Bradesco launched its Next standalone digital bank in October 2017 to attract millennials and to compete with digital-only start-ups. The Brazilian bank is also transforming itself into an innovation centre, reports Robin Arnfield

Brazil’s second-largest private bank with 75 million customers, Bradesco wanted to increase its market share among digital natives and millennials, who account for 30% of the population.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

But when Bradesco created Next, it did not just develop a digital banking app: it created a bank to meet the lifestyle needs of millennials, with smart budgeting tools, personalisation and customised graphics, says Jeferson Honorato, Next’s superintendent executive.

“Bradesco sees Next as a hub where consumers can manage their finances and their lifestyle, and access services such as Airbnb and Uber,” he says.

Achieve more

Next offers discounts to over 70 partners including Cinemark, Uber, Airbnb and Hotel Urbano, along with a free current account and Visa credit card.

“Designed around the Faz Acontecer [Make It Happen] brand concept, Next offers a mobile banking experience helping customers do more with their money and achieve more in their lives,” says Honorato.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“It’s a full banking service that’s customer-centric, using data and context to inform better individual financial decisions.”

Next caters for millennials who spend much of their lives on social networks. Chat and social networks represent 96% of Next customers’ interaction with the digital bank. It uses Bradesco’s IBM Watson-based chatbot, Bradesco Inteligência Artificial (BIA), to answer customers’ questions in what it describes as millennial-friendly language.

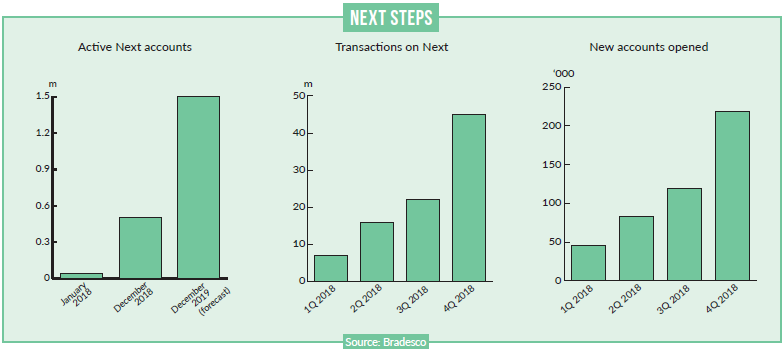

Bradesco heralds Next as a success. As of October 2018, there were three million downloads of the Next iOS and Android apps, of which 94% were by high-income millennials and 86% were by people new to Bradesco. One million applications were in the approval phase, and there were 350,000 active clients, growing 40% a month.

In October 2018, Next had 7.8 million transactions, growing 80% a month, and the inactivity rate was 2%, compared to the market average of 24%.

Next competes with digital-only neobanks such as Nubank and Banco Original, which have captured significant numbers of Brazilian millennial customers through digital onboarding and attractive rates on bank accounts and credit cards.

Bradesco’s president, Octávio de Lazari, was quoted in the Brazilian press as saying he sees Nubank as a threat to his bank’s digital strategy. Nubank, which has five million credit card customers, of whom 2.5 million have a Nubank digital bank account, launched a debit card in December 2018 in a bid to reach Brazil’s unbanked segment. Launched in 2016, Banco Original had 600,000 customers in November 2018.

While it has invested heavily in digital channels, Itaú Unibanco, Brazil’s largest private bank, did not launch a standalone digital bank, unlike Bradesco.

However, in August 2018, Itaú announced a partnership with PayPal to offer PayPal services to the bank’s card clients. PayPal’s general-director in Brazil, Paula Paschoal, told Reuters that the company expects to add a million users to its existing 3.8 million client base in Brazil in two years as a result of the partnership.

All digital

“By launching an all-digital bank under a different brand, Bradesco is betting that millennials are less concerned about the ‘safety’ factor that comes with traditional banking brands, and more focused on excellent user experience” says Katie Llanos- Small, editor of specialist Latin American banking publication Iupana.

“All-digital spin-offs such as Next and Bancolombia’s Nequi offer an excellent opportunity for banks to try out new products, services or UX on a small group of consumers, before rolling out to their millions of customers.” Honorato adds, “While consumers migrate to mobile-only experiences in everyday life, banks have lagged behind. The opportunity was to create a mobile-only bank empowering millennials and seamlessly integrating into their lifestyles.

“We did this by reimagining the banking experience for the digital age, putting design at the core of every decision, and using the newest technology to enable a proactive relationship and innovative features that have never been delivered by competitors.”

Strategies

Honorato says Bradesco merged technology, data intelligence and design to implement three strategies.

“The first strategy is an innovative business model,” he notes. “By delivering value beyond transactions, Next ensures that customers will give value back to the business by using Next more and managing their financial life within Next over the long term. Even the selling of traditional financial products is contextual, so it’s perceived as just another service.

“Second is embedded financial education. Next uses data to learn about customers’ 30-day financial cycles, and proactively guides them to stick to their budget and reach their goals.

“Third is responsive branding. The brand itself becomes the interface and provides an instant representation of how customers are doing compared to their plans. Algorithms were designed to understand and learn individual financial habits, to predict future outcomes, and to deliver a customised experience that guides customers to make better daily financial decisions.”

Bradesco innovation

Llanos-Small says Bradesco is really pushing innovation, and has numerous initiatives in that area.

“One interesting angle in its strategy is to launch a New York hub for innovation,” she notes.

“It has a team in New York City that can see international and US developments up close, and think about potential applications for Brazil.”

In 2017, Bradesco invested BRL6bn ($1.6bn) in technology and innovation, with major developments including its BIA chatbot, the roll-out of cash-recycling ATMs, and a digital account-opening app.

In November 2017, Bradesco signed a memorandum of understanding with MUFG Bank, part of Mitsubishi UFJ Financial Group, to use Ripple’s blockchain-based inter-bank platform for cross-border payments between Japan and Brazil.

Brazil’s Valor newspaper said the central bank is expected to introduce legislation for Open Banking in 2019. Separately, the new administration of President Jair Bolsonaro has said it wants to increase competition in Brazil’s bank industry, where the top five banks have 85% of total assets.

Llanos-Small says Bradesco, like other big Brazilian banks, is actively looking at how API platforms work and how it can use them.

“This has largely been a proactive move, as banks have sought to understand how APIs work and how they can benefit from them – not one that’s really been pushed by regulators,” he says.

“It’s become clear that Open Banking is really going to be mandated in Brazil, so the move toward APIs has been quite proactive in that sense. I’m not sure how much of this is ‘live’ and how much is in sandbox, however.”

Digital channels

Like other Brazilian banks, Bradesco has a big focus on digital channels, says Marcelo Frontini, its director of digital channels.

Between January and September 2018, digital channels – Bradesco Celular, Internet, Autoservice (ATMs) and Fone Fácil (telephone banking) – accounted for 96% of the bank’s transactions.

The number of digital transactions rose 17% year on year to 13.2 billion in January to September 2018. Bradesco Celular saw 34% growth year on year in January to September 2018, and has 13.2 million active customers. Over 250 different products and services are available via Bradesco Celular, says Frontini.

Since August 2017, Bradesco has offered its BIA chatbot to users of Bradesco Celular. As of September 2018, over seven million customers used BIA to communicate with Bradesco about products and services.

Bradesco also is a world leader in the use of biometrics. All its ATMs feature biometric authentication, identifying cardholders using their palm veins