Biometrics are putting an end to password-only. Allowing for increased customer convenience while adding additional levels of security, multi-faceted biometric applications will soon be the norm. It’s time for banks to leverage biometric security across their distribution channels.

Biometrics were a key theme at the 2018 Money 20/20 conference in Las Vegas. While industry experts agree that the application of biometrics has the potential to tackle fraud more effectively than ever before, more has to be done to roll it out to different aspects of the bank.

Utilising biometrics

GlobalData’s 2018 Consumer Payments Insight Survey shows that 16% of consumers globally have been victims of payment fraud over the past four years. Not counting the reputational damage providers suffer as a result, this is costing the industry billions every year.

Of those consumers who have been subjected to fraud, 9% closed their accounts and switched to another provider. Given the costs involved in acquiring and retaining customers, this is a significant proportion. Yet, financial services providers’ level of concern remains low.

This is particularly true in the wealth management and private banking space where we see the highest-value transactions, and hence the highest risk of fraud and reputational damage. Only 34% of providers regard the effect of data breaches on their company’s brand as a threat, suggesting a blind spot in executive thinking.

Clearly, providers have to up their game – especially as customer impetus is not lacking. Biometrics will replace or supplement pin codes and passwords.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

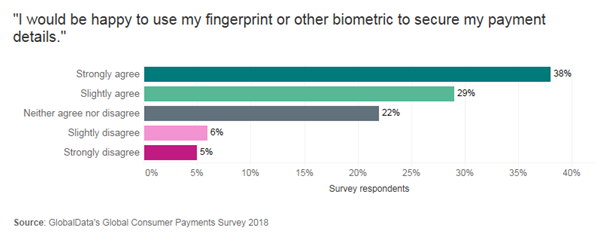

By GlobalDataGlobally, 67% of consumers would be happy to use some form of biometric to secure their payment details. This is in line with statistics shared at Money 20/20, according to which adoption rates of biometric authentication are as high as 93% among banking customers if rolled out properly.

Banks often worry about the balancing act of extra security and maximising convenience, but clearly there are solutions such as biometric security that can address both. It’s time to act, or be left behind.