As branch networks continue to diminish, smartphone banking apps are fast becoming the most convenient way for consumers to engage with their banks, writes Briony Richter

Traditional banks are under more pressure than ever to provide seamless and efficient digital services, as customers move away from traditional banking and opt for online channels to meet their banking needs.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

That is also not to mention that incumbent banks are no longer the only big players in the market. Waves of digitally focused banks have swept through the financial sector with the goal of providing the best digital services that consumers desire.

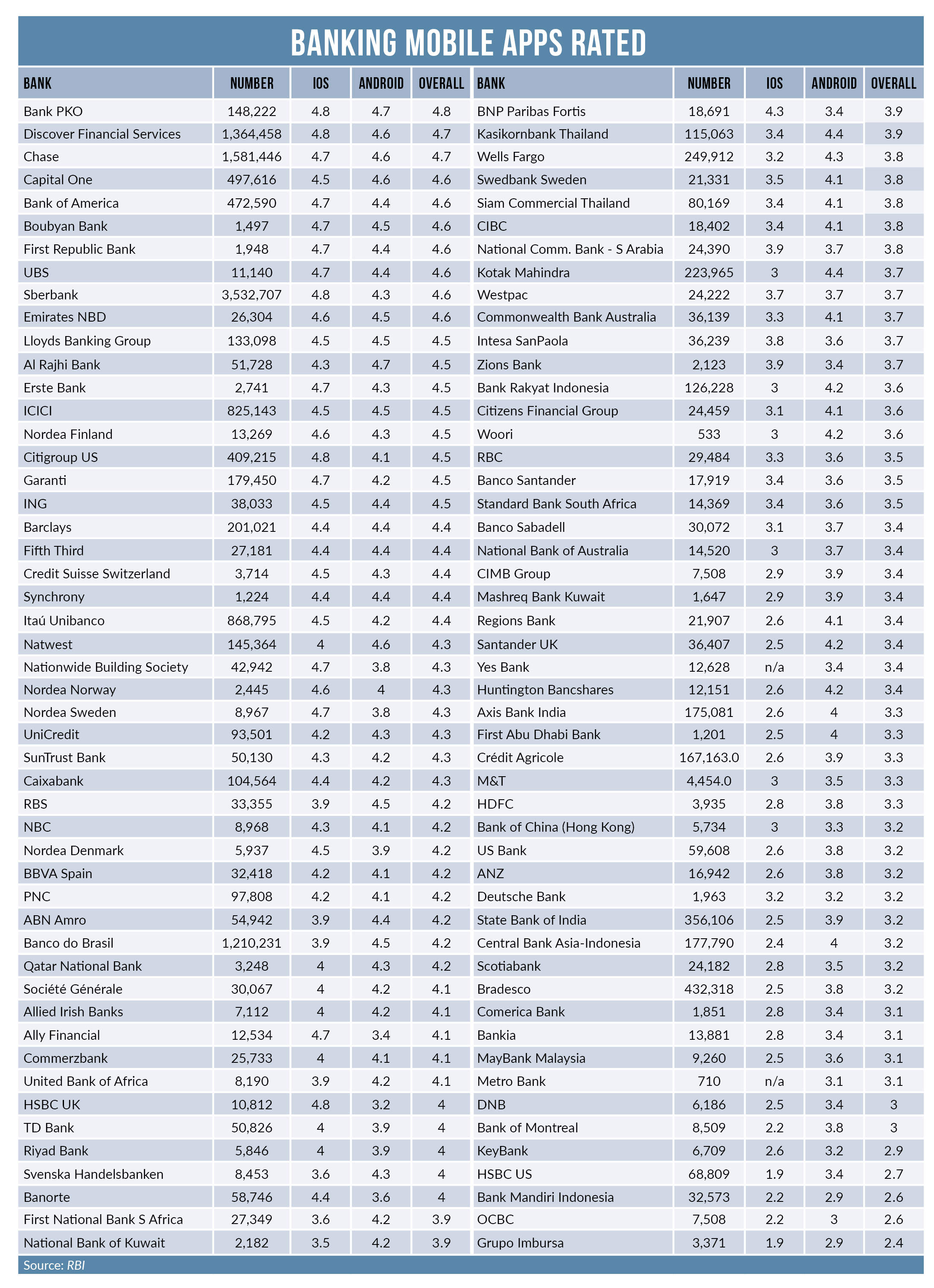

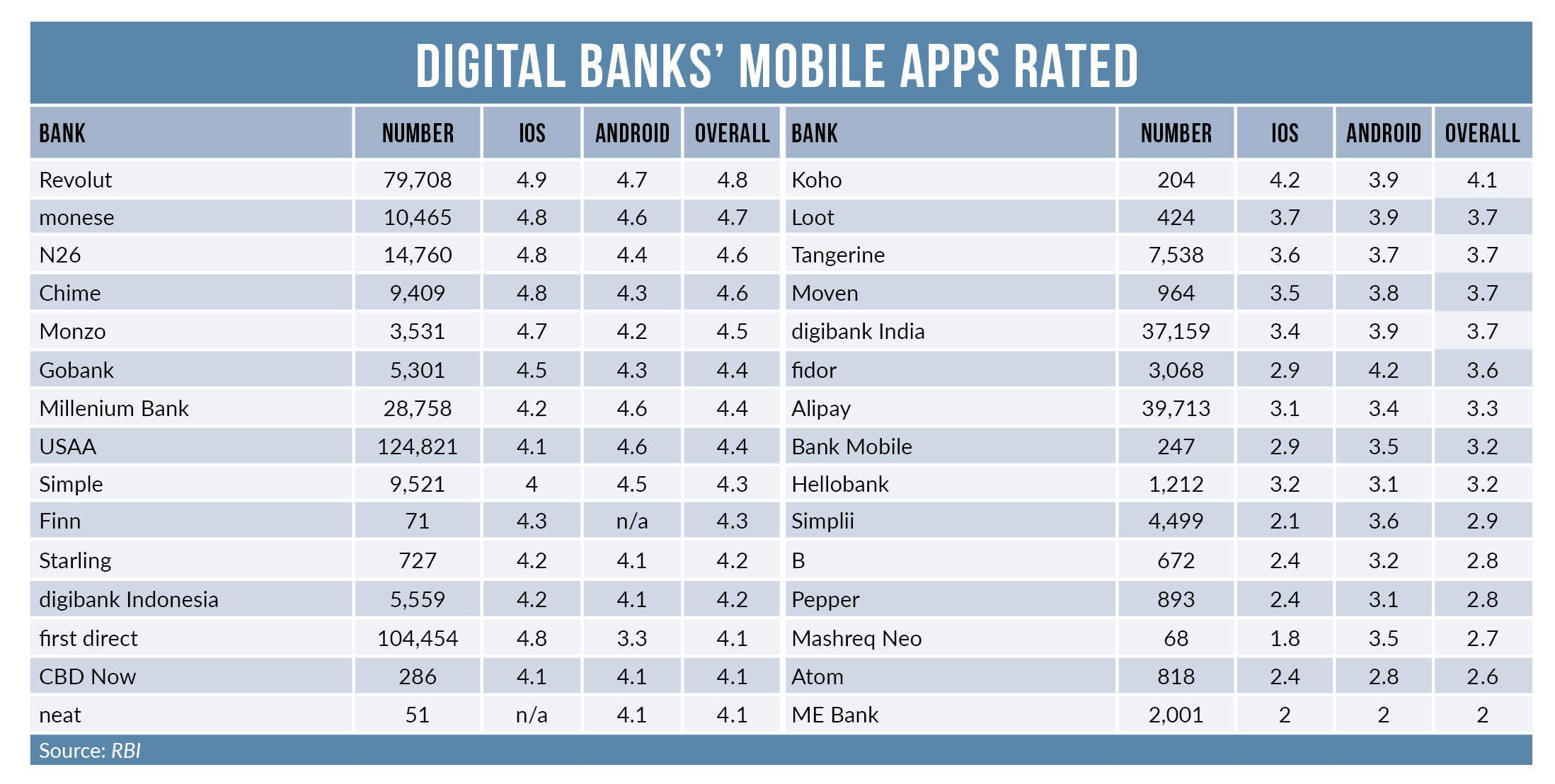

RBI has aggregated user rankings from the Apple and Android app stores to find an overall rating of mobile banking apps. Of 100 traditional banks, 49 scored ratings of 4.0 or above out of 5.0, and 17 out of 30 digital banks had ratings of 4.0 or above. However, none of the traditional or digital banks dropped below an overall rating of 2.0.

Traditional Banks

Poland’s Bank PKO achieved the highest overall rating, 4.8, with its mobile banking app, IKO. The app provides all the basic banking services such as balance checking and transfers, as well as allowing customers to withdraw from ATMs without a bank card.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSpeaking to RBI, Łukasz Kuc, head of mobile and internet banking bureau at PKO, states:

“For almost two years IKO has been within the top-rated mobile banking applications in Poland. Every single day we work on boosting the IKO app, adding other features that are expected and desired by its users, improving the app’s ergonomics in reaction to customers’ comments and notifications. This fantastic rating is a result of many small steps made systematically and consequently in our organisation. We are the best example that shows operating on a large scale can go hand in hand with excellent quality.

“While creating products and services that set new trends in the market, we are a forerunner of innovation, and actualise the idea of omnichannel. We systematically develop the range and quality of the electronic banking services, including iPKO, Inteligo and IKO mobile banking.

“Our customers appreciate the innovative solutions offered to them, which is reflected in the dynamic growth of the number of users of remote channels.”

Just behind, with overall ratings of 4.7, are Discover Financial Services and Chase bank. The Discover app allows customers to check balances and make transactions. According to reviews on the Android and Apple stores, Discover customers are extremely happy with the ability to freeze and unfreeze accounts, as well as Discover’s cashback offers. Seven banks scored 4.6, including Capital One, Lloyds Banking Group, UBS and Bank of America (BofA). The BofA app is celebrated for its speed by users.

Speed and responsiveness are hugely important for customers to carry out banking tasks effectively. Itaú Unibanco achieved an overall rating of 4.4. Its app is praised for its simplicity and quick response time.

Lívia Chanes, head of digital channels at Itaú Unibanco, comments: “We aim to design functions that answer our clients’ demands – we want an app that is more convenient and intuitive. To achieve that, we have thorough monitoring of feedback from app stores and social media.

“All of our interactions are tested with client groups and gradually adjusted to their feedback to become as practical and charming as possible. We also add our technical achievements to reach these top evaluations – we are currently at the lowest point in history in crash occurrences.

“These good evaluations of our app originate from three sources: intuitive experience; complete features, with virtually all of the bank’s products and services available in the app; and safety, with a cybersecurity team fully dedicated to making sure that mobile operations remain safe.”

In Canada, Royal Bank of Canada (RBC) has positive ratings overall, with minor complaints about update glitches and speed. One reviewer on the Android app store offers high praise for the fingerprint login capability.

Rami Thabet, VP of mobile and digital money management at RBC, states: “At RBC, we’re making the mobile experience for our clients delightfully simple by building digital capabilities that are more convenient, seamless and more personalised to help them manage their day-to-day finances and reach their financial goals.

“In just two years, RBC has become the number 13 bank in the world for mobile features. This year we delivered more features to market than the other big four Canadian banks combined, while continuing to deliver value through our other digital channels. We’re so proud to have been ranked highest in customer satisfaction among mobile banking apps and the Canadian big five banks in the inaugural JD Power 2017 Canadian Mobile Banking App Study.”

