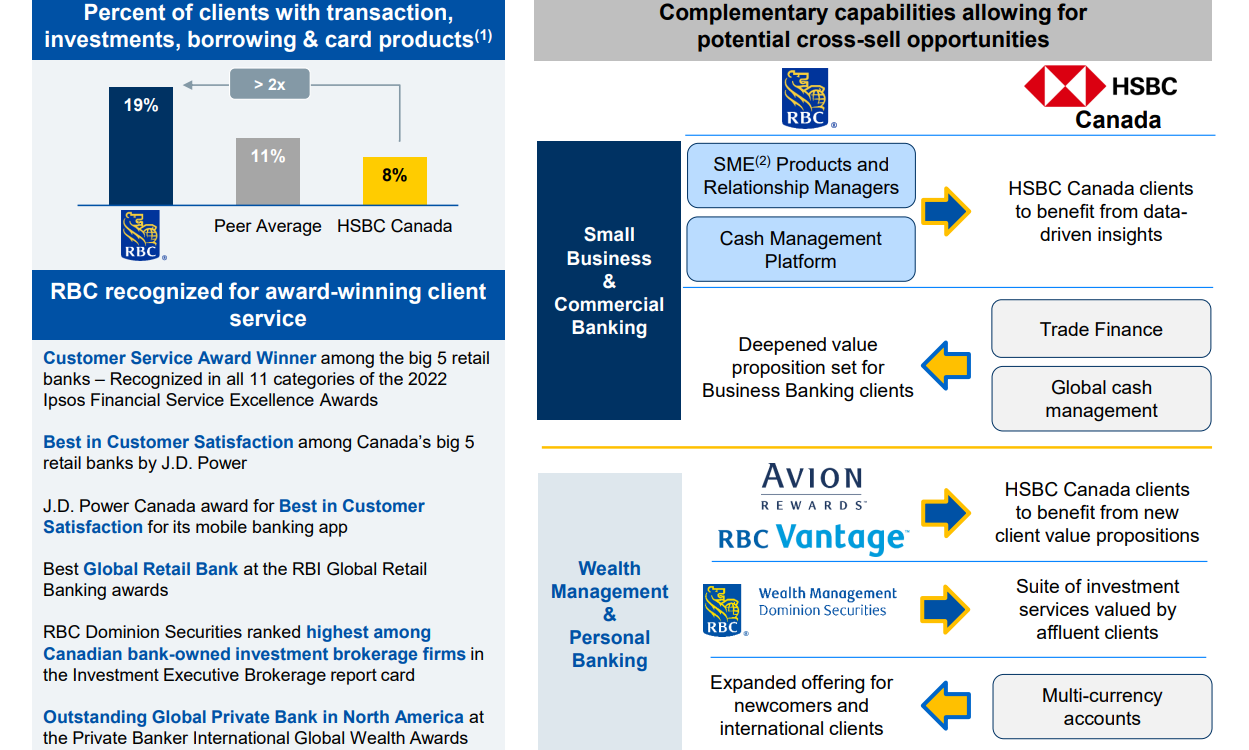

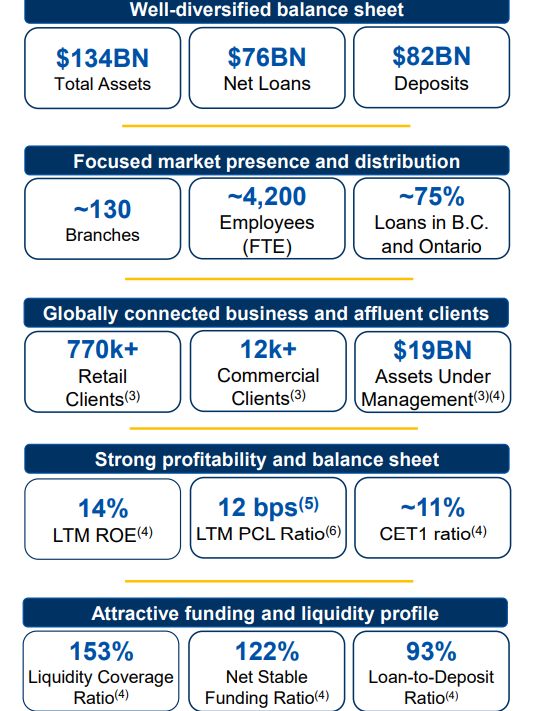

HSBC Bank’s decision to exit the Canadian marketplace in 2022 caught the attention of the country’s financial sector. It was the seventh largest lender in Canada and its affluent, globally connected client base and robust commercial portfolio made it an attractive acquisition.

For RBC, the country’s largest bank by market share, combining with HSBC Bank Canada would strategically expand its Canadian business, while fulfilling key priorities such as generating new sources of deposits and carving out new competitive advantages.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Most importantly, it would provide a broader range of products and services to RBC clients and an opportunity to deepen those relationships by creating even more value – a core tenet of RBC’s investment thesis, and an important way the Street evaluates its growth strategy.

Accelerating growth

Ultimately, the Toronto-based bank’s winning bid of $13.5bn has set up RBC to “accelerate key components of our growth strategy,” according to Dave McKay, RBC’s CEO.

To build on the momentum of the acquisition, RBC recently announced changes to its executive team to align leaders and teams with growth priorities. This includes the expansion of RBC’s commercial banking capabilities and global wealth management business, the advancement of its digital platforms and the strengthening of its deposit franchise.

“We are positioning ourselves to take advantage of our scale, speed up decision making and elevate leaders to deliver on strategic growth priorities. This will help us focus on the things that matter most—bringing clients trusted advice, ideas and experiences that they truly value,” said McKay.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataNeil McLaughlin, who led RBC’s personal and commercial bank during the HSBC Canada acquisition and integration, agrees. “To ensure a consistent banking experience for HSBC’s Canadian customers, RBC fast-tracked the development of various new products and services, including foreign currency accounts, liquidity management products, and the ability to trade on international markets.”

McLaughlin described the introduction of a suite of new international banking services as “well-timed” as immigration continues to fuel Canada’s population growth, building a pipeline of prospective clients with unique needs and circumstances.

“By bringing together the capabilities and international connections of HSBC Bank Canada and RBC, we’ve taken our differentiated client experience to the next level. It was a massive undertaking but we’re excited to expand these important global banking services to all our clients,” added McLaughlin.

HSBC Canada Key Metrics

Massive undertaking

This once-in-a-lifetime acquisition also came with a once-in-a-lifetime challenge according to McKay. The deal required RBC to extract all client and employee data from HSBC’s systems and place it on top of RBC’s technology stack immediately following the closure of the deal. That meant RBC needed to migrate more than 780,000 clients and 4,500 employees to RBC systems over a 48-hour period, not to mention the conversion of five new business lines and the overnight transformation of more than 125 branches from HSBC Bank Canada to RBC.

The integration project was overseen by Neil McLaughlin, Bruce Ross, RBC’s Group Head, Technology & Operations and RBC’s Chief Human Resource Officer, Kelly Pereira. The aim around the leadership table was to elevate the interests and ambitions of RBC above a specific business or function, thereby looking at the integration through a ‘One RBC’ lens.

12,000 technical steps

As with any major transformation, success often hinges on the strength and resilience of an organisation’s tech infrastructure.

“This integration was a massive undertaking – one of the most complex technology transitions in our history,” said Ross. “While our scale and existing tech capabilities uniquely positioned us to handle the complexities of the close-and-convert process, nobody had a playbook for how to do this.”

To ensure a clean integration and a seamless tech transition, more than 2,000 tech employees spent almost 18 months preparing for the conversion weekend and everything was planned down to the minute.

“Our long-term investment in next generation technology delivery platforms has been pivotal to the successful execution of the HSBC Bank Canada acquisition and conversion,” added Ross.

Leading with culture

Pereira explained that without a playbook for this scenario, the bank’s culture served as both the benchmark and litmus test of big discussions and decisions that took place around the leadership table.

“From my perspective, culture is the single most important factor that guides organisations to solve tough challenges and accomplish bold and ambitious goals,” said Pereira. “RBC’s culture supports candour, transparency, and speaking up and is about putting the client at the heart of every action and decision that is taken.”

Siloes were knocked down and hierarchies flattened to help the bank lean on ‘“radical prioritisation’” and speed up decision-making processes. Employees were invited to put their ideas out there and raise difficult problems, regardless of level.

“The work we did to deliver on our transformational acquisition of HSBC Bank Canada showed us what we are capable of when we work as One RBC; unlock the tremendous potential of our talent and bring the full strength of RBC together to take on an ambitious challenge,” said McKay. “Teams moved faster to deliver on an incredibly complex project. And leaders prioritised organisational ambition to drive outcomes. I’m confident our collective effort and experiences will serve as a catalyst for accelerated growth.”