Collaboration across distributors, underwriters and regulators of credit protection insurance (CPI) is key to delivering the type of ‘best-in-class’ digital experience that Canadian consumers have increasingly come to expect.

That is the key takeaway of a report from Deloitte Canada, outlining the challenges and opportunities for financial institutions in keeping pace with the evolving needs and preferences of Canadians.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

What is credit protection insurance?

Credit protection insurance, also known as Creditor’s Insurance, Creditor’s Group Insurance, or Credit Insurance, is used to pay out a mortgage or loan balance (up to the maximum specified in the certificate of insurance) or to make/postpone debt payments on the customer’s behalf in the event of death, disability, job loss or critical illness. It can be obtained for a variety of debt obligations, including mortgages, consumer loans, lines of credit and credit cards.

Commissioned by the Canadian Association of Financial Institutions in Insurance (CAFII), the report says digitisation is at the heart of the insurance industry’s most prominent and disruptive trends, which requires the industry to respond with new and innovative business models and customer experiences.

Transforming credit protection insurance: optimising digital strategies

Four key trends are driving the need to transform the insurance business in ways that are truly more digital:

- Consumers expect more seamless, convenient, and personalised digital experiences from their insurers;

- There is growing competition from new entrants with tech-enabled business models;

- There are opportunities to create greater efficiency in back-office operations; and,

- The increased availability of data and use of advanced analytics has made it possible to generate greater customer insights.

In order to offer a leading digital experience, the report says that insurers will need to exhibit six attributes and underlying capabilities:

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData- Have a well articulated business digital strategy with clarity on the supporting customer, product, and channel strategy;

- Be highly customer-oriented in how they do business and take a human-centred design approach to their end-to-end user journey and digital experience;

- Become hyper-focused on operational efficiency, optimising investments and data through process automation and digitisation;

- Inform business priorities, product development, and customer experiences based on data-driven insights;

- Utilise modern technology architecture to support flexibility, seamless integration, and speed to market;

- Embed digital culture, skills, and ways of working throughout the organisation which drive a holistic culture of innovation.

Canada’s credit protection insurance industry: unique challenges

There are unique challenges facing the CPI industry in Canada, accentuated by the multiple stakeholders involved including underwriters, distributors, and regulators.

For example, the CPI digital experience is highly dependent upon the future lending journey (i.e., mortgages, loans) where most sales take place, and the regulatory environment can be difficult to navigate digitally, especially due to lack of harmonisation across provinces.

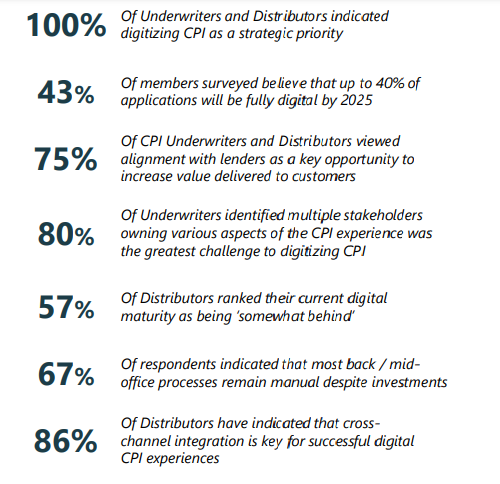

Despite the challenges, the CPI industry is committed to keeping pace with client expectations, with all CAFII members surveyed by Deloitte indicating that digitising CPI is a top strategic priority for their company.

“While the digital expectations of insurance consumers have been evolving for a while, the pandemic was a turning point for accelerating digital maturity in the Credit Protection Insurance industry,” says Keith Martin, Co-Executive Director of the Canadian Association of Financial Institutions in Insurance (CAFII). “Consumers of CPI expect a ‘best-in-class’ digital experience, and our members are committed to working with all of our stakeholders to deliver that outcome.”

The Canadian Association of Financial Institutions in Insurance is the not-for-profit industry Association dedicated to the development of an open and flexible insurance marketplace. The CAFII has published a series of studies looking at customer satisfaction with CPI and travel insurance, and how its members can keep pace with evolving consumer expectations.