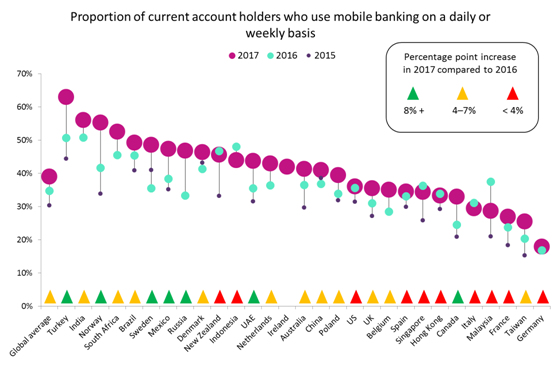

The use of mobile banking around the world has grown at a modest rate over the last 12 months.

GlobalData’s 2017 Retail Banking Insight Survey found that the proportion of consumers who use this channel on a daily or weekly basis rose from 35% in 2016 to 39% in 2017. However, there are significant differences between markets, with developing markets and the Nordics in particular experiencing above-average growth.

In Turkey, daily or weekly use leapt from 51% in 2016 to 63% in 2017, making it the market leader on this measure. Norway, Sweden, Mexico, and Russia also experienced significant uplift in the number of daily or weekly users during this period.

Mobile usage tends to be highest in developing markets, with the lack of physical banking infrastructure playing a critical role in adoption. Nordic markets – where there has been a concerted effort by governments, banks, and retailers to push consumers away from cash to card and mobile payments – have also seen an impressive uplift.

In contrast, usage in other advanced markets such as the US, Spain, Singapore, France, and Germany has barely changed in the last 12 months. Mobile banking appears to be reaching a plateau in these countries, and further significant growth will depend upon moves by the authorities to discourage the use of cash.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData