Facebook recently pulled the ability for users to pay their friends via Messenger. The feature allowed users to set up a payment account by adding their bank card to their account, enabling them to both send and receive money via the app.

However, its lack of popularity among users in France and UK led to its demise. Meanwhile, the M virtual assistant – which made payment suggestions when it recognised that users were discussing money – has also been removed.

The Facebook Messenger functionality got all of the major UK banks on board when it was launched in 2017, but consumer uptake never took off. GlobalData’s 2018 Retail Banking Insight Survey found that 55% of users in France and 71% of users in the UK have never used instant messaging to complete banking tasks.

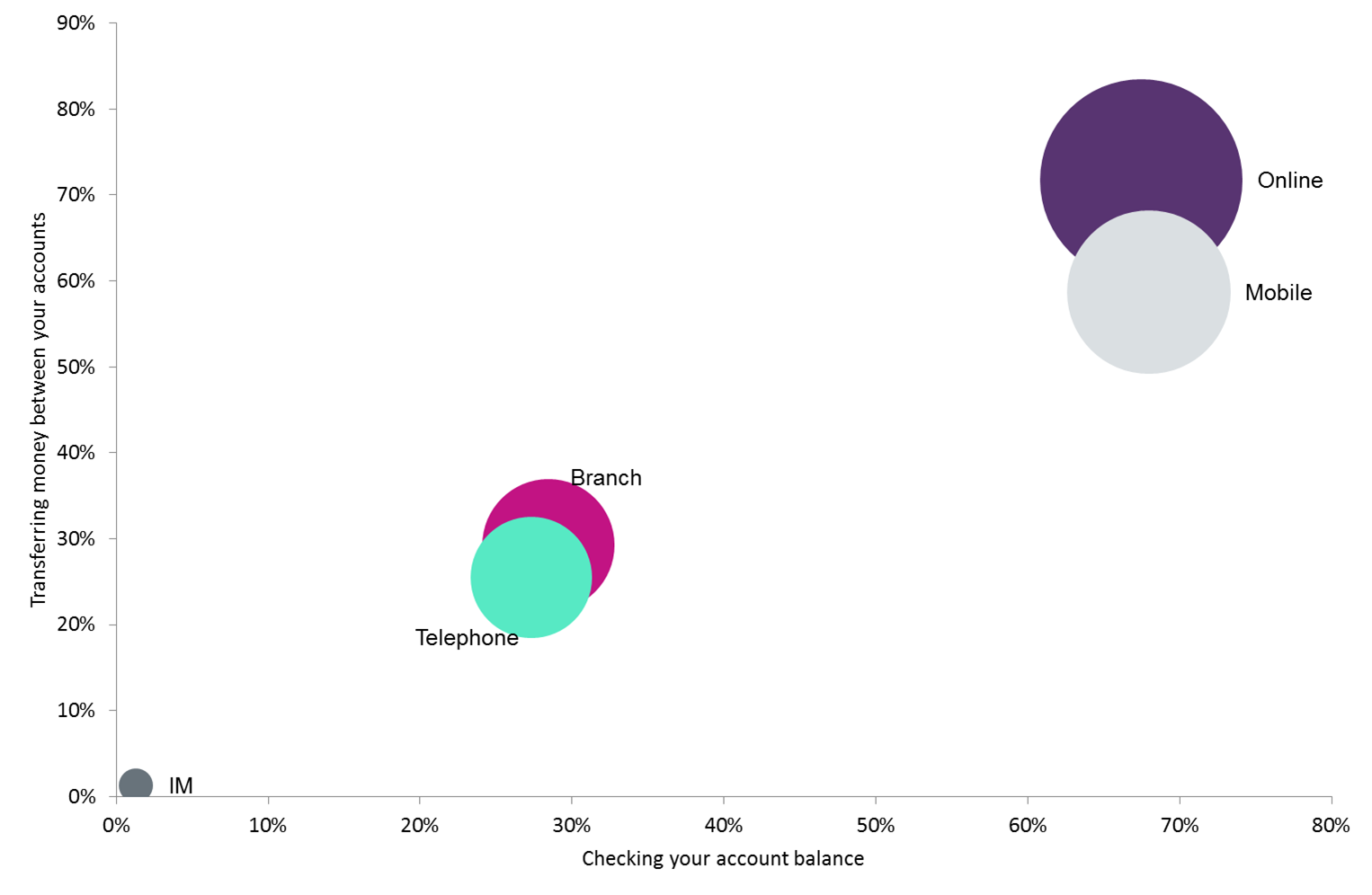

One reason for this is that users have a channel preference when undertaking their banking needs. GlobalData’s survey found that users who actively use online banking at least once a month also state it is their preferred channel to complete 11 different banking tasks – including checking their balance, paying bills, and depositing cheques. Mobile banking users also show loyalty in terms of their preferred channel, with mobile favoured for conducting banking activities such as checking their balance, viewing transactions and statements, and transferring money to other people.

On paper, banking via instant messaging sounds like a useful innovation. But in practice the functionality lags too far behind other channels to drive consumer adoption, with both online and mobile banking allowing users to carry out a wider range of tasks. Users do not typically stray far from their banking preferences – something banks must keep in mind when formulating their channel strategy.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData