The UK economy’s prospects are likely to remain more uncertain than usual for the next few years as a consequence of Brexit. In 2017 the economy grew at a slower pace than over the last few years, and the UK’s current position is a little mixed, as the rate of inflation has risen and economic growth has been slow.

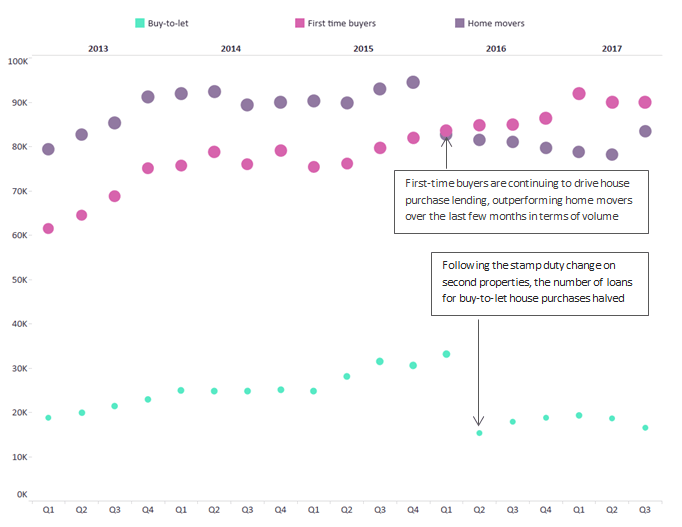

Our UK Mortgage Market 2017: Forecasts and Future Opportunities report confirms that overall the UK mortgage market was slightly subdued in 2017, with some components holding up better than expected. Data from UK Finance (as shown in the chart below) shows that the underlying trend in housing transactions softened a little last year.

The buy-to-let sector had a weak start to 2017, with lending falling as landlords reduced their exposure to the market in response to major tax changes and tighter lending rules. While falling mortgage interest rates helped support borrowing, tax and prudential measures exerted pressure on the buy-to-let space.

Volumes have declined as the market has stagnated, with business levels in Q1 2017 declining by 42% compared to Q1 2016. It seems that the loss of tax relief was the biggest blow for most landlords. The impressive growth in buy-to-let lending seen over the last few years came to a sudden halt, and is unlikely to resume in the near future.

In the residential space activity was limited by stamp duty changes. However, this constraint will potentially be eased for first-time buyers as a result of the stamp duty relief announced in the 2017 Autumn Budget.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFirst-time buyers are also being supported by various government initiatives, including the Help to Buy equity loan scheme. Our expectation is that the recovery in first-time buyer numbers will continue over the next two years, albeit at a slower rate than we have seen in previous years.

Weak housing transaction activity has also originated from home movers, who have benefitted far less from government schemes and whose numbers have been flat over the last 12 months. Taking all of these factors together, we expect to see regulated house purchase activity grow modestly in 2018, driven wholly by first-time buyers, as home mover numbers will remain flat.

As it is still not clear how Brexit negotiations will pan out, both buyers and sellers are waiting to gain a clearer picture of where the economy might be headed. For this reason we expect overall activity in this sector to be fairly flat in 2018, in part a result of the economic uncertainty.