UBS has rolled out a blockchain-based digital currency system, UBS Digital Cash, tailored for commercial and institutional customers. The Swiss bank’s innovative payment solution is designed to increase the efficiency of its clients’ domestic and international transactions, supporting multiple currencies, including Swiss francs, US dollars, Chinese yuan, and euros.

By leveraging blockchain technology, UBS seeks to eliminate the reliance on traditional intermediaries, embedding compliance checks directly into the code through smart contracts. These self-executing contracts not only enhance operational efficiency but also address inefficiencies in cross-border payments, a long-standing pain point for global commerce.

A major benefit of UBS Digital Cash is the transparent and immutable nature of the blockchain ledger. Once transaction data has been recorded, it becomes nearly impossible to change, bolstering system integrity even in the face of potential cyberattacks.

Each entry in the ledger contains information about all previous entries, and maintenance of the ledger is decentralized, making fraudulent activity far more difficult. Greater transparency can generate greater trust in a system, a key variable when moving large sums of money around the world.

Smart contracts provide advantages over traditional payment methods in speed and reliability. By automating the processes of clearing, settlement, and fund transfers via blockchain code, UBS offers real-time payments that bypass regulatory intermediaries, reducing both costs and delays. This also eliminates the complexities of foreign exchange, expediting transactions while removing exposure to currency volatility.

The end result of these efficiency gains is that the settlement and transfer of funds is able to happen in near real-time, compared to hours or even days under traditional systems. The speed of using this currency gives UBS’s corporate and institutional clients a much clearer picture of their current liquidity.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis is most impactful for banks and financial institutions, which are subject to strict liquidity constraints that limit their level of lending, but also helps firms manage their supply chain and cash flow. Banks must hold enough cash to be able to cover expected withdrawals and liabilities for the day and must borrow from other institutions if this threshold is not met, impacting profit margins.

GlobalData Payment Instrument Analytics

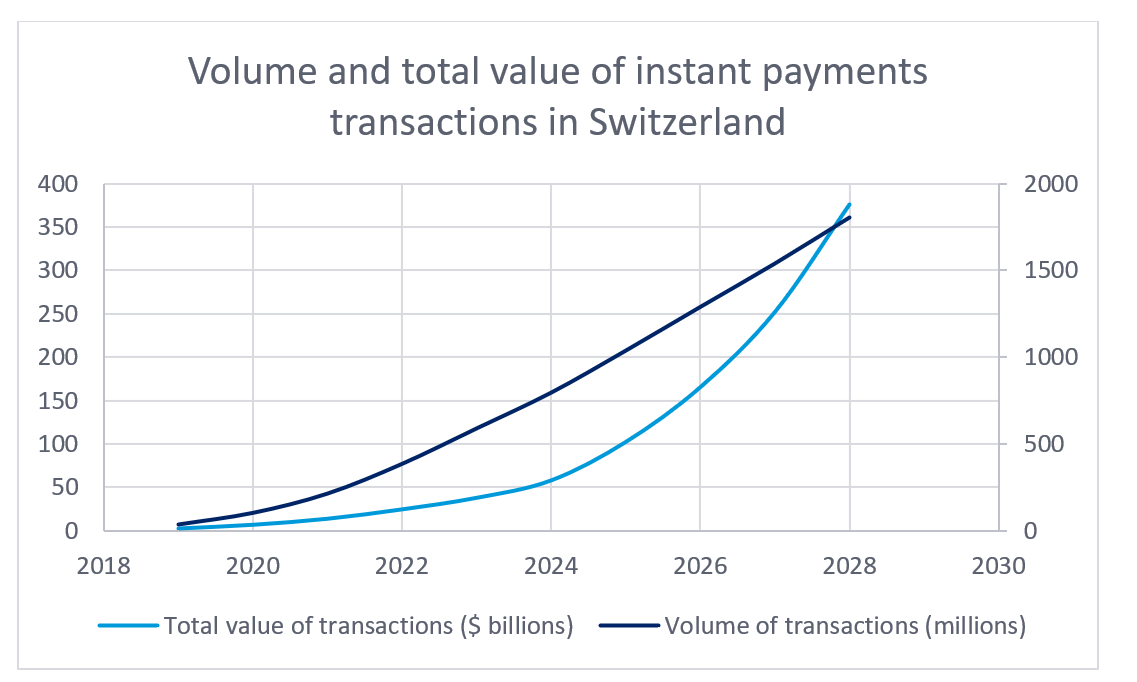

An increase in liquidity is equivalent to a reduction in the cost of lending, increasing banks’ willingness and ability to lend. While UBS is a large bank, it does not have the power to affect macroeconomic variables. However, if investment into this technology continues among other financial institutions, the increased lending represents an effective increase in the money supply. GlobalData’s Payment Instrument Analytics reveals that the volume of instant payments in Switzerland has risen 21-fold over the last five years.

Moreover, the total value of instant payments transactions is forecast to increase from $2bn in 2019 to $376bn in 2028. This suggests that consumers and businesses value the efficiency benefits of these payment channels very highly, increasing the adoption of the technology and driving innovation by providers.

Potential unintended consequences

This could have unintended consequences including inflationary pressures, increased economic activity, and increased levels of bank risk. In the coming years, governments and central banks will need to consider fiscal and monetary policy to address the effect of digital currencies on the macroeconomic level. Regulation around this new technology also needs to be strengthened. While identity and legitimacy checks are in place before institutions are given permission to the private blockchain, the transactions are not subject to the same scrutiny as traditional payment channels.

The likelihood of fraud is mitigated by the transparency of the blockchain, but suspicious or irregular transactions can still be made with no process to ensure legitimacy. UBS Digital Cash exemplifies the transformative potential of blockchain in monetising payments.

Yet its success and broader adoption hinge on addressing regulatory gaps, managing systemic risks, and ensuring that technological benefits align with macroeconomic stability. This pilot could redefine the payments value chain but also challenges regulators and policymakers to adapt to a rapidly evolving financial landscape.

Jonathan Vaughan Burleigh is an associate analyst, banking and payments, GlobalData