The banking sector is innovating at breakneck speed. Now, in a digital arms race, banks around the world aim to invest a whopping $97bn to improve and accelerate their digital capabilities in the front office alone. Briony Richter writes

Deloitte’s report, Accelerating digital transformation in banking, surveyed 17,000-plus banking consumers in 17 countries to analyse the current state of banks’ digital engagement. Participants were asked how often they used different channels, and their overall opinions and expectations of digital banking.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Banks want to provide compelling customer engagement and grow their customer bases, so now more than ever, it is crucial that they provide a unique, tailored approach that draws customers in, both online and in person.

Customers today have a wide range of banking services to choose from. It is therefore vital to be able to provide a top-notch customer experience to compete and attract customers. With digitisation in the financial industry growing rapidly, banks must embrace new technology; this can be a struggle as banks constantly try to meet customer demand while complying with regulations.

However, according to the Deloitte report, bolder digital moves have been paying off in some countries. Nearly two-thirds of respondents reported that they were either completely or very satisfied with their primary bank, with levels varying between countries. The report highlighted that in Asia-Pacific, consumers in India and Indonesia were more satisfied with their banks than those in Singapore, Australia or Japan. In Europe, consumers in Norway and the Netherlands are more satisfied with their banks than those in Germany, France or Spain.

When it came to recommendation, many countries voted slightly lower than for satisfaction. More consumers in India and Indonesia are likely to recommend their banks than are those in Japan, Singapore or the US. Frequently, it is not only about what services banks offer, but how they offer them. That skill has become far more important; customer satisfaction is increasingly connected to innovative and convenient digital channels, designed around consumer preferences.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Digital adoption

Too often, banks fall short by assuming that focusing on branches directly corresponds with customer need. However, digital capabilities are making financial tasks more convenient and quick. Technology is changing how customers can, and want to be, served.

The results of the report indicate that consumers worldwide are ready for more digital engagement from banks. Branches still have a place, and it is important to note that the majority of consumers use a mix of channels rather than cut one out completely.

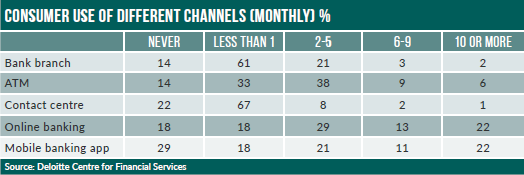

The report highlights that, although branches and ATMs are still used by slightly more banking customers, online and mobile channels are very quickly catching up.

Furthermore, 86% of consumers use branches or ATMs to access their primary bank, as compared to 84% for online banking and 72% for mobile apps. On the other hand, consumers more frequently tap into their online or mobile banking than head into a branch or use an ATM.

There were some interesting exceptions: Japan, for example, seems to have broken away from the crowd with only 7% using online and 6% using mobile banking more than five times a month.

Most countries are seeing steady and strong increases in digital channels. Branches will not – and should not – be kicked out; they should evolve to continue meeting the needs of consumers who, although using digital more, still like the security of a person to speak to. Of the respondents who had filed a complaint with their bank, 42% did so through contact centres, while 26% used branches and only 30% used digital channels. The trend is also true for consumers in the market for new products, such as mortgages or loans, that require multiple verification.

Digital engagement should be embraced by banks. By sending tailored push-notifications, banks can keep customers happy and attract more that appreciate the instant engagement of digital. The key is optimising the physical with the digital to maintian a proactive relationship between consumer and bank.