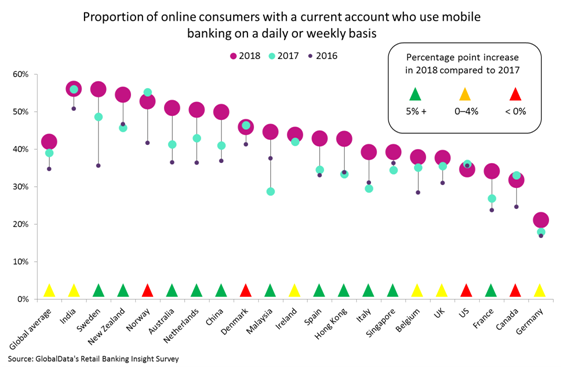

Consumers in the majority of global markets, both developed and developing, are using mobile banking services more often than ever before. In 11 of the 20 countries covered by GlobalData’s Retail Banking Insight Survey, the proportion of online consumers who use mobile banking at least once a week increased by at least five percentage points between 2017 and 2018.

Overall, the global proportion of frequent mobile banking users grew from 39% in 2017 to 42% in 2017, but there was significant regional variation. Malaysia, Australia, and Italy saw the biggest increases, all having registered double-digit growth over the last 12 months. Over a two-year period Sweden witnessed the biggest gains, prompted by the efforts of its banks and regulators to promote a cashless society.

At the other end of the scale, India, Norway, Denmark, Canada, and the US all registered negligible or negative growth. Nevertheless, India maintains a leading position, bolstered by the government’s demonetisation program and the rapid uptake of Paytm’s mobile wallet.

Germany remains a significant outlier – use of mobile banking is far lower than in any other market, and there has been virtually no growth in recent years. Previous research by GlobalData found that security fears are a major barrier to adoption by consumers, and banks need to gear up their public education programmes to overcome these concerns.

For more insight and data, visit the GlobalData Report Store (https://www.globaldata.com/store/) – Retail Banker International is part of GlobalData Plc.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData