Hong Kong has seen more than its fair share of disruption in recent months, with protests and Covid-19 postponing the plans of some virtual banks. Despite the delays, however, a number of new banks are pushing ahead with launches, and many are optimistic about their prospects. Jane Cooper reports

Expensive real estate, Covid-19 and protests that have closed branches have all added to a new environment in Hong Kong where digital, branchless banking is gaining attention.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

This, along, with the Hong Kong Monetary Authority (HKMA)’s push for a new wave of virtual banks, means a handful of players have started pilots and are preparing for a full launch.

Although some plans have been delayed, the recent disruption has been shrugged off by the virtual banks, which argue that they will be well positioned in the changing retail banking market in Hong Kong.

What is a virtual bank?

A ‘virtual bank’ may sound like the latest buzzword – and not much different from a neobank, challenger bank or even a regular digital bank – so, what is it? In Hong Kong, it refers specifically to a retail bank that primarily offers its services via digital channels rather than branches, and has been granted a new licence by the HKMA. It is part of the HKMA’s wider Smart Banking Era initiative, and aims to promote fintech, improve customer experience, and enable financial inclusion – both for individuals and SMEs.

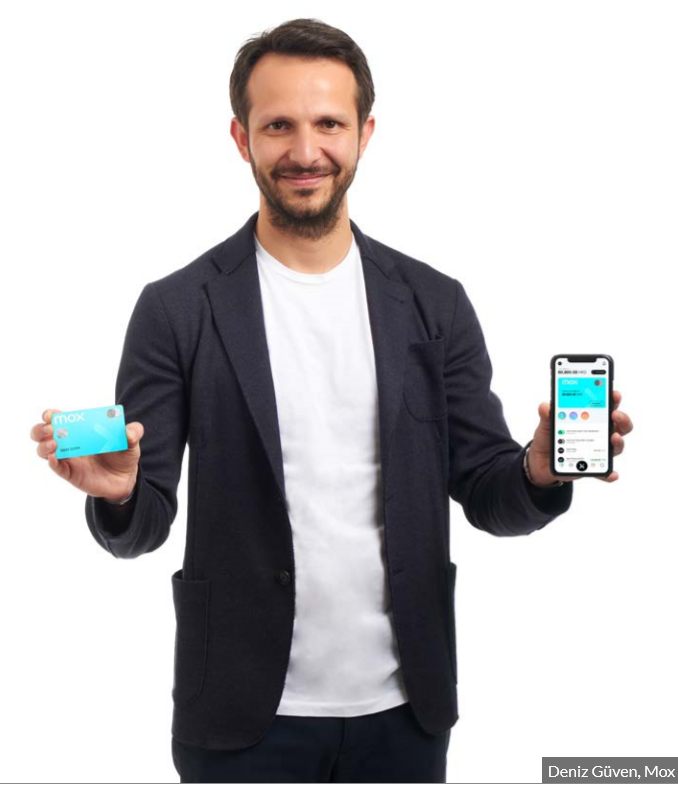

Deniz Güven, CEO at virtual bank Mox, explains how he believes the new licences will make a difference. “If you want to create an ecosystem in a market like Hong Kong, you need to create some strong and solid initiatives,” he says.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThrough the HKMA’s measures, virtual banks can attract technology and talent to Hong Kong and get fintech partners on board. Without the substance of a solid initiative, it is difficult to attract them, Güven explains.

The HKMA has also laid out what it expects of its new virtual banks, stipulating, for example, that they cannot impose minimum account balances or low-balance fees. In terms of products, it is expected the new banks will offer deposits, loans and interbank transfers, with the product suite developing over time.

HKMA deputy chief executive Arthur Yuen wrote in December 2019: “We believe that as virtual banks gain a better understanding of their customers’ preferences and habits over time, they will leverage financial technologies to offer more personalised products and services, and a new user experience to customers.”

He added that since the first virtual licences were announced, a number of other institutions have approached the HKMA, “suggesting strong market confidence in the industry’s prospects”.

