In the first quarter of 2017 the national savings rate reached an all-time low of 1.7%. The Office for National Statistics claims that a combination of higher tax payments, stagnant wage growth, and higher inflation accounts for most of the decline. However, the decrease in the national savings ratio has been a long-running trend, falling from a high of 11.8% in Q1 2010.

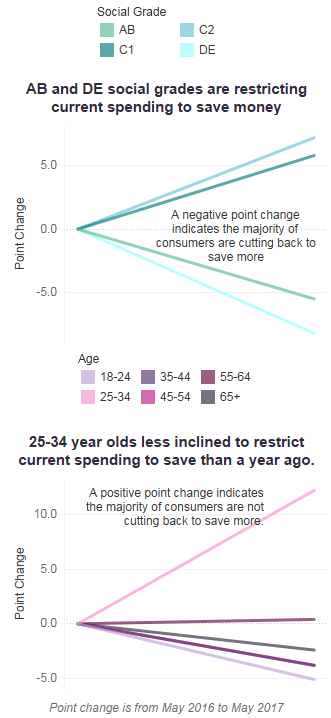

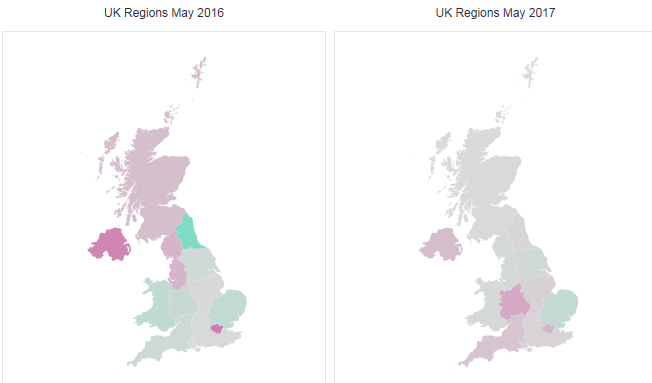

GlobalData’s UK Consumer Sentiment Tracker gives further weight to this analysis. Between May 2016 and May 2017 the Current Savings Index moved downwards by 0.4 points, indicating that saving intention has barely changed. This leaves only external factors as the main reason for the decline in national savings. That said, there have been significant changes in saving intention across the UK in terms of region, social grade, and age group.

UK consumers in the North East have changed their saving behavior the most, with a decline of 20.3. However, Northern Ireland, Scotland, and London have seen their scores increase, with consumers feeling less pressure to save.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData