Some of the most exciting and groundbreaking startups call Europe home. From Berlin to Barcelona, innovators are crafting cutting-edge solutions set to change the future. In early 2024 alone, European startups attracted more than €47.3bn in investments, including €18.7bn in debt funding.

Such investment in European startups emphasides the potential growth the continent is currently experiencing. Even with global socioeconomic and political pressures, Europe is fast changing the way business occurs. Early-stage deals, in particular, were dominated by 82.8% of transactions being pre-seed, seed, or Series A.

Europe’s potential to lead the world includes eight startups valued at over $1bn (known as unicorns). Among them, Quantinuum, Eleven Labs, and Wavye are UK-based leaders, helping the region secure the most startup investment, valued at €13.3bn. That investment was followed by Sweden retaining €12bn and France at €6bn. Funding prioritised crucial industries like energy storage, biotech, and fintech. Climate tech investment alone attracted €21.3bn through significant debt rounds.

Even with all this international investment in Europe’s startup environment, fragmentation challenges involving regulatory complexities, market barriers, and uneven fund distribution are hindering collaboration and scalability. To ascend the global stage, Europe must focus on enhanced connectivity between all diverse ecosystems.

To underscore this need, Zubr Capital experts provide information highlighting the recent European Commission report, providing insights into how we can address and overcome such challenges.

What does fragmentation look like?

The pathway to startup success is riddled with challenges. Even when you have a solid team of experts, a great idea you know can scale, and big dreams to influence an industry, regulations can often get in the way. The variance of inter-regional labour laws and tax codes make raising venture capital a complex maze where expanding to new markets requires jumping through endless hoops. Such hurdles reduce growth, discouraging founders from considering Europe a hotbed of startup activity.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe fragmentation of such environments directly influences startup capabilities, increasing costs, reducing scalability, and marking Europe as a less attractive location. Something as simple as varying rules for employee stock options across EU member states makes it far more challenging for startups to attract top-tier talent. The result is that European startups often appear smaller and riskier compared to U.S. or Asian endeavors.

Connectivity: The solution to fragmentation

To directly address the challenges of fragmentation, Europe must focus on connectivity. Creating strong links between varying ecosystems cultivates rich soil for startups to grow. A unified startup landscape encourages shared resources, talent, and open space for ideas to flow. Such connectivity is already making an impact through ideals like:

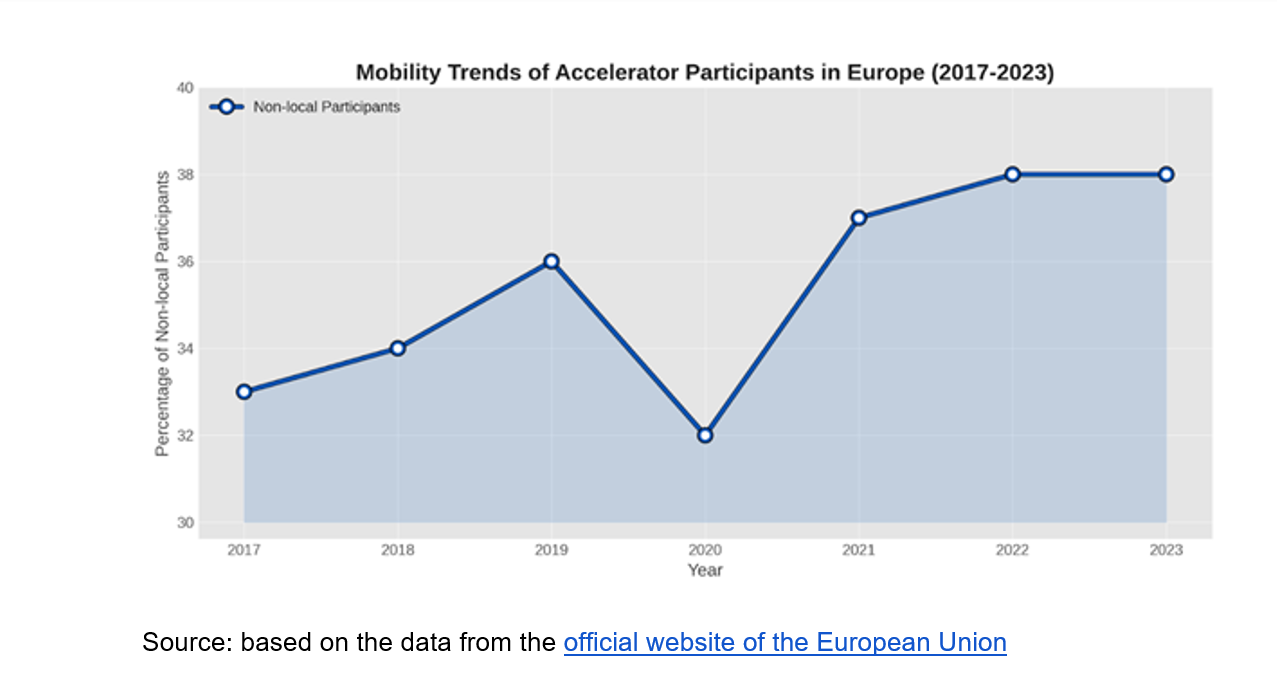

- Founder Mobility: Around 33% of European founders move to different regions to access more supportive resources and ecosystems. Popular destinations like Berlin, Paris, and Barcelona top the list due to increased funding, talent availability, and an inclusive entrepreneurial culture.

