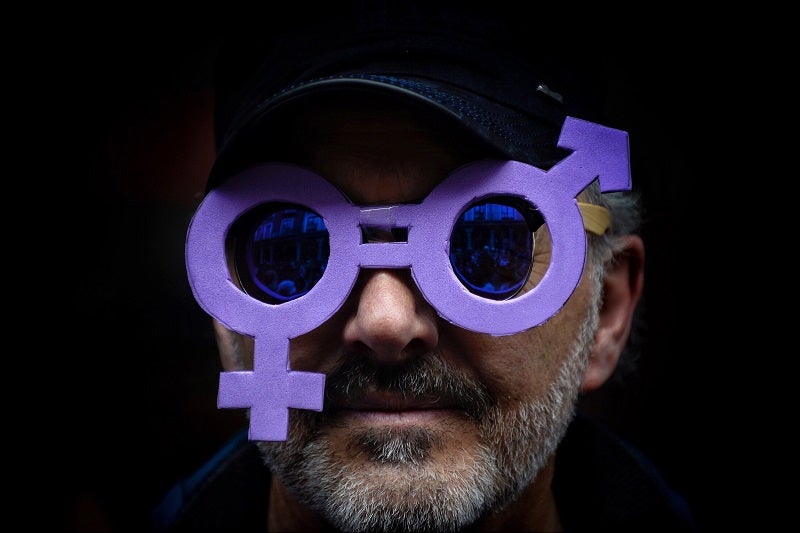

The theme for this year’s International Women’s Day is #EachforEqual, but in a heavily male dominated sector like retail banking, it can be difficult to find women taking up leadership roles. Evie Rusman analyses how some of the top banks measure up when it comes to gender diversity and speaks to women leading the way

On March 8, International Women’s Day, people across the globe celebrate the achievements of women in an attempt to further the fight towards an equal society.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Over the past decade, retail banking has seen a positive shift towards this society with many banks increasing the number of women being given executive positions.

Speaking to RBI, Andrea Bracht, Head of Group Audit at Commerzbank, discusses how the banking industry has changed over the last decade and argues that good female role models are essential.

She says: “First of all, good female role models are needed to encourage other women to follow such a path in the first place and take on responsibility. It is also important to promote women at all levels along their career path, for example by actively encouraging them to take on leadership roles. The idea of equality has become increasingly important in most companies in recent years.

Fortunately, this can also be seen on the executive floors, where there are many good female role models today.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe best performers

When it comes to the percentage of women in directorial roles, Canada’s top five banks performed the best with 28 of 71 board members being female, a percentage of 39.5%. Canada’s largest bank by assets RBC fronted the results with a promising 42.9% of female directors. Next is Scotiabank, who has five women in directorial positions out of 13, a percentage of 38.5%.

Following closely behind Canada, is the UK with 37.9% female directors (25 of 66) across its five biggest banks. Out of the UK banks surveyed, RBS leads the way as 46.2% of boardroom members are female (six of 13).

RBS’ goal is to have at least 30% women overall in its top three leadership layers (c.800 roles) in each of its businesses by 2020 and achieve a full gender balance across the bank by 2030. And as of December 2018, the bank’s top three leadership layers were 37% female on aggregate, an 8% increase since the targets were introduced.

HSBC has six of 14 (42.9%) female directors; Barclays four of 12 (33.3%); Lloyds four of 13 (30.8%); and Standard Chartered five of 14 (35.7%). These figures show a massive upturn in the UK’s retail banking sector as in 2013, across the top five retail banks, only 18.4% of board members were female.

France

France ranks third in terms of gender diversity – across the top five retail banks, 26 out of 79 of directors are female, a percentage of 32.9%. This is an improvement from 2013, where the percentage across the five biggest banks was 30.9%.

Out of the five French banks surveyed, BNP Paribas scored joint highest with six of 14 (42.9%) of its directors being female.

Caroline Courtin, Head of Diversity & Inclusion at BNP Paribas, tells RBI how gender equality is at the forefront of the bank’s mantra.

She says: “Financial services have so far progressed towards gender equality by focusing on their workforce. This narrow focus has helped tackle low-hanging fruit like workplace gender discrimination and stereotyping. Now we need to go further, by driving behavioural and cultural change in individuals.

“For BNP Paribas, the question of Gender equality transcends gender discourse, and the only way for us to truly progress effectively is by having both men and women engaging in a frank dialogue. This is why our Group joined the HeforShe movement. In order to provide a systematic approach in which men can share in the engagement and become themselves agents of change, geared towards the achievement of gender equality.