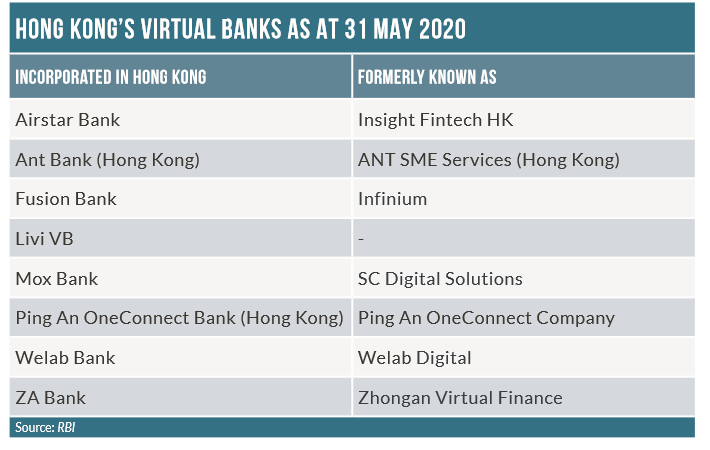

Eight virtual licences

There are currently eight virtual banks that have Hong Kong licences, which were granted in the first half of 2019: Airstar Bank, Ant Bank, Fusion Bank, Livi VB, Mox Bank, Ping An OneConnect Bank, WeLab Bank and ZA Bank.

An HKMA spokesperson provides an update on their current status: “Two virtual banks have officially commenced operations, and five other virtual banks are conducting pilot trials in the HKMA’s Fintech Supervisory Sandbox.

“The remaining virtual bank is completing the necessary preparatory work, with a view to offering services to the public as soon as practicable.”

These plans have been a long time in the making, and part of a careful selection process. The HKMA published its revised guidelines on virtual banks back in May 2018 and received a total of 33 applications, which were eventually whittled down to the eight that currently have licences.

The announcement of those licences was staggered – in March, April and May 2019 – with each press release stating that the virtual banks intended to launch within six to nine months. However, those plans were postponed, with local news reports giving the protests and coronavirus as reasons.

ZA Bank goes live

ZhongAn Virtual Finance – which has branded its virtual unit ZA Bank – was the first to go live in Hong Kong. The bank, which is 51% owned by ZhongAn Online and 49% by Sinolink Group, launched a pilot for 2,000 customers in December 2019, focusing on transfers, savings products and multicurrency accounts.

The other virtual banks have been working on similar pilots. For example, Livi – a joint venture between Bank of China (Hong Kong) with a 44% stake, and JD Digits (36%) and Jardine Matheson (20%) – began a beta test in May 2020.

In March 2020, Airstar Bank launched a pilot and later announced its official launch in June 2020, which included savings, time deposits and loans. An Airstar spokesperson said at the time of launch: “With a mission to become ‘everyone’s bank’, we harness financial technology to deliver simple, tailor-made and practical products at very reasonable costs to our users through a personalised and efficient virtual banking experience.”

Also in June 2020, Ping An OneConnect (PAOB) – which has parent companies OneConnect Financial Technology Co. and Ping An Insurance (Group) Company of China – announced its pilot. One of its initiatives is with a partnership with e-commerce provider Tradelink, through which the virtual bank has created a risk assessment platform so SME clients do not need to submit documents to have loans approved. During the trial, selected SME clients “can experience hassle-free and speedy account-opening service, with no minimum account balance required.

“Selected SME clients can open business accounts with facilitation by PAOB’s SME banking mobile application, officially known as PAOB SME, and a face-to-face interview with a PAOB relationship manager. For example, for the selected SMEs with only two shareholders, we shorten the account-opening time to as fast as 40 minutes,” a spokesperson tells RBI.

With the entrance of so many new players in the market, it is difficult to distinguish between them. Guy Parsonage, partner and Hong Kong leader at PwC’s Experience Consulting unit, says of the new virtual banks: “There is no clear winner or loser in the market at the moment. They are all doing a good job of making some noise, and there has been some level of attraction and sign ups – even if customers are signing up just to know when they will launch.”

Although the initial licences appear to be granted to operations that are not the large, traditional players in the Hong Kong market, this does not mean the traditional players do not have a plan for the virtual market. “All traditional banks in Hong Kong have a virtual bank or a neobank strategy,” says Parsonage, who adds that virtual banks have the advantage of starting from scratch without the burden of history and connecting to legacy systems.

“The virtual banks are building on customer needs and do not have to fit in with existing systems, politics and policies – that is why traditional banks are carving out new virtual banks. They can start with what the market needs, evolve it and address a specific pain point that has not been considered.”

