International fund transfers rely on correspondent banking, where one bank provides services to another. Correspondent banking is essential for global trade, facilitating cross-border transactions primarily in dollars. However, this network is shrinking despite the need for access to emerging markets.

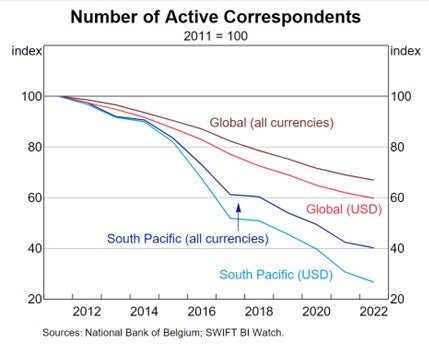

The number of active correspondent banks worldwide fell by about 4% in 2020 and about 25% between 2011 and 2020. This is partially due to increased compliance costs associated with enhanced regulatory scrutiny. Moreover, the dominance of the USD in global trade, despite the advantages it can present, creates challenges for the global south. This is because moving money requires a USD correspondent bank, which can be difficult to find for emerging market banks.

Addressing correspondent banking risk

So, why is this an issue? This contraction of correspondent banking creates risks in terms of both financial inclusion and the effectiveness of global efforts to combat money laundering, terrorist financing, and sanctions enforcement. Additionally, alternative networks may emerge for countries unable to access reliable correspondent banking, undermining broader global efforts to ensure a secure and inclusive financial system. For emerging markets, it is a crucial tool for accessing global networks, allowing for international finance and investment, humanitarian aid, disaster relief and a range of other development functions.

Addressing correspondent banking risk is therefore crucial not only for financial stability but also in fostering growth, financial inclusion, and international trade while countering illicit activities and bad actors.

Banks retreat from correspondent banking and the different forms of risk

Banks have historically had a strong and extensive network of correspondent relationships, but this has diminished. Over the years, regulatory requirements for correspondent banking relationships have become more stringent, primarily to combat money laundering, terrorism financing, and other financial crimes.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataEach correspondent bank has varying degrees of risk appetite and different procedures for evaluating respondents. This has given rise to varying levels of client due diligence, allowing multiple cases of money laundering and financial crime to slip through the net during financial crime risk management and evaluations within notable institutions. For example, between 2007 and 2015, the Estonian arm of Danske Bank was found to be responsible for the facilitation of $236bn of illicit transactions. As a result, compliance standards have become more stringent, prompting some banks to reevaluate risks and retrench to core activities such as retail and corporate banking, whilst reducing their appetite for correspondent relationships. Often, this has led to the termination of respondent relationships based upon geographic factors as opposed to the true risk posed by the respondent. This process, known as ‘de-risking’, disproportionately impacts banks in emerging markets and thereby exacerbates the issues associated with access to global financial systems.

Consequences of shrinking correspondent banking networks

Additionally, maintaining correspondent relationships can be costly, especially if the volume of transactions is not substantial. Smaller banks or banks operating in regions with limited trade volume may find it less economically viable to maintain an extensive network of correspondent banks.

These shrinking correspondent banking networks can have far-reaching consequences.

Limited access to financial services may impact individuals and businesses in certain regions, leading to delays and higher costs for international transactions. Financial exclusion could worsen for underserved areas, hindering their participation in the global economy and access to vital financial services. Moreover, reduced correspondent networks disrupt the flow of foreign aid and development funds to countries relying on these channels for support.

What needs to happen to address the problem?

With de-risking and a shrinking network, the ability for individuals and businesses to send and receive international payments becomes more limited. This can push people into using unregulated and potentially unsafe “shadow payments” with negative consequences for financial inclusion, international trade, and the efforts to address illicit activity.

To effectively de-risk, regulators must align local regulations with international standards, like those set by the Financial Action Task Force (FATF). They should rigorously enforce these rules and regularly assess banks’ compliance, identifying weaknesses for improvement.

Commercial banks, integral to correspondent banking, must establish transparent, trusting partnerships with counterparts. They should enhance AML/CFT measures with robust customer due diligence, risk assessments, and transaction monitoring.

And in line with correspondent banks’ risk tolerance, commercial banks should exit relationships not aligning with these standards. This proactive approach safeguards system stability and mitigates potential financial and reputational risks.

Overall, de-risking in correspondent banking can be effectively addressed through a multi-faceted approach that involves collaboration between regulators, commercial banks, multilaterals, and governments. To reduce overreliance on a limited number of large correspondents, it is crucial to identify and engage a broader network of specialist banks capable of working in partnership with larger correspondents, aggregating flows from smaller jurisdictions. Many of these smaller jurisdictions have taken all of the appropriate steps to limit the impact of de-risking but the volume of payments is low which negatively impacts the commercial viability of maintaining correspondent relationships.

Additionally, multilaterals and governments should actively collaborate with correspondents and de-risked countries to understand specific challenges and implement targeted solutions, such as training regimes and financial assistance. Furthermore, it is imperative that countries acknowledge and address the inherent risks within their domestic financial system if these risks are impacting access to correspondent banking relationships.

Afterall, it is the markets that are most vulnerable to de-risking that most need to be connected to the wider financial system.

Furthermore, promoting financial inclusion and stability in the most fragile countries requires innovative measures.

Granting licenses to specialist banks with expertise in emerging markets to operate as correspondents in these regions can help address the significant challenges posed by correspondent banking de-risking. Additionally, it can also reduce the burden on the small number of large correspondents who today manage the vast majority of the world’s payments.

By fostering these strategic partnerships and addressing the unique needs of vulnerable countries, the global financial community can enhance the resilience and effectiveness of correspondent banking relationships, ensuring a more robust and more inclusive international financial system for all, rather than just the few.

Steven Marshall is Chief Partnerships Officer, Crown Agents Bank