Becoming a cashless country brings numerous consumer benefits to the UK, but the country is not ready to say goodbye to cash yet.

Cash is no longer king. The UK is accelerating towards a ‘cashless society,’ due to the popularity of contactless cards which now account for over half of all card transactions.

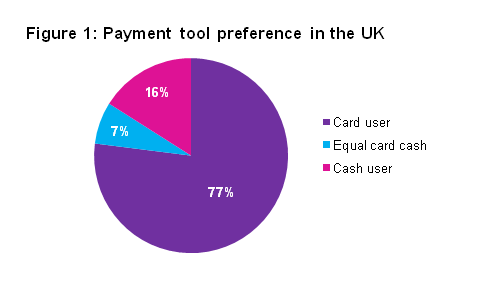

The surge in cashless payments has led to banks closing ATMs and branches, which is in turn accelerating the shift from cash to cards. The volume of cash being withdrawn from cash machines is falling fast, while data from UK Finance indicates that customers are substituting cash for cards – even for low-value purchases. GlobalData’s 2018 Consumer Payments Insight (CPI) Survey revealed that over three quarters of respondents prefer card payments over cash.

With contactless comes cashless

Furthermore, 64% of respondents agree that contactless payments are more convenient than cash and other cards. This additional spending, coupled with the availability of cheap POS and mPOS terminals, makes accepting electronic payments attractive for merchants of all sizes, in spite of the fees associated with doing so.

One of the biggest drivers of the contactless revolution in the UK was the technology’s adoption by Transport for London.

As of 2018, 17 million tube and rail journeys across London are now paid for with contactless cards or mobile devices each week. The convenient contactless payment method was also launched on buses, and more than 1.7 billion journeys through contactless payments have been made across the capital.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThis implementation shows the material benefits of a cashless society, most notably shortening queue times at ticket machines as well as reducing cash handling costs for merchants. Londoners and visitors have recognised contactless payments as the ‘norm’ and contactless usage has grown quickly, from everyday use for transit to everyday use for payment generally. Yet despite the contactless boom in London, many rural areas lag behind in terms of contactless adoption and usage.

Convenience required

Consumers in general want the quickest and easiest way to pay, and the industry is only too happy to accelerate the shift to a cashless society. Yet there is a real danger of exclusion if cash is eliminated entirely.

In particular, the reduction of ATM networks has a negative impact on rural communities that rely on cash, and the reduction of cash in local economies can hit small businesses hard, despite the easy availability of POS terminals. People on low incomes are also at a disadvantage if they only have access to contactless payments, as cash is more inherently suited to budgeting, as well as being the only tool accessible to some consumers.

Contactless cards provide numerous benefits for consumers in terms of the speed and convenience of payments, while benefiting businesses by boosting sales. However, given that there are certain segments of the UK that rely on cash, the UK will not entirely be a cash-free society in the near future.