The banking and payments industry continues to be a hotbed of innovation owing to ever changing consumer expectations. The rapid technological developments in the areas of banking and payments that aim to offer seamless experience to consumers are now becoming even more vital for industry participants as competitors leverage new technologies such as artificial intelligence, Internet of Things, cybersecurity, and embedded finance as they compete to stay relevant and grow in the market. In the last three years alone, there have been over 92,000 patents filed and granted in the banking industry, according to GlobalData’s report on Cybersecurity in Banking: zero knowledge proof. Buy the report here.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

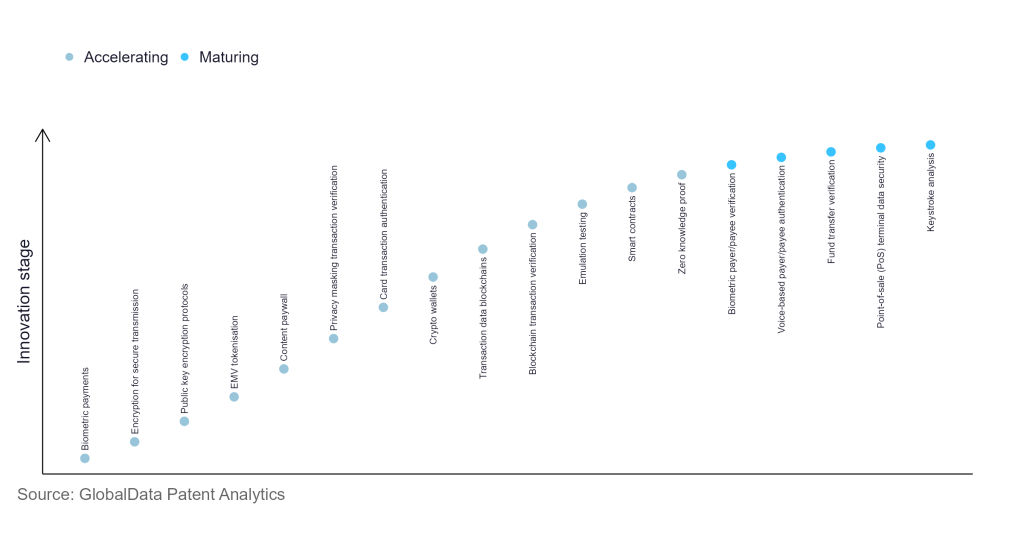

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

60+ innovations will shape the banking industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the banking industry using innovation intensity models built on over 195,000 patents, there are 60+ innovation areas that will shape the future of the industry.

Biometric payments, encryption for secure transmission, and public key encryption protocols are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are biometric payer/payee verification and voice-based payer/payee authentication, which are now well established in the industry.

Innovation S-curve for cybersecurity in the banking industry

Zero knowledge proof is a key innovation area in cybersecurity

A zero-knowledge proof, also known as zero-knowledge protocol, allows one party called prover to confirm to another party called verifier that a statement given by the former is true without the need to divulge further details, except the fact that the statement is true. Banks can use the zero-knowledge proof to validate customer identification and avoid revealing any confidential data.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 50 companies, spanning technology vendors, established banking companies, and up-and-coming start-ups engaged in the development and application of zero knowledge proof.

Key players in zero knowledge proof – a disruptive innovation in the banking industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Alibaba Group is one of the leading companies in the area of zero-knowledge proof. The zero-knowledge proof is used in financial services sector in many instances where banks require to authenticate customer identity during customer onboarding, loan processing and opening of investment account, among others. Some other key players in this space include Tencent Holdings, nChain Holdings, Ping An Insurance, IBM, and Hangzhou Qulian Technology.

In terms of application diversity, Toyota Motor leads the pack, while Mastercard and Hitachi stood in the second and third positions, respectively. By means of geographic reach, nChain Holdings holds the top position, followed by State Farm Mutual Automobile Insurance and Swirlds.

To further understand the key themes and technologies disrupting the banking industry, access GlobalData’s latest thematic research report on Cybersecurity in Banking.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.