JPMorgan’s exit from the Net Zero Banking Alliance marks the sixth such action from a large US bank since early December 2024, when Goldman Sachs was the first to announce its withdrawal from the group.

Since this time, other large actors such as Wells Fargo, Morgan Stanley, and Citi have opted to leave the NZBA, citing fear of political backlash from pro-fossil fuel Republican politicians who view the alliance as threatening the future of US oil and coal. While the NZBA remains healthy, still comprising 141 members including all the largest European banks, the move away from environmental, social and governance (ESG) initiatives by the largest US banks raises concerns for the future of sustainable finance.

While ESG has become somewhat of a buzzword in recent years, the underlying principles have been discussed for decades; the importance of minimising the impact of corporate activity on the environment and local area, and transparent and fair governance principles such as equal pay and equal opportunities.

The impact ESG initiatives have on company performance is not yet clear; following the guidelines usually restricts revenue-generating activity and incurs higher costs that damage a firm’s bottom line, however could be outweighed by attracting consumers concerned with environmental and social justice issues.

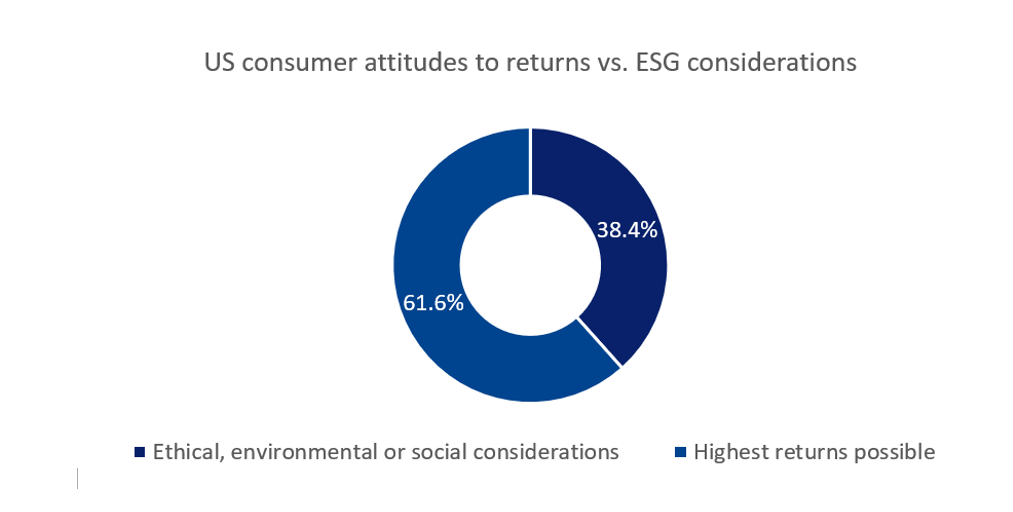

GlobalData’s Financial Services Consumer Survey 2024

Despite media coverage reporting changes in attitudes among consumers, especially those in the younger generations, support for ESG principles is still in the minority. GlobalData’s Financial Services Consumer Survey 2024 shows that, globally, 57.1% of all consumers who invest prefer to receive the highest returns possible over investing companies with ESG considerations. This figure is even higher in the US, with 61.6% of consumers preferring maximum returns, which could be a driving factor behind the banks’ decisions to exit the NZBA.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData(Source: GlobalData’s Financial Services Consumer Survey 2024)

GlobalData Competitor Benchmarking Analytics

Further data from GlobalData’s Competitor Benchmarking Analytics reveals that 79% of consumers are satisfied with their main bank’s ESG approach. This relatively high figure, paired with the fact that ESG just scrapes into the top 10 concerns for consumers, is likely to lead banks to believe that the costs associated with ESG programs vastly outweigh the benefits. Although large segments of consumers claim to be strong supporters of social justice and environmental ideals, only 17% consider ESG principles when choosing a main bank, demonstrating that the importance of ESG is overshadowed by other metrics such as product range and quality, price, and customer service offerings.

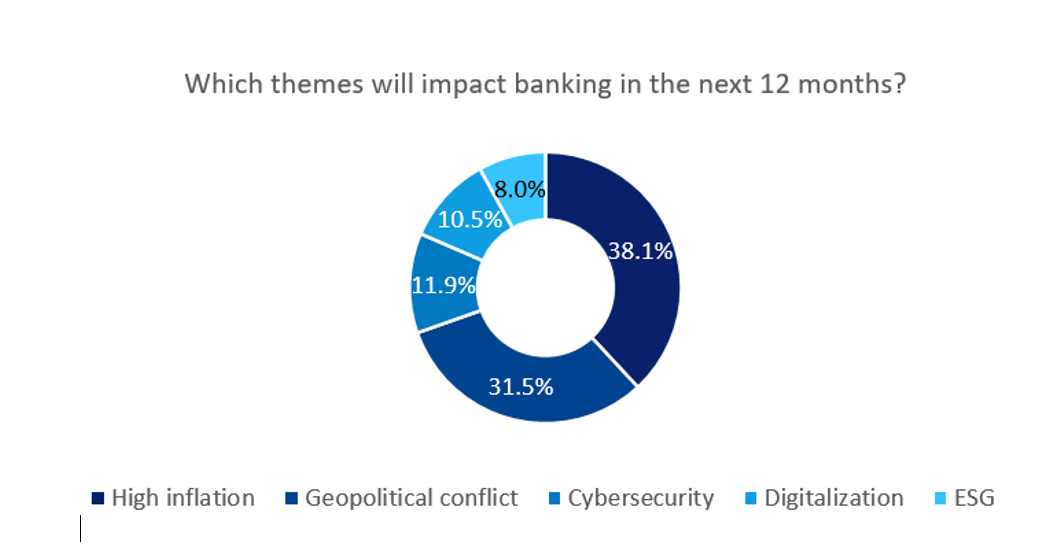

GlobalData’s ESG Sentiment Polls

Negative attitudes toward ESG principles are not just limited to consumers and are also pervasive in the corporate environment. GlobalData’s ESG Sentiment Polls conducted in Q4 of 2024 highlight the attitudes of executives toward such principles, revealing that the vast majority of corporations do not believe ESG to be impactful. Just 8% of executives believe that ESG will be an impactful theme on their business in the next 12 months, compared with 38.1% and 31.5% for high inflation and geopolitical instability. This reinforces the idea that ESG is not viewed as key issue for company performance. Indeed, 57.9% of executives believe that ESG is just a marketing exercise, compared to only 4% who believe that companies are fully committed to ESG. Given that adopting ESG principles does not improve financial performance and is not highly valued by consumers, companies have little incentive to align with values which incur higher costs and restrict commercial activity.

(Source: GlobalData’s Thematic Intelligence: ESG Sentiment Polls Q4 2024)

While the banking industry itself does not have a large environmental or social footprint, the activity facilitated through lending and credit access often does not align with net-zero commitments. According to the Rainforest Action Network, JPMorgan Chase, the largest financer of fossil fuels has spent over $430bn since the Paris Agreement and the 60 largest banks across the world have invested more than $6.9trn into the industry.

It is becoming increasingly clear that high returns on fossil fuel investments are more attractive to large banks than riskier and less profitable alternative fuel options such as renewables, resulting in more sustainable options being sidelined for energy sources that produce emissions, scar the landscape and damage the health of workers and local residents. If suppliers of credit continue to support these industries, there will be little that companies in other sectors can do to reduce their impact on the planet and their local environment, reducing ESG considerations to a footnote in corporate reports, or a buzzword not backed by any meaningful policies.

Jonathan Vaughan Burleigh is an associate analyst, banking and payments, GlobalData