- Cross-Border Teams: Over 74% of EU startups have transnational makeups. They hire talent, raise money, and establish branches in different countries to maximise growth potential.

- Payhawk is one such example of an EU startup leveraging the cross-border modality. As a fintech startup, it keeps the development team in Bulgaria to maximise cost efficiency while operating in more high-growth areas like Berlin and London – ensuring a strategy that supports scalable growth.

Accelerators: The connectors of ecosystems

Accelerators are crucial to Europe’s growing entrepreneurial ecosystem. These organisations provide startups with the necessary tools to succeed. Beyond funding, they deliver essential mentorship, access to partner networks, and tailored guidance that help navigate launching and scaling an EU business.

The benefit of accelerators is that they can increase base startup survival rates. When startups participate in legacy accelerator programs, they report a survival rate of up to 85% in the first five years. That is a much higher success rate compared to the average of only 50% survival.

Cities like Paris, Berlin, and London are leading the charge with accelerator activity. Over half of participating startups expanding operations beyond home territories rely on such city resources, often securing larger follow-on funding (with an average increase of 35% compared to non-accelerated competitors).

More corporate accelerators, like those run by Techstars or Plug and Play, are needed to better connect startups with known industry leaders and investors. Innovation can only be achieved when sectors like fintech and healthtech have support from such organizations. In more research-heavy areas like biotech and cleantech, academic accelerators should be emphasised.

Research demonstrates how the “pipeline” accelerator model encourages growth by viewing such organisations as intermediaries linking startups with much-needed resources. Pipelines empower startups to dive into broader innovation ecosystems, providing quicker time-to-market and improved market fit. In central and Eastern Europe, these pipelines report a 40% reduction in time to market for participating startups – all due to structured programs and access to connected regional networks.

There are significant growth opportunities for the EU market. The more accelerators drive collaboration and growth across emerging and legacy ecosystems, the greater the advancement of startup success.

Funding: Closing the gaps

Europe is adjusting to the changing startup ecosystem. Deal activity remains below the pre-pandemic peak, with fundraising taking much longer and fund sizes growing. Fragmented venture capital markets across the EU slow cross-border investment and scalability.

While all this occurs, the lack of a unified exit market is forcing many promising startups to look elsewhere. It is common to see an EU startup seek IPOs or significant funding rounds in the US.

The trend of startups and entrepreneurs leaving the EU underscores a “brain drain” where talent leaves European ecosystems for more appealing locations. The urgency to create more scalable and exit opportunities within EU borders is high. Such growth exists in sectors leveraging the power of AI, quantum computing, and climate tech.

The European Investment Fund (EIF) has taken steps to bridge funding gaps. Supporting mega funds and cultivating gender diversity in venture capital help ensure greater access. However, early-stage and emerging managers still face increasing challenges in securing much-needed capital, raising fears over future seed and startup investments.

Zubr Capital is addressing such concerns by focusing on another emerging trend. The fund operating in the EU market, with offices in Poland and Cyprus, is serving underinvested regions. Companies from Eastern Europe, like Ukraine, are relocating to such areas to take advantage of the venture capital. Talented entrepreneurs whose startups only need financing to launch look to resources like Zubr Capital. This niche market promises fantastic growth by matching promising target companies with European financial institutions to close funding gaps.

How policies Are paving the way

Connectivity goes beyond building relationships between founders and investors. Policies across the region must also adapt to change. The European Startup Nations Alliance (ESNA) is working to better harmonise regulations across EU member states, making it far easier for emerging startups to expand quickly. One notable method ENSA is pushing is faster company registration processes and better support for cross-border hiring.

Another policy-driven change comes from Horizon Europe CONNECT. This organisation funds projects fostering more collaboration between ecosystems, creating “open ecosystems” that streamline the sharing of knowledge, resources, and innovative developments.

What’s next?

For the EU to become a global leader in startup potential, it must take three crucial steps forward:

- Step 1: Harmonise policies that simplify regulations so startups can quickly scale across borders without barriers;

- Step 2: Support collaboration and encourage multi-ecosystem partnerships through accelerators, events, and funding programs.

- Step 3: Invest heavily in talent development by creating a unified marketplace that addresses issues like visa policies and stock option rules.

Europe must work with everyone involved to cultivate a more welcoming startup ecosystem. A connected Europe is fertile soil for startups, innovation, economic growth, and global competitiveness.

Final thoughts

There is rich opportunity in Europe’s startups. The talent, ideas, and ambition are there to take the world by storm. To ensure such growth is possible, steps must be taken to remove the barriers of fragmentation and embrace greater connectivity.

When we foster collaboration, harmonise policies, and make real investments in talent, we create a unified ecosystem where startups can thrive. The future is bright – and all it takes is working together.

Oleg Khusaenov is CEO at Zubr Capital, a private equity firm specialising in the TMT sector