As history shows, sustainability has never been a priority for financial services. However, with the climate change movement gathering momentum, banks are facing pressure to become more eco-friendly, as well as disclose climate-related risks. Evie Rusman reports

Over the past few years, banks have invested heavily in unsustainable practices; since the Paris Climate Change Agreement in 2015, some of the world’s largest banks have funnelled a whopping $2.66trn into funding fossil fuel projects.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

US investment bank JP Morgan Chase has been the largest contributor of fossil fuels in the four years since the agreement, investing over £220bn to extract oil, gas, and coal.

Just behind the US banks is Barclays, who spent $85bn on funding fossil fuel companies between 2016 and 2018. This is extremely worrying and paints a particularly grim picture of the banking industry.

Canada’s TCFD

What is happening in Canada? In a bid to tackle climate change, Canada’s Financial Stability Board (FSB) formed the Task Force on Climate-related Financial Disclosure (TCFD).

Its aim was to help identify the information needed by lenders, underwriters, asset owners and asset managers to appropriately assess and price climate-related risks and opportunities.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSpeaking on managing climate risks, Tiff Macklem, Governor of the Bank of Canada, says: “Measuring, pricing and managing climate risks will require an all-hands-on-deck approach—involving the private sector, the public sector and the research community.”

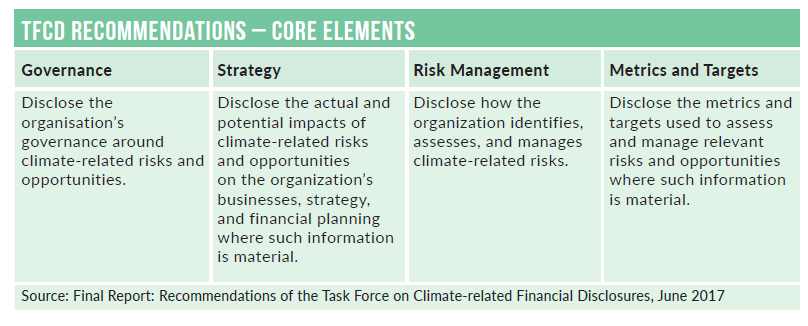

In 2017, the TCFD introduced several recommendations for reporting. This included providing a framework for companies to disclose their financial-related governance, strategy, management, and metrics and targets.

However, the TCFD was developed as a voluntary framework, which means financial firms do not have to declare their intended alignment nor structure their reporting in a standardised way.

In response, the Global Risk Institute in Financial Services has undertaken a three-year progress report, which looks at how 58 financial firms are faring when it comes to the TCFD’s recommendations. The company’s reasoning behind the report is that it believes the sector plays an essential role in “mitigating climate risk and accelerating opportunities across the economy”.

The findings

According to the research, from an original sample of 58 financial institutions across banks, pensions, insurance, financial Crowns, and credit unions, there were a total of 25 reporting in alignment with TCFD recommendations in 2019. This is a 40% increase from 2017.

The findings also showed that firms tend to present succinct information within annual financial reports and use other voluntary channels such as sustainability reports or standalone climate change reports to present more extensive information.

Governance

The Global Risk Institute argues that board members need to put climate change on their agenda as the risks and opportunities that it poses are likely to have a significant impact on their business.

By disclosing board oversight investors and stakeholders are more likely to be able to evaluate whether climate risk receives appropriate board management and attention.

The report showed that every disclosing firm indicated that the board oversees climate risk, with the risk committee most commonly cited as the lead.

Strategy

It is clear climate change will alter the world as we know it – this includes how businesses operate. The report insists that “through improved risk assessment and deepening understanding of climate risks, firms can align their strategic plans with their risk appetite and capitalise on new opportunities that will manifest as the world shifts away from carbon dependence”.

TCFD guidelines recommend that firms disclose the short, medium and long-term risks of climate change on its businesses, strategy and financial planning.

Nearly 80% of disclosing firms reported that they were assessing risk over the short, medium and long terms, and of those, 70% disclosed the specific risks they were facing in each of these time horizons.

Risk Management

The next step is for firms to disclose how they identify, assess, and manage climate-related risks. According to the TCFD, such information supports the evaluation of the firm’s overall risk profile and risk management activities.

In 2019, 72% of firms had disclosed that they undertook a materiality assessment for climate risk, up from 44% two years earlier.

Metrics and targets

Using metrics and targets can help firms and investors assess progress made – 72% of firms disclosed metrics related to portfolios and sustainable finance, a 35% jump since 2017.

The Global Risk Institute states that “by including metrics and targets within their disclosure, firms improve accountability and are able to produce measurable outcomes”.

Looking ahead

Despite the efforts made by the TCFD, there is still a long way to go when it comes to minimising the risks of climate change in the financial sector. The fact that over half of the financial institutions surveyed in the report are still yet to disclose climate-related information proves this.

To ensure widespread practice across the sector, the Global Risk Institute has proposed a path forward. The plan includes encouraging policymakers to articulate a roadmap for the adoption of the TCFD Recommendations by Canadian firms, outlining what is expected and by when, as well as providing the foundational elements needed by firms to accelerate climate risk assessment and management.

It also suggests that company boards deepen their involvement in climate risk planning, and that firms consistently structure climate-related financial disclosures so progress can be shown and assessed annually.

The institute also encourages investors to engage with boards to encourage climate disclosure.