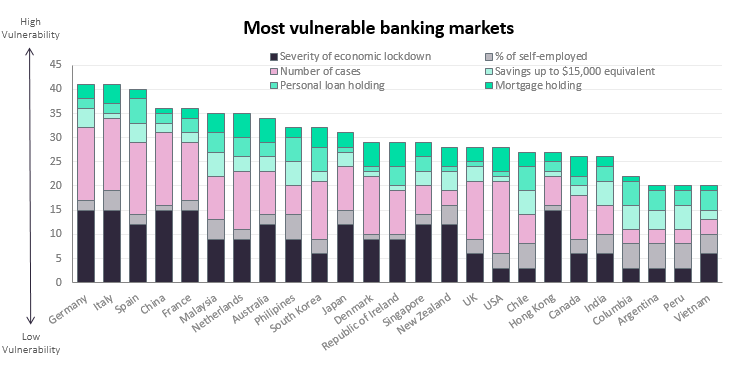

GlobalData’s analysis covering a variety of macro factors such as the loan penetration rate, the numbers of self-employed, and quarantine measures puts banks in Germany, Italy, China, Spain, and France as the most vulnerable to Coronavirus.

As Covid-19 spreads throughout the world, governments have acted by putting in place restrictive measures, grinding economic and social life to a halt in many countries.

Although most see these restrictions as the prime threat to banks’ businesses, GlobalData has also looked at more ingrained factors found in each nation, coming to the conclusion that European banks face the most disruptive potential.

The scores have been created by studying six factors: the number of virus cases, the severity of economic restrictions, the percentage of self-employed workers, and of them, the percentage that hold a personal loan, mortgage, or savings of up to $15,000 equivalent. Banks in Germany are likely to face potential funding problems due to the high level of savings that self-employed consumers hold. However, with 13% of its workforce being self-employed and high in mortgage holding, Italian banks may have to deal with a rise in non-performing loans.

Banks in APAC countries such as Malaysia, Australia, and the Philippines also face potential disruption through the high penetration rates of mortgage and personal loan debt. However, the lack of widespread infection in these areas has so far kept them lower down in the rankings, leaving banks in Europe with spiraling case numbers as the prime areas of global disruption in banking.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData