The traditional strategy of attracting customers with cash offers is an extremely simple one that works. Between April and June this year, figures from the Current Account Switching Service showed that banks offering lucrative switch incentives were far more likely to attract customers than banks that were not.

Banks like First Direct, Nationwide, and NatWest all had net gains in customers whilst simultaneously offering gifts like $121 (£100) for signing up, $152 (£125) cashback, and $242 (£200) to share when successfully recommending a friend.

However, as the figures for whole switches will be masking, this only gets incumbent banks so far. Digital challengers such as Monzo have been offering potential customers £5 incentives to open an account, but with no obligation to switch. Since last year, it has gained one million customers. This strategy, which is equally threatening to incumbents, allows digital banks to hook customers before gradually converting them.

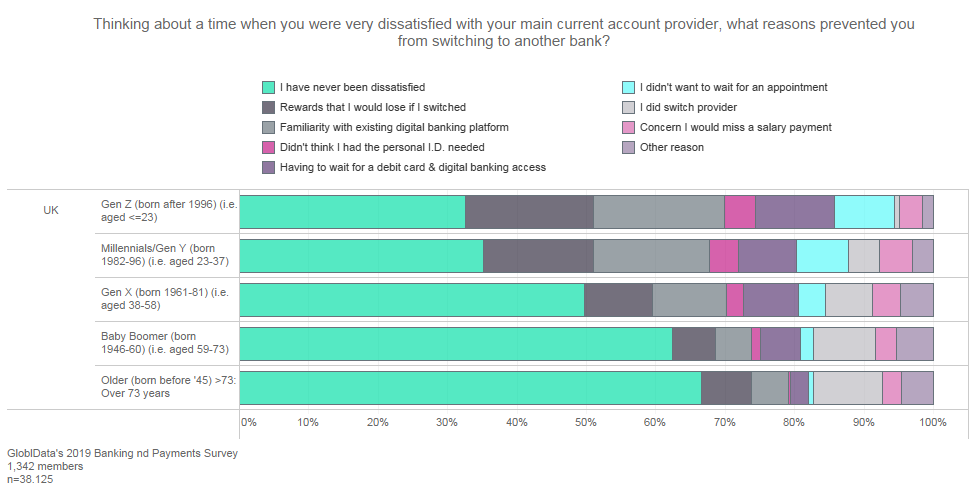

In addition to switch incentives for attracting customers, banks should focus on retention. GlobalData’s 2019 Banking and Payments Survey shows there are opportunities for banks to keep UK customers by enhancing the features they would miss most should they leave.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn particular, our data shows that banks can construct key defences against digital challengers by providing loyalty or reward programmes as well as offering personalisation features to their online banking propositions. An example of this is HSBC, one of the few major banks actually gaining customers (Pay.UK, 2019). It uses customer data to personalise its reward offering including travel, merchandise, and gift cards, with 70% of users checking out AI-recommended e-mails to redeem their reward points.

As the competition over consumers intensifies, banks need to come up with strategies that deliver both acquisition and retention. Once banks have incentivised new customers to switch, they should focus on delivering enhanced features that will make them want them to stay.