“In a heavily male dominated industry, the fight against inequality must have the full backing of the male workforce. Having men on-boarded onto those initiatives will enable us to enlarge the scope of work, aimed at changing behavior and culture.”

France’s lowest performing bank was BPCE with four out of 19 female directors, a percentage of 21.1%.

US

The US maintained a middle ground – across the top five banks 31.3% of directors are female.

Citi tops the US ranking as seven out of 17 (41.2%) of its directors are female. This is closely followed by Bank of America who has six out of 17, a percentage of 35.3%.

Speaking to RBI, Cynthia Bowman, Chief Diversity & Inclusion and Talent Acquisition Officer at Bank of America, explains how the banking industry can ensure more females are put into senior roles.

“It starts with attracting the best female talent to our industry and extends to the ways we support their professional development, career growth and engagement once they’re here,” she says. “This means demonstrating that we have a culture that works for them—one that offers not just a job, but a rewarding career with opportunities and resources to help them grow and develop—as well as a workplace environment that recognises and rewards performance and offers a range of benefits to help women balance their work and home lives.

“At Bank of America, for example, our commitment to gender diversity is rooted in leadership accountability, starting with our Board of Directors and CEO and permeating through the company. We are proud that 50% of our global workforce are women; over 45% of our management team are women; and our manager population is over 40% female. Bank of America is also one of only four S&P 100 companies with six or more women on the Board.”

The worst performers

Out of all the countries surveyed, Spain’s retail banking sector is the worst when it comes to gender diversity – just 23.3% (17 out of 73) of board directors across the country’s top five banks are female.

Despite a poor show overall from Spain, CaixaBank performed considerably well with 6 of 16 (37.5%) female directors, according to its website.

Anna Quirós, Corporate Director of LR, Culture and Development at CaixaBank tells RBI: “Diversity is part of our culture at CaixaBank, and we strongly believe that diversity adds value to organisations, making them more competitive, more profitable and sustainable over time. The company values, develops and includes diversity in all its aspects, notably featuring a diversity programme, Wengage, which seeks to develop talent and provide equal opportunities by fostering the inclusion and involvement of all people.

“In order to boost the presence of women in managerial positions, at CaixaBank we have included the scope of gender in managerial development programmes and in promotion, recruitment and training processes. We also have a specific female mentoring programme, which has already been taken by more than 400 women at the company.

“The company has an equality agent figure in all its regional centres, and we also promote measures to seek out a work-life balance, such as teleworking and flexible working hours for the entire workforce.”

In addition, Banco Santander also scored highly with 37.5% (six out of 16) female directors.

Germany

Germany ranked the second lowest – collectively, across Germany’s top five banks 30.2% (29 of 96) of directors are women.

DZ Bank is the only bank to have just one female on its board of directors. This brings its female directorial percentage to 14.3%.

However, Commerzbank shows more promise with eight female directors out of 20, a percentage of 40%.

Bracht adds: “Commerzbank has done a lot in recent years to enable women to take up management careers. These include a guarantee of return after parental leave, childcare, flexible working hours and job sharing. In addition, we have set ourselves the goal of always giving female candidates the opportunity to fill a management position alongside male candidates. This means that if there are not both genders in the selection for a position, we specifically address potential female candidates.”

An industry shift

Speaking to RBI, Prema Varadhan, Chief Architect and Head of AI at banking software company Temenos, explains how women must overcome the biases presented to them in the financial world and argues that banks should focus on hiring people based on merit.

She says: “I believe that the focus should always be on meritocracy. If someone is a good leader, they should be able to obtain any senior position regardless of their sex, which has no correlation to performance. There are plenty of biases out there and as a woman you must not let these distract you from achieving your goals.

“In many industries today, there are many biases, and not just towards women. We see these biases in every industry today – not just in Banking, Software or Technology. If you’re a woman just starting out or at an early stage of your career, you need to be clear on your personal goals and make sure these are aligned with the goals of your organisation. Pursue your passion with conviction and where you need to compromise; be absolutely sure that you are doing it for the right reasons. In my view, following this approach keeps an individual happy and much more likely to thrive as a result.”

Varadhan adds: “I have faced difficulties for a number of reasons, including my gender, the fact that I’m relatively young and also because I am not a native English speaker. But that is beside the point. All individuals face different types of challenges throughout their careers. What we do to overcome those is what defines the individual.

“Ultimately, your actions must speak much louder than your words. We must not focus on complaining about there not being enough opportunities. It’s what we do with the opportunities that are in front of us that matters the most.”

Improvements

Bowman also argues that the number of women within the retail banking industry has improved considerably over the last decade.

