The number of people from ethnic minorities in senior finance roles remains significantly low. In response, banks and financial institutions are promising to up their DEI strategies to create a more inclusive world. Evie Rusman writes

According to UK stats from Randstad, in 2018, only one in 10 management positions within financial services were held by people in the BAME community. And globally, 2020 research from Gartner found that only 6% of senior finance roles were filled by people from minority backgrounds.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

As a result, financial institutions have faced increasing pressure to be more proactive when it comes to diversity in the workplace. Meanwhile, movements including the Black Lives Matter (BLM) protests have heightened this pressure in recent months.

The UN’s World Day for Cultural Diversity is also fast approaching (21 May), which looks to celebrate the understanding and respect of all cultures. Considering this, now is the perfect time for banks to focus their efforts into creating a space where all cultures thrive together.

DEI strategies

So, what are banks doing? One bank praised for its efforts is Santander – in 2020, the group was recognised as Euromoney’s top bank for D&I.

According to Santander, inclusion and diversity are at the top of its list of objectives, with the group setting targets for the coming year. By the end of 2021, Santander hopes to increase female representation on the board to between 40% and 60%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAdding to this, in the UK, 40% of executive hires from outside the bank are women.

Santander also prides itself on cultural diversity – in Brazil it has pledged to increase the number of black employees to at least 30% of its headcount by 2021.

The bank also launched Santander Integra (‘Santander Integrates’) in Spain and several new cultural diversity networks in the United States and the United Kingdom.

Standard Chartered

Standard Chartered is another bank that is looking to put diversity at the forefront of its operations. The company says: “At Standard Chartered we know that fostering an inclusive culture allows us to harness the potential of our diverse workforce. Diversity of thought and views not only help our clients and communities prosper, but diversity of thought also benefits our business.”

Currently, 71% of all Standard Chartered’s market CEOs are of African, Asian or Middle Eastern heritage.

The bank also recognises that recent events have made it clear that to become fully inclusive, it must listen carefully to individual’s experiences. Therefore, Standard Chartered has started hosting listening sessions globally, providing senior leaders with the opportunity to reflect and drive targeted action to change necessary behaviours.

The bank says: “We recognise that creating the environment to have constructive dialogue on race is an important first step.”

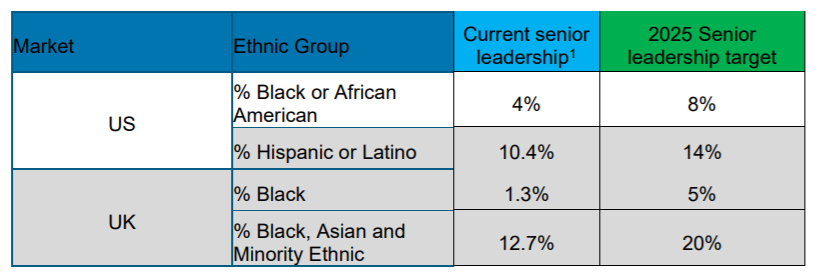

As part of its efforts, Standard Chartered has also launched a toolkit called ‘How to have conversations about race’. In addition, the bank has committed to ethnicity targets for senior leadership in both the UK and the US.

By 2025, StanChart hopes to increase the number of black or African American individuals in US senior leadership roles from the current rate of 4% to 8%. Meanwhile, in the UK, it aims to up the number of black people in senior roles from 1.3% to 5%.

Standard Chartered ethnicity targets table

Boasting similar initiatives are banks including, Bank of America, HSBC, Goldman Sachs and Lloyds, who all have set targets to increase the number of people from minority backgrounds in senior roles.

Not enough being done

Despite the efforts and promises being made by banks, there is still a long way to go – a report from mthree, Diversity in Tech, has highlighted that the majority of financial services business are still failing to take action to improve diversity and inclusion.

The research showed that 52% do not currently have diversity targets in place. Furthermore, 68% of financial services businesses say they are aware of a continuing lack of diversity on their tech teams, and over 80% admit that they struggle to recruit tech talent from a range of backgrounds at every seniority level.

Becs Roycroft, senior director at mthree, says: “With so much public discussion around diversity and inclusion, it might be easy to assume that this increased awareness across the financial services sector is being translated into action. Unfortunately, this just isn’t true in many cases.”

It is difficult to know why this is, especially since having a more diverse team is likely to lead to increased business success – McKinsey & Company’s report, Delivering Through Diversity, revealed that companies in the top 25% for ethnic diversity were 33% more likely to achieve profit above the industry average.

It also showed that more ethnically diverse boards were 43% more likely to outperform on profits.

Roycraft adds: “Diversity in business is not only proven to be good for businesses themselves, with a recent report by McKinsey showing that ethnically and gender diverse teams are typically more profitable, but also for society.

“With this in mind, it’s important that finance organisations look at how they can both attract and retain talent from all backgrounds and walks of life.”