In recent times, extensive research has been conducted on the profound impact of immigrants on the tech industry, particularly in the US and Europe. Despite the wealth of existing data, there is an ongoing need to reevaluate this issue, especially considering the widespread misconception that immigrants pose a financial burden to host nations – a belief influencing investors’ perceptions, leading to challenges for immigrants and relocates in fundraising activities.

However, the reality couldn’t be more divergent. While the integration of immigrants – facilitated through language and professional training – can initially weigh on the public budget, numerous studies unequivocally suggest that the short-term costs are more than compensated for by long-term economic, social, and fiscal benefits.

The dominating role that immigrants play in tech sector growth and innovation cannot be overlooked. Immigrants have proven their entrepreneurial prowess by founding so-called unicorn companies and leading powerful startups, contributing significantly to the economies of their host nations. Furthermore, they inject fresh ideas into the industry and form a substantial segment of the tech workforce.

Interestingly, these untapped potentials and the existing misconceptions about immigrants create a valuable opportunity for new funds to invest in promising relocated entrepreneurs. Zubr Capital, a private equity firm committed to investments in companies within the TMT sector, firmly believes that it’s pivotal for the tech industry and investors to align their perceptions with this reality and embrace the diverse talents immigrants bring to the table.

Entrepreneurial energy: new settlers outperform natives threefold

A wide-ranging study examining data spanning three decades from 15 countries in Western Europe deduced that relocates and migrants can contribute positively to their host nations’ economies within a mere five years of their arrival. Such a finding encapsulates their potential for rapid economic integration and high productivity.

In the context of the United States, where the foreign-born population represents 13.7%, immigrants remarkably account for 20.2% of the self-employed workforce and 25% of startup founders. This disproportionate contribution underscores the integration and vital economic participation of immigrants.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMoreover, a comprehensive study carried out in 2016 by the Global Entrepreneurship Monitor (GEM) disclosed that immigrants are thrice more likely to be entrepreneurial compared to native UK citizens. The report highlighted that UK immigrants exhibited the highest levels of “Total Early-Stage Entrepreneurial Activity.”

The persistent misconception of immigrants as a financial burden to host nations is far from the truth. Instead, the picture portrayed by hard data suggests that immigrants are a high-value addition to the economies – particularly in sectors like technology, where their entrepreneurial spirit thrives.

Immigrant impact: A close look at founders with immigrant backgrounds

Founding a business is a remarkable feat, but it is even more impressive when tackled by immigrants. With the right ecosystem and support, immigrants have proven to be significant contributors to technological innovation and economic growth, particularly in the United States, United Kingdom, Germany, and Estonia.

In the US, where the foreign-born population stands at 13.7%, the contribution of immigrants to new startups significantly surpasses this percentage. Foreign-born citizens in the U.S. are 80% more likely to establish a firm. Furthermore, the entrepreneurial input of immigrants in Silicon Valley between 1995 and 2005 exceeded 50%, offering a significant boost to California’s economy. With over half of the US start-ups valued at over $1bn having at least one immigrant founder, there’s no denying the enormous value immigrant entrepreneurs add.

Moving over to the UK, despite only 15% of the population being foreign-born, they comprise 39% of the founders of fastest-growing companies. Half of these fast-growing businesses have at least one immigrant co-founder, attracting substantial investments and contributing to the nation’s overall economic growth. Immigrant founders are significant contributors to the UK’s tech industry boom, founding nine out of 10 unicorn businesses.

Germany’s tech scene also brims with stories of successful immigrant entrepreneurs, with 44% of new businesses established by people with non-German heritage. In Estonia, the tech sector growth is largely driven by foreign-born entrepreneurs. Estonia’s intentional policies promoting innovation and immigration have fostered a vibrant startup environment. The Startup Visa program, Estonia’s e-Residency, and the Digital Nomad Visa have attracted global investment and expertise, with 32% of Estonia’s founders being of foreign origin.

These cases powerfully illustrate the entrepreneurial potential of immigrants, contributing to economic growth and innovation within the tech sector. Rather than viewing immigrants as a financial burden, investors need to see the unique opportunity that lies in these untapped potentials – that of backing disruptive tech ideas and the next big tech unicorns.

