Cryptocurrency in payments has had its ups and downs. The financial industry is split between crypto enthusiasts and critics.

A major development that has sent shockwaves across the industry is Facebook’s new crypto project. Libra is backed by an impressive set of investor. This includes Libra Association based in Switzerland. Furthermore, other firms involved include Mastercard, Visa, PayPal, eBay, Uber, Spotify, and Vodafone.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Tapping into the lucrative yet mysterious world of crypto, Facebook aims to create a global reserve currency that harnesses blockchain.

Furthermore, Libra will attempt to reach the unbanked population which is estimated to be around 1.7 billion. In particular, its potential is greatest in India. There is a high level of unbanked as well as a large Facebook and WhatsApp-using population.

That being said, critics state that this would not actually help the unbanked population integrate financially but alienate them from traditional banking products and systems.

Furthermore, privacy concerns and fierce competition are likely to stand in the way of Facebook and the Libra cryptocurrency endeavor.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn fact, US lawmakers do not trust the Libra cryptocurrency due to Facebook’s past data breaches.

As a result, Facebook paused Libra’s rollout whilst Congress and regulators inspect the digital currency. Given the privacy and security concerns, Facebook users may have lost trust and might be unwilling to use the P2P service, particularly in the West.

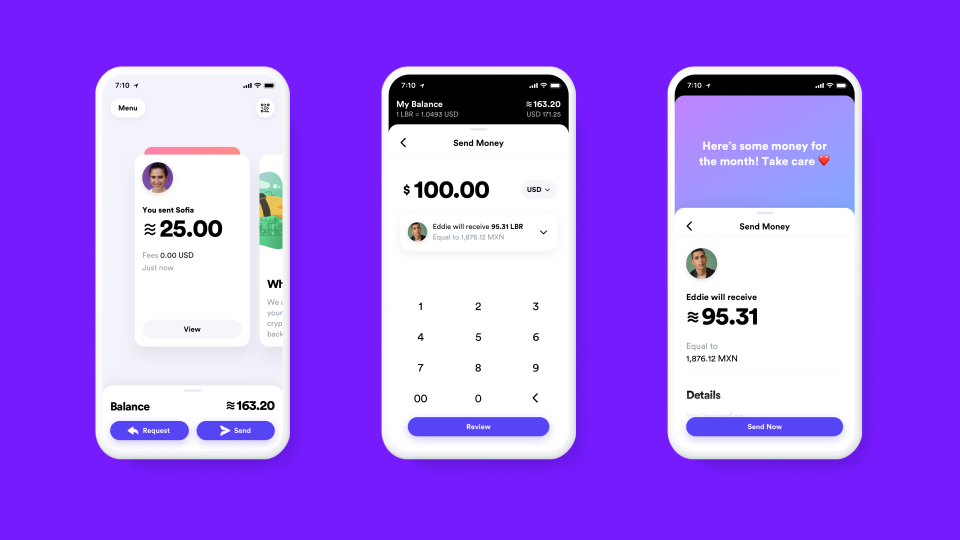

Libra is supposedly a cheap, fast and borderless. In addition, Facebook won’t control all of Libra. The company will have a vote on its governance. While Libra is targeting the unbanked, it seems that Facebook is simply trying to become like a bank.

The digital wallet will be available in its own standalone app, as well as in WhatsApp and Messenger. It hopes to launch in 2020.

Cryptocurrency in payments: the governments backing digital currencies

There are some central banks that are looking into how cryptocurrency in payments could fit into their platforms. The most innovative and enticing part of a cryptocurrency like Bitcoin, is the technology behind it.

The distributed ledger technology, or blockchain, offers a way of being secure about the journey of a transaction without the need of a bank as an arbitrator. Basically, it cuts out the middle man.

The Bank for International Settlements (BIS), warns central banks of the damage Bitcoin could do to the stability of the financial sector. However, that hasn’t stopped some venturing into the space.

Sweden

Sweden always pops up when it comes to cashless technology. The launch of the Swedish eKrona might not be too far off. However, according to the governor of Riksbank, Stefan Ingves, banks should always handle physical cash.

“350 years ago we replaced large copper coins with notes. Notes could now be replaced with electronic notes and coins.

“We’re thinking about it. But if you’re releasing electronic money it can be divided in a different way than notes. We wouldn’t use an electronic 100 kronor note if we’re buying something for 98 kronor. Nor would we use two kronor in electronic change. It would work just as well with a 98 kronor note.

“It’s reasonable for banks to expect to handle money. You should be able to deposit money in the form of notes. You should be able to take out money. A ban on cash goes against the public perception of what money is and what banks do.”

Ingves predicts that a Swedish digital eKrona is about 3 or 4 years away. In that time, the central bank has to weigh up the risks and decide if it is worth the instability.

Saudi Arabia

In February 2018, Saudi Arabia’s central bank signed a landmark deal with US-based fintech Ripple. A first of its kind programme, the deal will enable banks in the kingdom to settle payments using blockchain technology. Most of the regulators in the Gulf have expressed their criticism of using such volatile and untested technology.

However, the central bank and Ripple both agree that by harnessing the technology, Saudi banks will conduct faster, cheaper and more transparent cross-border transactions. In December 2017, the UAE Central Bank governor, Mubarak Rashed al-Mansouri spoke about the Saudi Central Bank working with the UAE Central Bank to issue a digital currency. One of the most sought after advantages of using cryptocurrency in payments is that it has the ability to increase efficiency and reduce settlement costs.

There are both risks and opportunities surrounding launching global cryptocurrencies. Globally, consumers may see it as too much hassle for too little reward. If cryptocurrency in payment is to succeed, more attention needs to be paid to what consumers want and actually need, rather than just being a gimmick.