“There’s no denying that the representation of women in senior roles is improving – at Bank of America for example, female representation at the highest levels of leadership increased from 33% in 2015 to 42% in 2018,” she says. “I’m incredibly proud to be part of the progress we are making, but we still have more to do.

“What’s been noticeable over the past decade is the focus on leadership accountability, with many financial services firms baking diversity and inclusion into their business scorecards, talent and succession planning, and quarterly business reviews. Our own research notes that stakeholders are placing increasing importance on intangible assets such as gender diversity, to assess the overall value of a company and its chance of long-term success.”

Industry challenges

Rossana Thomas, VP for Product Management, Enterprise Payment Platforms at Fiserv, discusses with RBI what it is like to be a woman in a heavily male dominated industry.

“Balancing a successful career with family life has been a challenge,” she says. “When I first started my career, many women stayed at home to look after their children, and most companies did not offer flexible hours or the option to work from home. My roles throughout my career involved a lot of travelling and late hours. I was just as busy as the men I worked alongside, but there was a social expectation that I should be spending more time at home.

“Over the past decade or so, the workplace environment has changed, and great strides have been made to break down some of the unintentional barriers that women have previously faced. The best advice I can give women who are facing a similar struggle is, whatever decision you make – whether it’s tending to business or a family obligation – don’t second guess your decision. Make the most of the moments you have whether at the office or at home. “

Thomas also explains how she has not let being a woman stop her from achieving her goals.

“I’m very proud of what I’ve accomplished in the last 30 years and don’t feel that being in a male-dominated industry has held me back during my career,” she says. “In my nearly two decades at The Clearing House, I set the strategic direction for The Clearing House’s ACH, wire and check image exchange solutions. I played an active role in the National Automated Clearing House Association (Nacha), changing the way payments were made and moving the needle for introducing electronic payments for consumers.

“I also served as a Nacha board member and was the Chairperson of Nacha’s Marketing Management Group. At Fiserv, I’m developing and implementing strategies for our Enterprise Payments Platform. Key initiatives I’m currently working on include how we enable financial institutions to transition their global high value payments systems to ISO 20022, looking at how we offer value-added services with data analytics and artificial intelligence.”

Advice

Entering the retail banking industry can be a daunting process for a woman, and comes with a series of challenges. Bowman advises that women looking to enter the banking world should do company research before applying for positions.

She says: “Seek out companies that put D&I at the top of their agenda – make sure they are ‘walking the walk’, not just ‘talking the talk’. Look at their leadership – are they holding their managers accountable for having diverse and inclusive teams; what do their diversity statistics look like; are they actively promoting gender equality in their workplace through Committees and offering programmes that specifically focus on the advancement of women to senior levels?

“Women should also take advantage of learning and development opportunities provided by their company – these can have a huge impact on their career. For example, 92% of the women who have participated in Bank of America’s Women’s Next Level Leadership programme – that addresses the unique challenges many multicultural women face in progressing their careers – reported being more effective in their role following the training.”

Furthermore, Thomas suggests that women should have the confidence to step out of their comfort zone and prove themselves.

“Keep learning and try new things. Be curious about other people’s roles and see what you can learn from them,” she adds. “Don’t ever feel like you have to restrict yourself to a certain career path. If there’s an opportunity that you’re curious about, make the most of it.

“Build your own plan. Find a role model, preferably in the financial services industry, who represents what you want from your career. Understand what they are doing that makes you respect them and observe how they make decisions and carry themselves in different settings. What you learn from them will help you as you build your own career.

“And never give up. Learn from your failures and work hard to never repeat them. No one is perfect, but we should always aspire to do the best we can, staying true to ourselves.

How are banks celebrating IWD?

In celebration of International Women’s Day banks and financial organisations are increasingly launching and partaking in numerous initiatives.

For instance, Bank of America promotes awareness of Women’s history through company-wide programmes as well as through sharing teammates’ personal stories.

Bowman says: “As part of our courageous conversation series that engages our teammates in candid dialogue on a variety of topics including diversity and inclusion, and emotional wellness, we’ll host a conversation focusing on the importance of women looking after their own emotional and physical wellbeing.”

Additionally, Fiserv celebrates through a series of “Did You Knows” highlighting important milestones and achievements, including recognition of the 100th anniversary of the ratification of the 19th Amendment to the U.S. Constitution, which granted women the right to vote.

Fiserv also offers year-round programming that supports women, including the Fiserv Women’s Impact Network (WIN), which fosters supportive and productive relationships among female associates and their male allies across the company to enhance engagement and create an environment of equality and success.