COVID-19 has had a detrimental impact on the financial world – everyday more and more banks are introducing support packages to help those struggling. On top of this, there is a concern that cyber fraud will continue to rise as most of us switch to online banking. Evie Rusman reports

It is not unusual for cyber criminals to take advantage of a global crisis. In recent weeks, the crown prosecution service (CPS) in the UK warned that financial fraud could be at an all-time high due to the virus. Not to mention, last week, the National Crime Agency also informed the public that scammers are using fear about the coronavirus outbreak to hook victims.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Speaking to RBI, James Richardson, head of market development, risk and fraud, at Bottomline Technologies discusses how COVID-19 is becoming a catalyst for fraud.

“It is clear that fraudsters will never let a good crisis go to waste, evidenced by the number of cases we’ve seen related to COVID-19 scams around the world,” he says. “By leveraging the good will and curiosity from those who want to learn more or protect their loved ones, they are encouraging people to click on fraudulent emails and texts and make payments.”

Rising fraud

Why such a rise in fraud levels? E-commerce fraud prevention company Forter argues that COVID-19 has increased the pace of online consumer activity. As a result, fraudsters are looking for weaknesses in over-stressed systems to exploit.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMichael Reitblat, Forter CEO and co-founder, tells EPI: “Fraudsters are abusing the fact that most companies are currently operating on work-from-home practices. Additionally, employees are, in general, less aware of these types of fraud attempts and less able to stop them.

“For the delivery of physical items, Coronavirus has created a good excuse for fraudsters to leverage data that may not match the expected information for that order, i.e. excuses for items not being at the specified shipping address, or requesting items to be left in specific places, etc.”

Data from Forter indicates that there has been an increase in more sophisticated fraud attempts including social engineering and account takeovers. Significant increases were also highlighted within loyalty and membership accounts.

Regulation

Regulation plays a key role in ensuring fraud scammers are kept at bay. Recently, financial regulators and central banks have faced increasing pressure to tighten regulation on financial fraud to protect those at risk.

Fran Wiwanto, Chief Compliance Officer, APAC at Flywire, tells EPI: “In times of crisis, there needs to be a unified effort to prevent fraud. Governments, central banks and regulators should be working in close collaboration to combat the problem.

“They should also deter fraud with tougher laws and higher penalties, especially potent when combined with higher enforcement rates of non-compliance cases. The increased visibility of such cases and more educational outreach to the public by the government and industry bodies will all contribute to the fight against fraud at such a difficult time.”

Lloyds and fraud

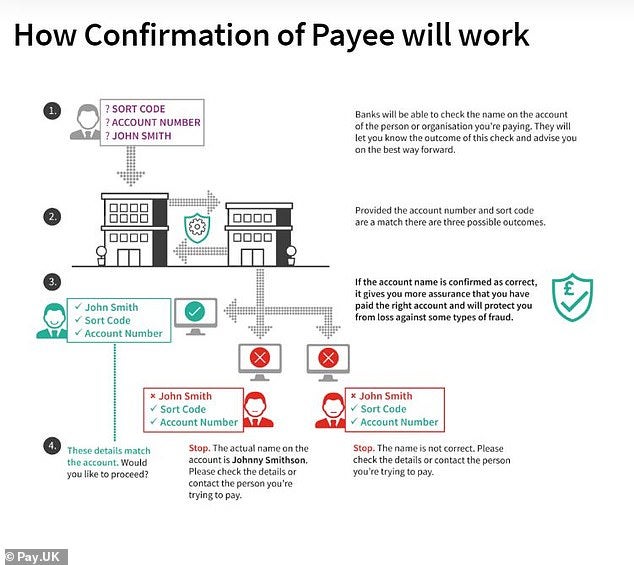

This week Lloyds Banking Group announced that its name-checking fraud prevention system had reduced scams by 31%.

The bank rolled out Confirmation of Payee to Lloyds, Halifax and Bank of Scotland customers in February and March. To date, it has carried out 4m name checks.

Paul Davis, Lloyds fraud director, says: “The evidence we’re seeing suggests Confirmation of Payee is already making a real difference. It has reduced the number of scams affecting our customers by nearly a third.

“This extra layer of protection gives customers added peace of mind when making payments. It also gives an extra reminder to stop and think before transferring cash out of their account.”

Confirmation of Payee helps people targeted by fraudsters by alerting someone setting up a new payee or amending details of an existing one if the recipient’s name does not match their bank details.