Why immigrants are more likely to become entrepreneurs

Today’s market is decorated with an array of successful entrepreneur immigrants, who, despite encountering hardships, have managed to contribute considerably to their host countries’ economies. But why are immigrants more likely to take on the entrepreneurial route? Are they simply forced into it or is there another hidden motivator?

A crucial aspect is the linkage between high-risk tolerance and entrepreneurial endeavors. Both emigration and entrepreneurship are risky feats, and it seems that those willing to undertake both are the ones with a high risk-tolerance. A comprehensive study of Austrian students confirmed this link, where individuals with a high achievement motivation and willingness to take risks were more likely to emigrate and gravitate towards entrepreneurship. This ‘personality-based self-selection’ illustrates a key aspect that drives immigrant entrepreneurship.

So, far from a financial burden, immigrants are, in fact, a valuable addition to the economic fabric, with a pronounced entrepreneurial spirit.

Investment perspective: Recognising the value of investing in immigrant entrepreneurs

Interestingly, even the top 20 US venture capitalist funds exhibit a strong bias in favor of male founders with STEM degrees from elite universities. However, by focusing narrowly on this demographic, these funds risk overlooking a growing sector.

Christian Dorffer, founder of Defiance Capital, commented on this trend, stating that the majority of seed funds often make the error of backing the wrong type of founders. Citing a study on unicorn founders, Dorffer revealed that 62% were immigrant founders, often originating from countries where building unicorns is nearly impossible.

The fact that immigrant founders often face difficulties raising funds, presents a golden opportunity for new funds to enter the scene and actively seek out these diverse founders. Immigrant founders, typically from developing countries, display remarkable hunger, self-belief, ingenuity, and resilience, proving that they are capable of delivering outstanding results.

Understanding the untapped potential of immigrant entrepreneurs, venture capitalist firms like Unshackled Ventures and OneWay Ventures are pioneering a new trend – setting up funds exclusively for businesses started or co-founded by immigrants. Providing startup support, they also cater to the unique needs of foreign-born founders, including offering legal advice and visa assistance. Their investment rationale is straightforward and strongly bolstered by concrete evidence. According to OneWay Ventures, owing to self-selection, immigrant founders possess a competitive edge in building impactful, globally influential ventures.

A future driven by diverse talent

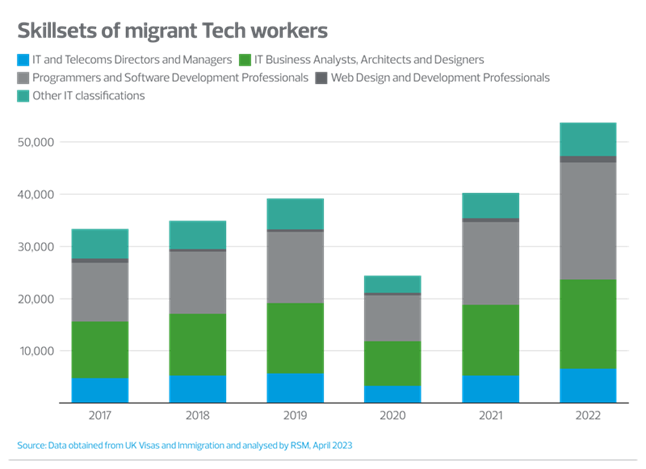

In summary, there is a powerful economic case for embracing the diverse and rich talent pool that immigrants bring to the tech industry. The 2022 Tech Nation report reveals that out of 14.85 million UK job vacancies, a whopping 2 million are in the tech sector alone, speaking volumes about the global and industry-wide talent crunch.

With such pressing demand for specialised skills, it’s irrational to underutilise immigrant talent due to misconceptions. Immigrants have shown their entrepreneurial acumen by founding unicorn companies and leading innovative start-ups, contributing immensely to their host economies. The Korn Ferry Institute further heightens the urgency by predicting that the talent shortage will cost governments and companies $8.5trn by 2030, making it imperative to tap into the untapped potential of immigrant entrepreneurs. As more funds begin to invest in these talented individuals, the tech industry stands to reap an avalanche of benefits from this rich diversity of thought, innovation, and entrepreneurship.

Oleg Khusaenov is CEO & founder, Zubr Capital Investment Company