After posting its second consecutive year of profits in 2024, amounting to €85.3m ($97m), bunq announced its intention to enter the US market by applying for a broker-dealer license. While the bank has not yet applied for a full license, the broker-dealer license will allow it to offer investments and cash management capabilities as well as issue debit cards to US consumers.

During this time, bunq will be able to gather data including user feedback and operational insights, helping it to adapt its product offerings to address the needs of digitally minded consumers across the pond. This is a strong strategic decision by bunq, moving into the US market to provide unique banking products and take advantage of the low concentration of digital-only banks in the country.

GlobalData Competitor Benchmarking Analytics 2024

The US banking market is dominated by large traditional incumbents, including some of the largest banks in the world. According to GlobalData’s Competitor Benchmarking Analytics 2024, Bank of America has the largest retail market share, with 19% of consumers considering it their main bank. By another measure, GlobalData’s Global Banking Performance Analytics shows that JPMorgan Chase is the largest bank by total assets, totaling $4trn. Among these giants, the largest digital-only banks include Chime, with a 5% main bank market share, and Ally Bank, with $191bn in assets, suggesting that digital challengers have made some ground, but a dominant player has not yet emerged. In addition, the prevalence and popularity of local and regional banks makes the US market relatively dilute, and therefore it is an attractive target for a digital-only bank that is not subject to the same geographical constraints as traditional banks.

GlobalData Global Primary Banking Relationship Analytics 2024

Bunq is well positioned to take advantage of this low-concentration market with its broad portfolio of products and services, cloud-native digital platform, and seamless mobile user experience. According to GlobalData’s Global Primary Banking Relationship Analytics 2024, 16% of US consumers who switched banks did so because their new bank provided a better digital experience, suggesting the quality of digital banking platforms is a key factor for consumer satisfaction.

Bunq’s cloud-native platform is capable of superior performance when compared with the digital offerings of traditional banks, which are built on legacy infrastructure and are more likely to struggle with the increased demands of consumers. Many large US banks have suffered from digital outages, with Bank of America, Capital One, and JPMorgan all being affected within the last year. This lack of reliable service drives consumers to seek alternative providers such as digital-only banks that can deliver high-quality service at any time of day, any day of the year.

Furthermore, bunq’s broad product portfolio differentiates it from other digital banks in the market. For example, neither Chime, SoFi, nor Ally Bank offer mortgages, suggesting that bunq may be able to attract digitally savvy consumers who enjoy conducting all their financial activity online.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

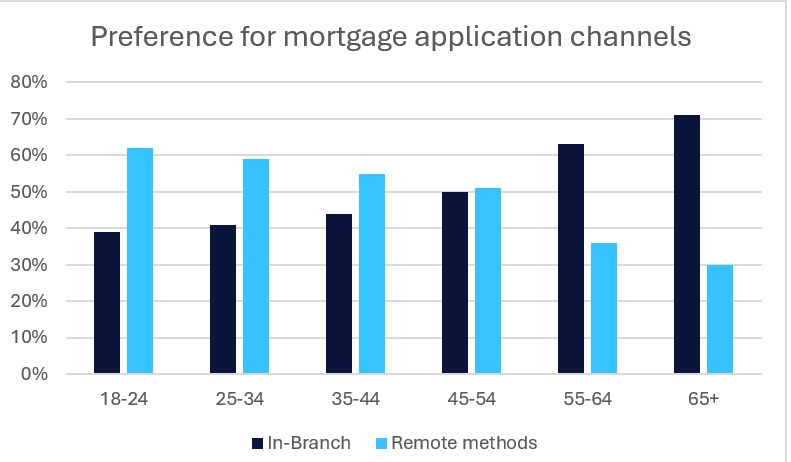

By GlobalDataGlobalData’s Global Channel Analytics 2024

According to GlobalData’s Global Channel Analytics 2024, consumers under 55 are more likely to prefer applying for a mortgage using a remote method such as telephone, mobile app, or desktop site than in a bank branch. This highlights the changing attitudes of consumers, showing that mobile apps are increasingly becoming a trusted and widely used tool for consumers to conduct even complex banking tasks. Bunq can benefit from this shift in preferences, as all the bank’s products are available through its mobile platform, and with many processes being automated, the time taken for applications or transfers to be resolved is greatly reduced.

Source: GlobalData’s Global Channel Analytics 2024

As bunq moves into the US market, it will need to focus on points of difference with other digital banks such as Chime, Ally, and SoFi. These banks tend to focus on underserved consumers in the lower-income brackets, providing services such as fee-free overdrafts and credit-building credit cards. Bunq may benefit from looking to higher-income consumers who are willing to pay a premium for high-value services such as investments, specialised lending, and paid plans offering both lifestyle and financial benefits.

Jonathan Vaughan Burleigh is an analyst, banking and payments, GlobalData