US regional bank BB&T has the potential to weather economic downturns due to its stable management team, a diversified business mix and a strong customer base. Robin Arnfield reports

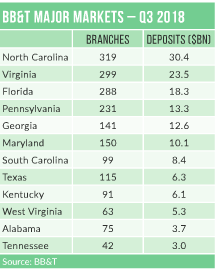

Winston-Salem, North Carolinabased BB&T operates 1,958 branches in 15 states and Washington DC, serving 7.6 million clients.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

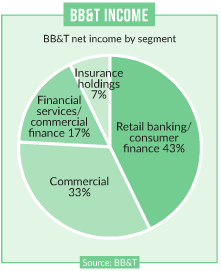

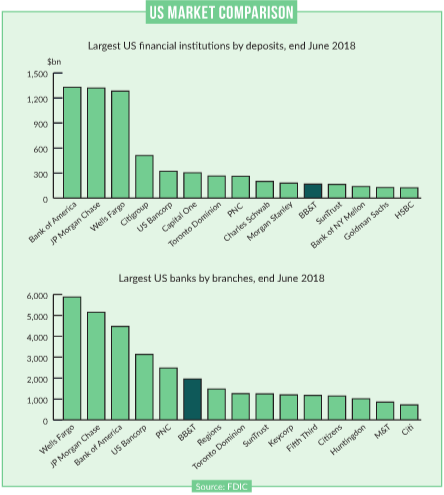

Organised as a group of autonomous community banks, each headed by a community bank president, it also owns an insurance business, BB&T Insurance Holdings. In June 2018, BB&T was the 11thlargest financial institution in the US, based on domestic deposits; by branches, it is the sixth largest US bank (see table).

Unlike other US banks, BB&T did not report quarterly losses during the 2008-2010 financial crisis, and has the benefit of a stable, long-term management team, says Allen Tischler, senior vice-president at Moody’s Investor Service.

Historically, BB&T has actively acquired other FIs, but in recent years has slowed its pace of acquisition. Its most recent was the April 2018 purchase of Regions Insurance Group from Regions Financial Corp., reinforcing its position as the fifth-largest US insurance broker. In 2016, it bought National Penn Bancshares, following its 2015 purchases of Bank of Kentucky and Susquehanna Bank. “

Since 2015, BB&T has stepped back from bank acquisitions and focused more on organic growth,” says Tischler. “But it’s open to acquisitions. It might make some modest acquisitions of banks in the future, but not as frequently as in the past.” A key area for acquisitions is insurance.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“BB&T hasn’t been active in buying mortgage companies, but insurance is its primary acquisition area,” Tischler notes.

“BB&T is one of the largest players in the insurance agency and brokerage business globally, and will continue to make insurance acquisitions. Being in insurance helps to diversify BB&T’s revenues.”

Branches

BB&T is engaged in a “reconceptualisation” process to transform itself into a new type of bank, in response not just to disruptive fintechs but to consumer expectations of Amazon-style digital banking.

“Substantial change is going on in BB&T, all of which are conceptually about building the new bank,” BB&T chair and CEO Kelly King said in November 2018. “We have to build a new bank by pruning the old bank; close a bunch of branches to invest in digital; make backroom changes to create a new technological system.

“We can either wait for someone to disrupt us, or we can choose to disrupt ourselves. We have huge opportunities to position our company to be a survivor and a thriver for decades to come, as we’re absolutely willing to change anything that needs to be changed – except our vision, our mission and our values.”

As part of this effort, BB&T is realigning four of its 24 community bank regions, which will drop to 20 regions in total.

“We’re elevating the role of the [20] community bank regional presidents,” spokesperson David White tells RBI.

“They now report directly to Community Banking president David Weaver, a member of BB&T’s executive management team. These changes help us simplify our community bank structure, which allows us to be more agile in decision-making and more nimble in the way we respond to our clients.”

“BB&T, like most other US banks, has been reducing its branch count,” says Tischler. “I think it plans to reduce its branch numbers by several hundred more from its current 1,900.” At the end of 2017, BB&T had just over 2,000 branches.

“As BB&T particularly focuses on retail and small business depositors, it has more branches in rural areas or outside metro areas relative to other banks,” says Tischler.

“It does have a lot of branches in metro areas, but, unlike banks that focus entirely on larger cities, BB&T is more spread out. That gives it more stability in terms of the smaller markets where it has strong market share.”

Deposit base

Since 2015, BB&T has been transforming its deposit base to include more non-interestbearing accounts, which are less sensitive to interest-rate changes.

“BB&T has a diverse revenue stream, limited concentration risk, a granular loan portfolio and deposit base, and minimal leveraged lending exposure,” a December 2018 Moody’s report on BB&T says.

“Moreover, BB&T’s deposit mix has shifted to include a higher portion of core non-interest-bearing deposits in recent years, strengthening its funding profile and partly offsetting higher deposit funding costs. BB&T’s non-interest-bearing deposits climbed to 34% of total deposits in the third quarter of 2018, up from 23% in 2012. Over the same period, the peer median, comprising 14 of the largest US banks, fell slightly to 29% from 30%.”

“When interest rates were extremely low, BB&T focused extensively on offering noninterest- bearing chequeing accounts for small businesses and retail customers,” says Tischler.

“The consumer and small business segments of the non-interest-bearing account market have proved to be stickier now rates have risen, compared to the large corporate sector which is where other banks focused. BB&T has a more granular deposit base, as it focuses on smaller accounts.”

Technology

“The challenge for BB&T is to keep up with the national US banks in technology spending,” Tischler notes.

“BB&T is one of the few regional banks to detail how much it spends on technology.

“Its figures show that, in absolute dollar terms, it can’t compete with the big banks, but in relative terms it invests as much as them. BB&T invests over $1bn a year on technology, with 20% of this being focused on innovation and fintech investments. That goes a long way if you deploy it strategically.”

In its public statements, BB&T says its technology investments focus on two areas: retail and small business customer-facing platforms such as digital banking, and process efficiency.

“BB&T has invested heavily in software robotics to automate its manual processes and reduce its paper usage,” says Tischler.

In its 2017 annual report, BB&T said: “Using robotics, we reduced the time needed for financial reconciliation from 50 minutes to fewer than 10 minutes. We expect the cost savings from this reconceptualisation and others like it, and from optimising our branch structure, to help pay for our expanding technology investments.”

In January 2018, BB&T allocated up to $50m to invest in and/or acquire fintechs to benefit clients, lower operating costs and provide a competitive advantage. BB&T’s digital transformation began in 2015 by appointing W Bennett Bradley as chief digital officer.

Since then, BB&T has launched near-real-time payments for retail and commercial clients, and the U by BB&T digital banking platform. Its first fintech investment occurred in September 2018 when it took a $5m stake in Enigma, a New York City-based dataas- a-service company. Enigma is providing enhancements to BB&T’s anti-money laundering controls, and is expected to provide cost-savings in other areas of the company.