduce churn among segments that may feel sidelined by digital-only approaches.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSecondly, the integration of a value-creating tool into an online banking app will increase the uptake of the technology across the customer base. According to GlobalData, Postbank has the second-lowest digital engagement among firms in the German banking market; this is a necessary factor to increase the lifetime value of its consumers through integration into the online banking ecosystem. Furthermore, the fact that this offering is digital, convenient, and free of charge may also help to attract and retain younger users who are more tech-savvy, a market that Postbank has missed out on in recent years. The move positions Deutsche Bank and Postbank as digital pioneers within a traditional banking context, potentially generating goodwill and a competitive edge.

In the broader German market, this partnership could catalyze further innovation as banks seek to harmonise current consumer needs and emerging digital capabilities. For Deutsche Bank and Postbank, however, this initiative represents a move in the right direction towards improving their image among consumers and positioning themselves in the dynamic retail banking industry.

Jonathan Vaughan Burleigh is an Associate Analyst, banking and payments, GlobalData