Banks across the globe are trying to drag customers into branches. A number of variations on the physical presence are being trialed – a cafe in the branch being one of the more widely tested concepts. Patrick Brusnahan investigates DBS Bank’s offering in Singapore

Located at Plaza Singapura in Singapore, DBS’s cafe and branch concept has taken off. Featuring an open layout, customers can come in and carry out transactions while also enjoying a coffee.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

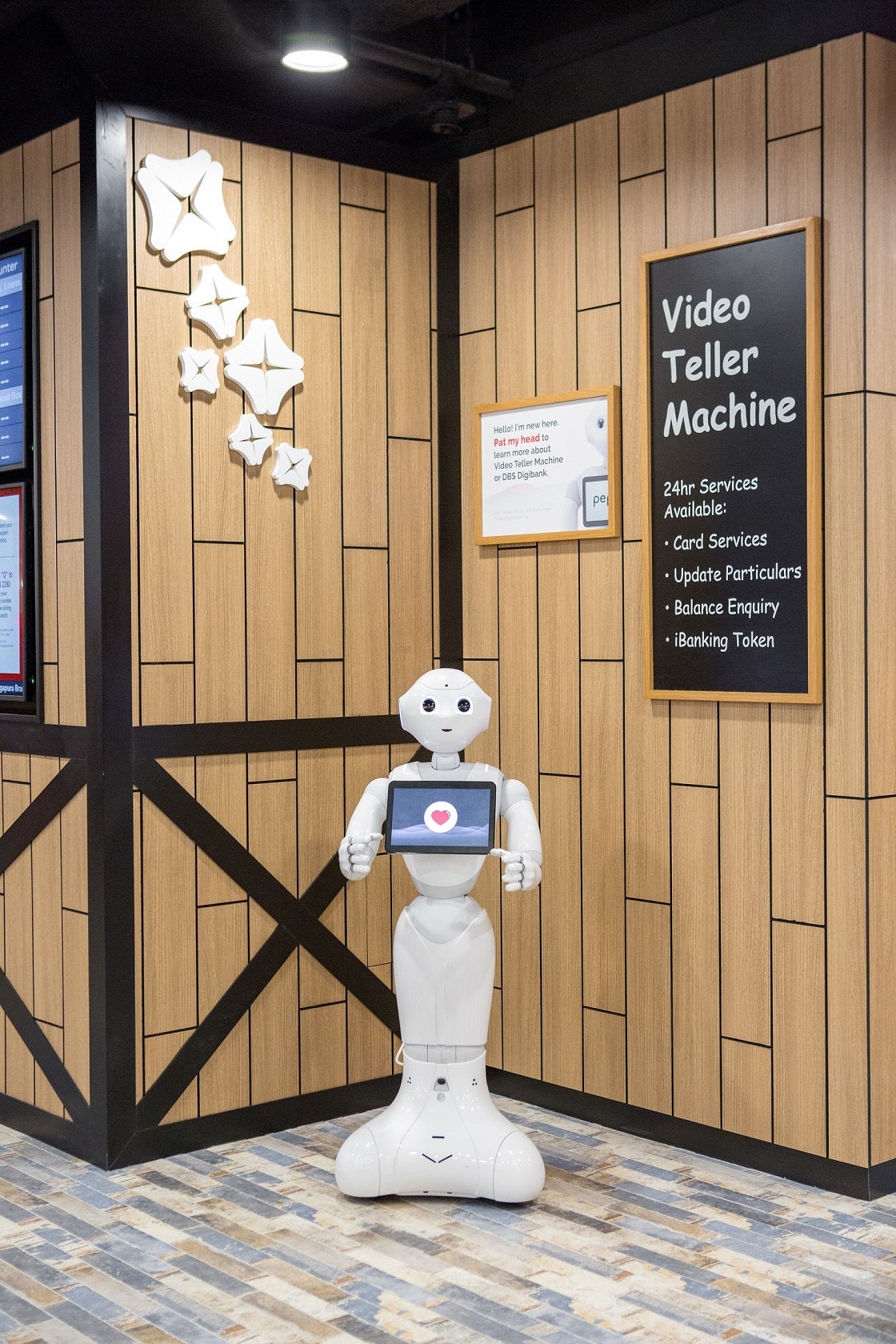

In addition, it has a VR corner for retirement planning, advanced ATMs with video tellers, and DBS’s very own humanoid robot, Pepper.

Susan Cheong, head of DBS and POSB branch banking, consumer banking group (Singapore) at DBS, believes the design is an answer to the question: how do we put together banking and lifestyle for the customers?

Speaking to RBI, she says: “I think none of us want to wake up and think we need to go to the bank to do something. It’s not something you enjoy. This is why it was important to see how we could embed ourselves as a bank as part of the lifestyle of our customers. We needed a look and feel to make people comfortable.”

Cheong continues: “[The new branch] has an area with a cafe; people can sit around and socialise. At the same time, the space is a functional branch, even thought it doesn’t look like a traditional one.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Back to the physical?

Is this a step to bring customers back to physical banking options? While every bank would like personal engagement with their customers, surely this can not come at the price of digital interaction.

“If you look at the elements we have in a branch, the fact is that the cafe doesn’t look traditional, it’s still fully functional,” Cheong explains.

“We have put in some of the digital and automated stuff. In a traditional branch, you will see a lot of high counters where people have cash transactions. In this branch, you can still do cash transactions, but we have a row of machines neatly lined up as part of the design, and it is functional. You can have the help of our service team around there.

“We try to use the traditional branch to get the customers into something a little more automated that they could get used to. There are iPads around with staff to help customers online, even though they are physically in the branch. It brings it together in a physical environment; now we can engage our customers and help them with online and digital transactions.

“In a way, this is a step to help customers to migrate themselves away from something that is fully served to assisted service, and eventually to self-service when they are comfortable.”

A common industry cliché is to say that younger consumers are into digital banking while older consumers prefer a branch. With this mix of the two, who is this branch for?

Cheong states: “I think, because of the fully functional branch, we have all customers coming into the Plaza Singapura branch; we have customers of all ages. We also have our corporate customers continuing to come in because the functionality is there.

“The way it looks is something very new and attracts a lot of the younger crowd. We see them coming in, going to the coffee area and doing what they need to do – whether that be withdrawing cash, making transactions or even hanging around even if they don’t need to do any banking. The space with the cafe is actually a free sitting area.

“The interesting thing is that when the branch itself actually shuts in terms of branch hours, a large part of the area is still open to the public and to customers. They can continue at the machines or sit around and enjoy a cup of coffee. It’s very different from the traditional branch.”

She continues: “One important metric for us is whether customers still come into the branch to do their banking. We continue to see that. We also get a lot of feedback from our customers on whether they like the look and feel. All this helps us to evaluate whether customers are taking it well, in terms of the form, the design, how it looks, how it functions.

“We think it’s gone quite well: customers have given us good feedback on the fresh look of the branch and they enjoy being able to sit down, have a coffee and talk with their friends. These are encouraging signs. We don’t set targets for ourselves in terms of ‘X’ number of customers coming in; we don’t do that.”

Cheong concludes: “Not many banks have the concept of a cafe inside the branch, at least not in Singapore. We are one of the first to have that.”