The full-scale public launch of STC Bank and D360 in Saudi Arabia is arguably the most impactful event yet within the Financial Services Development Program of the Saudi Vision 2030 initiative. The central bank, SAMA, aims not only to catch up with the level of digitalisation seen across the global financial services industry today, but also to position Saudi Arabia as a global leader in the sector. With two fully digital banks now in the market, and over 220 fintechs operating in the country, can Saudi Arabia achieve these goals within the next five years?

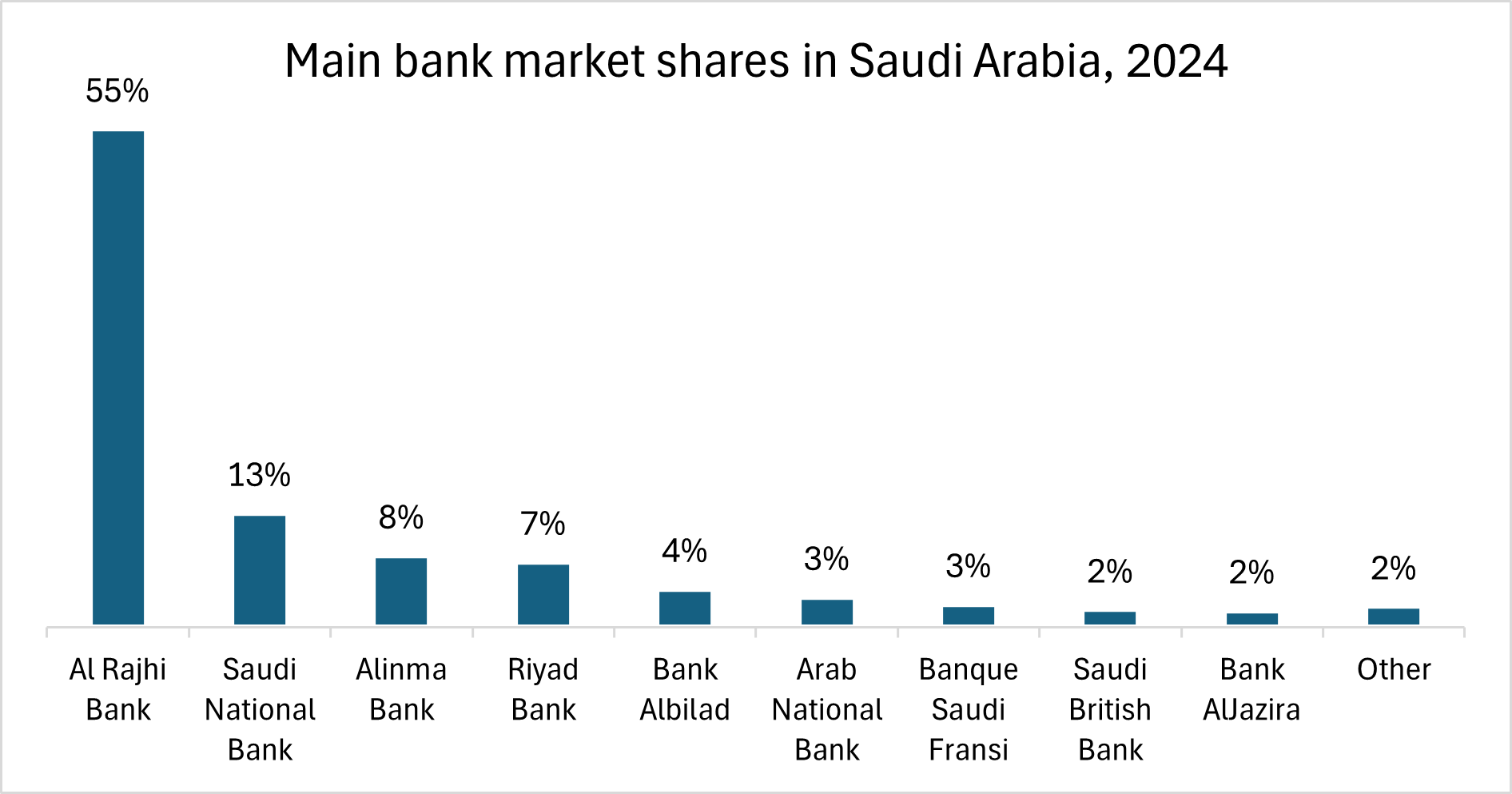

GlobalData Competitor Benchmarking Analytics 2024

GlobalData’s Competitor Benchmarking Analytics 2024 shows that incumbent Al Rajhi Bank held a clear lead in main banking relationships last year. However, 18% of Saudis would now turn to a digital-only bank when opening a new current or savings account, while another 32% are open to alternative providers such as Big Tech companies, telecom firms, and digital wallets.

GlobalData Global Customer Acquisition and Retention Analytics 2024

This leaves just half of the market for traditional banks when it comes to new accounts, according to GlobalData’s Global Customer Acquisition and Retention Analytics 2024. These indicators are promising for the two new digital players, which have an opportunity to challenge smaller legacy banks such as Bank AlJazira and Saudi Investment Bank in the coming years by offering a superior digital experience.

While STC Bank can leverage its existing wallet brand, STC Pay, for an initial customer base, D360 faces the challenge of acquiring customers from scratch. Despite this, its first-mover advantage has paid off, with D360 attracting 600,000 customers as of February 2, 2025, following its official launch in mid-December 2024, making it one of the fastest-growing digital banks in the region. The country’s first digital-only bank is using data analytics and AI to develop digital financing products for customer acquisition, while also planning to expand into travel forex cards and cross-border payments—an area of growing importance as Saudi Arabia continues to open up internationally.

STC, on the other hand, operates the second most popular mobile wallet brand in Saudi Arabia after Apple Pay, holding a 26% share of the local market according to GlobalData’s Mobile Wallet Analytics 2024. These wallet users are now encouraged to upgrade to a full-fledged bank account with STC Bank. However, more targeted efforts will be needed to establish a solid base of primary banking customers, where the strategic application of customer data and AI can enhance engagement and retention.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAs both banks continue rolling out their product lines, maintaining a strong focus on core banking functionalities will be crucial alongside product innovation. Any missteps in this area could significantly undermine customer trust.

GlobalData 2024 Financial Services Consumer Survey

This will be especially key in a market where the most common reason for switching main banking providers remains a lack of access to physical branches, according to GlobalData’s 2024 Financial Services Consumer Survey. While digital banking adoption is rising, ensuring a seamless and reliable customer experience will be key to sustaining long-term success in Saudi Arabia’s evolving financial landscape.

Blandina Szalay is a Banking & Payments Analyst at GlobalData