The UK economy grew by 2% in 2016, with activity having been relatively unaffected by the EU referendum result. However, with a weaker pound set to drive up inflation and squeeze household spending power, GDP growth is expected to slow to 1.8% on average over the forecast period.

UK economic growth held up better than expected in 2016 following the Brexit vote. However, it slowed in the first half of 2017 as inflation rose to 2.7% in August 2017 – much above the Bank of England’s 2% target – and household spending power is being squeezed as a result.

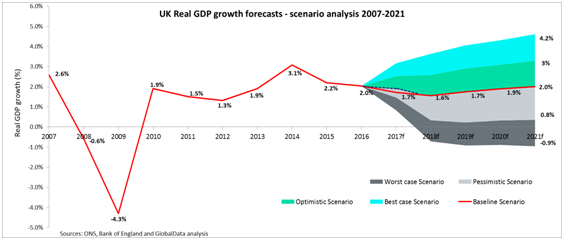

The Bank of England’s five potential scenarios for economic growth over the next decade suggest a relatively benign outlook. The baseline scenario estimates potential output growth of just 1.8% on average from 2017 to 2021.

This is lower than the 2012–16 period (2.1%) and it is expected that the economy will endure a softer patch over the next few years before resuming growth (1.9%) in 2020 and (2%) in 2021.

The risks to growth in the baseline scenario are weighted towards the downside due to Brexit, as well as the fact that in July 2017 the economy grew at a slower pace than anticipated (projections are highlighted by the dotted blue line in the chart below).

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe medium-term outlook in the worst case and pessimistic scenarios combined appears subdued, and is based on a period of relatively weak business investment.

The start of the negotiations around the UK’s departure from the EU means that there is a large degree of uncertainty around future prospects.

Increasing inflation and the persistent weakness in productivity growth also lead us to expect potential output growth of just 0.2% on average over the forecast period 2017–21, and this would represent a modest deceleration compared with the 2012–16 period (2.1% a year).

After the Brexit vote, the Bank of England’s monetary policy committee cut the base rate as an emergency measure from 0.5% to 0.25%, its lowest level in the bank’s 323-year history.

One of the main reasons for the UK’s slow growth in recent years was the weakness of the banking sector and its ability to support expanding businesses with extra loans.

However, in 2018, as the Bank of England is expected to raise interest rates, this would have the effect of supporting efforts by high-street banks to boost their profits and the reserves needed to protect them against a financial crash.

But since the performance of the UK economy in 2016 was broadly in line with expectations, with GDP growth coming in at 2.0%, the economy has proven to be far more resilient in politically turbulent times.

Therefore, under the best case and optimistic scenarios GDP growth is expected to be firmer, at around 3% on average from 2017 to 2021. Based on the fact that the UK has rebalanced its economy since the financial crisis began in 2008, the long-term picture is still one of robust growth and we’ll be able to see signs of recovery from 2019 onwards.