The New Zealand Commerce Commission’s report on competition in the country’s retail banking sector suggests the market is run as an oligopoly, dominated by the four large Australian-owned banks. The emergence of challengers in other markets over the past decade was driven by regulatory changes necessitated by the Global Financial Crisis, which the Reserve Bank of New Zealand (RBNZ) did not enact to the same level as the US and European markets. A patient and nurturing approach to new entrants will likely yield the improved competition desired by the commission.

GlobalData 2024 Financial Services Consumer Survey

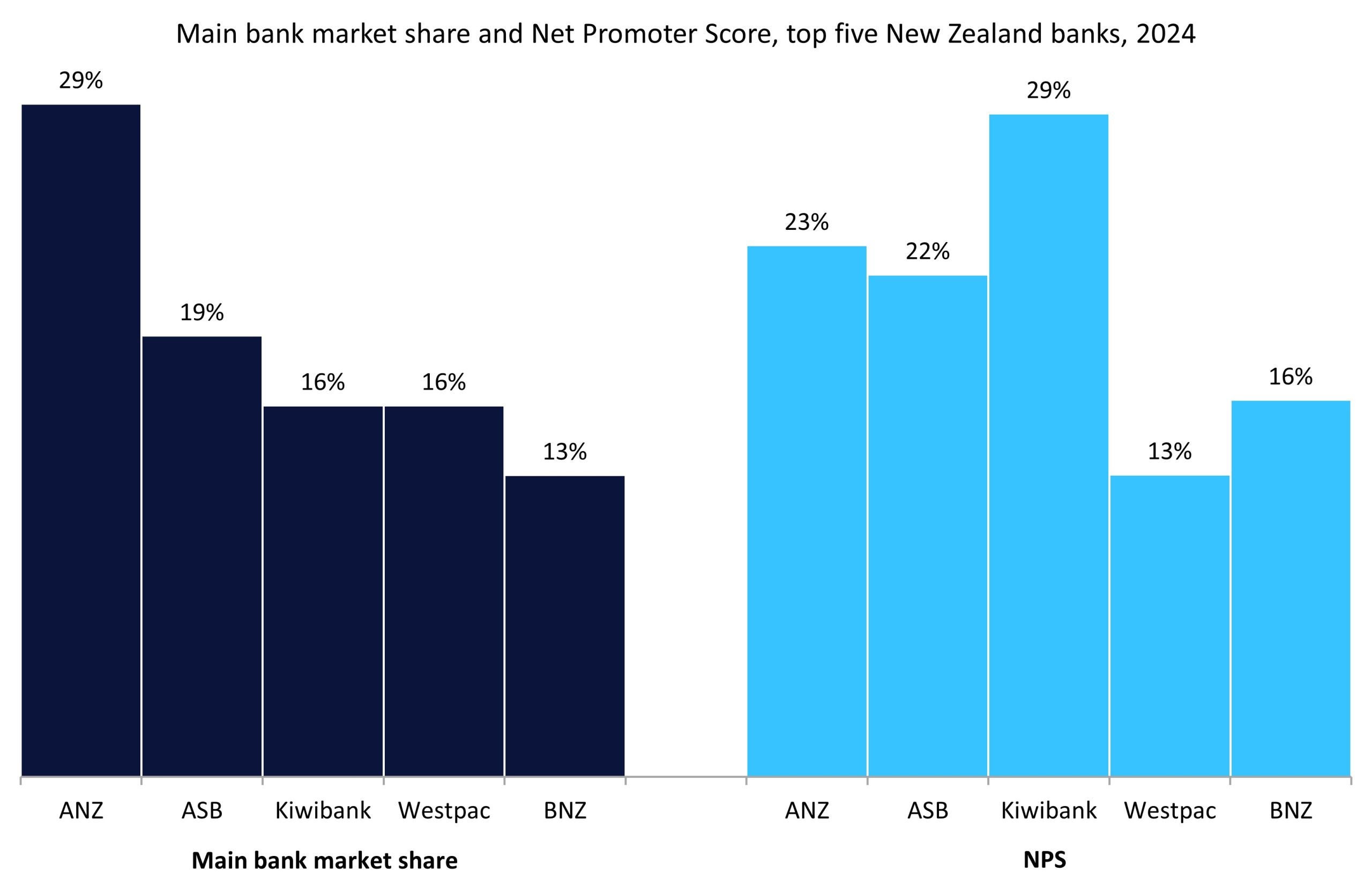

According to GlobalData’s 2024 Financial Services Consumer Survey, the New Zealand retail banking market is highly concentrated. 93% of New Zealanders say their main bank—the one with which they conduct the majority of their regular financial activity—is one of the four Australian-owned banks or state-owned Kiwibank. Minimal competition-inducing regulation over the past 15 years, failure to encourage transparency in publicising switching data (which may reduce customer inertia), and the RBNZ’s counter-Covid quantitative easing measures (a necessity at the time) have helped the leaders maintain their advantage over challengers.

The Net Promotor Score (NPS) of all five players is below 30%, illustrating the low level of customer advocacy between market leaders and consumers. Net satisfaction for competitive pricing among all four of the Australian-owned banks is below 68%, having declined (like many other satisfaction metrics) over the past few years, driving the desire to establish better competition.

Source: GlobalData 2024 Financial Services Consumer Survey

Of the recommendations to drive competition made by the Competition Commission, capitalising Kiwibank could be the simplest solution as it is the only player of similar size to the leaders. However, increasing the burden on the state to drive competition is unlikely to yield the strongest results over the long term. Price increases over the past few years have made public entities more expensive for governments, which will only increase over the coming years.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDigital challengers such as Revolut: potentially key to boosting competition

Fostering innovation and nurturing digital players may bring about greater competition over the longer term. New entrants have been slow to enter the New Zealand market; patience and beneficial policies aimed at newcomers will be needed for players to establish themselves. Revolut—which only entered the market in July 2023—could become a key player in this shift, given its record of success across other jurisdictions.

Having become a fully licensed bank in Ireland in March 2022, it now has a main bank market share of 6% in the country as per GlobalData’s 2024 Financial Services Consumer Survey. If Revolut and other digital players are given enough time and support, they may be able to grow in a similar way.

The New Zealand Government is also keen to accelerate open banking initiatives to promote this competition. However, the evidence of the past few years suggests open banking is yet to yield the rewards it has promised, despite significant investment and promotion of such schemes. Instead, policies that give a genuine competitive advantage to newcomers and fintech companies, akin to the US’s Durbin Amendment—allowing smaller players to charge higher merchant fees to give consumers better rates—may be more appropriate for fostering competition.

Benjamin Hatton is a banking and payments analyst at GlobalData