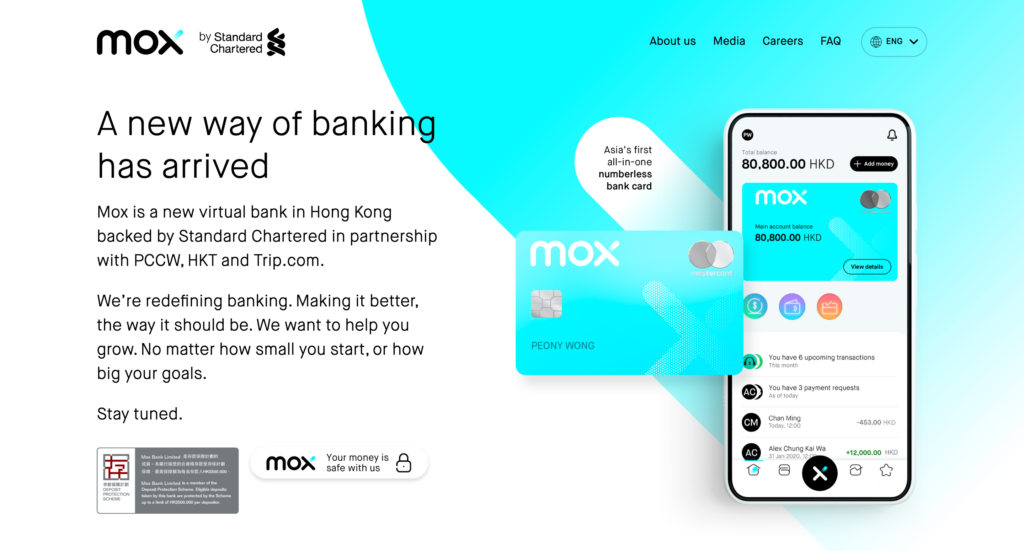

Explaining the rationale behind Standard Chartered’s decision to launch a separate virtual bank, Güven says that when the HKMA announced its Smart Banking Initiative, Standard Chartered thought carefully about how it could use the opportunities it presented in a different way. It considered whether Standard Chartered could attack this market with a virtual bank using its existing operating model. “The most important thing is that we did not start this journey to create a different mobile bank. We said: ‘Let’s create a future operating model for Standard Chartered’,” he says.

The bank, a joint venture between Standard Chartered Bank (Hong Kong) with a 65.1% shareholding, PCCW and HKT (25%) and Ctrip Financial (9.9%), is currently in its beta phase with invitation-only customers.

Güven comments that from a product standpoint, Hong Kong is a mature market, with a variety of different products available. However, when it comes to serving customer needs digitally, the market is still premature.

“The banks [in Hong Kong] have different products, but they are not digitalised,” he says, adding that while Hong Kong is highly banked, “a huge amount of people are underserved, which is different from being unbanked.”

Güven adds that almost everybody in Hong Kong has a bank account, but the mass and upper-mass markets do not get real service; they have to go to branches frequently, and cannot always access products easily. Mox started to investigate the difficulties for Hong Kong bank customers, and after conducting ethnographic research with 2,000 respondents, found a total of 80 pain points.

Investment paralysis?

Has the recent disruption added to Hong Kong customers’ pain points, or has it provided a unique opportunity for the new virtual banks?

PwC’s Parsonage comments: “Board decisions that have required lots of investment have been harder to make. There has been an investment paralysis and a slowdown in larger, strategic decisionmaking.”

Regarding the move from pilot to full launch, an HKMA spokesperson says: “The outbreak of Covid-19 has inevitably affected the virtual banks’ preparation for the launch of services. The HKMA will continue to maintain close dialogue with the virtual banks to understand their readiness for business commencement.”

Despite the recent disruption in Hong Kong, PAOB is optimistic: “We take the view that Hong Kong’s prospects are good and positive. PAOB is dedicated and focusing on our pilot trial currently,” its spokesperson says.

They add: “In order to support SMEs to ride through challenges from the Covid-19, PAOB has also participated in the SME Financing Guarantee Scheme launched by HKMC Insurance. We will support 90% Guarantee Product under the scheme from the third quarter of this year, in order to alleviate SMEs’ cashflow pressures.”

Focusing on what the recent disruption in Hong Kong means for customers, Güven notes: “We are now seeing an interesting inclusion: not financial inclusion, but real inclusion,” he says, adding that in the past, people may have thought their parents were digital if they were on Facebook.

Now, however, the disruption has pushed a change a more significant change in behaviour. “Right now, everybody of different ages has started to consume digitally,” Güven says, referring to data suggesting that approximately 500,000 people carried out their first e-commerce transaction in the first quarter of this year – a significant amount given Hong Kong’s population of approximately 7.4 million.

“Covid-19 has been unfortunate for everybody, but there is a huge potential to accelerate and gain new customers.” Güven continues.

“From a company standpoint, we are fully digital – we have developed everything digitally, so that helps us as well. In the beginning it was not easy for any of us, but I do not see any delays or difficulty right now,” he concludes.