Scotiabank has been making huge efforts to transform banking. The bank has opened up five Digital Factories, which focus on partnerships with fintechs and research institutions while paving the way for financial transformation. The factories are essential for searching out new ways to solve problems for Scotiabank customers. Taking advice from startups on how to approach the market differently will enable Scotiabank to improve on its mobile banking platform.

Dubie Cunningham, Scotiabank’s VP of enterprise innovation, says: “One of the exciting things about the Digital Factories is collaboration on mobile banking across the geographies.

“One of our key goals is to increase our customers’ adoption of digital banking, and to extend our digital reach to customers. We expect digital payment adoption to increase. We want to be where our customers want us to be, whether this in social media messaging apps or in chatbots.”

HSBC’s UK and US mobile banking apps score overall ratings of 4.0 and 2.5 respectively. Users of the UK app note how easy it is to activate and navigate, with many praising its new design. Banks, both traditional and digital, strive to provide excellent customer service and functionality, but also look to develop apps with creative designs that represent the brand.

Raman Bhatia, head of digital for HSBC UK and Europe, speaks about the importance of providing excellent mobile service: “Our new mobile banking app has been designed to improve the on-the-go banking needs of our customers.

“Since 2016 there has been over a 20% increase in the number of customers using the HSBC mobile banking app, and following detailed customer research the new app has been designed with improved functionality including the ability to add new payees, the option to report a debit card lost or stolen and a 70% reduction in login time.

“We will build on these features throughout the course of this year and next, introducing new services, such as Pay by Bank App, via a series of regular updates,” Bhatia adds.

However its US counterpart does not share the same positive reviews. Although some customers are generally happy with the app’s performance, others note an invasion of bugs, and the app crashing while updating.

A HSBC spokesperson responds to the rating, saying: “Our mobile banking app serves customers in 28 markets, giving them easy access to their accounts no matter where they are in the world.

“With the app covering so many countries, the features it offers vary from market to market and this may account for the rating differences.

“We have listened to customer feedback and built a new mobile banking app which has a number of enhancements. We are now in the process of rolling out the app across all of our markets over the coming months, with the UK being one of the first, resulting in its strong app store rating. We continually seek feedback from our customers to improve their mobile banking experience with us.”

Ameesh Vakharia, omnichannel executive for SunTrust Bank, comments on its 4.3 rating: “As our clients increasingly embrace digital banking, we are hard at work adding new features and ensuring the app remains easy to navigate, whether someone wants to quickly check an account balance, make a transaction or even start the process of opening a new account

“Last year we became one of the early adopters of Zelle to give clients a fast way to send and receive payments right from the app. We’re also making the mobile experience more personalised by alerting clients to services we offer based on their individual financial needs.

“At SunTrust, our purpose of ‘Lighting the Way to Financial Well-Being’ for our clients relies on this continued commitment to providing the tools and technology that make banking with us easy and enjoyable.”

Digital Banks

Digital-first banks continue to gain momentum across the world, and these challengers have brought a host of innovative new features that create an overall better customer experience. The need to conveniently manage money opens up a large space in the financial sector for branchless banks to offer efficient and simple banking solutions through digital channels.

Ranking number one is UK banking startup Revolut, achieving 4.9 overall. Promoting itself as ‘better than your bank’, Revolut is no stranger to embracing new ways to make banking easier for its customers. Reviews celebrate its simplicity and efficiency, as both a primary and secondary account.

Chad West, head of global brand and communications at Revolut comments: “Unlike the traditional banks, we don’t need big, fancy marketing budgets to acquire new customers. Instead, we focus all of our resources on building a product that actually serves the needs of our customers. From hidden fees to slow technology, people have been forced to accept the ways of the banks.

“From opening an account in 60 seconds and receiving real-time spending analytics to spending abroad with no fees and instantly exchanging cryptocurrencies, Revolut has demonstrated that banking can be done better – and this is reflected in our high approval ratings from our 1.3 million customers.”

Monese, N26, Chime and Monzo all score 4.5 or above. Android users’ reviews for Monese are generally positive, saying the app is hassle-free and easy to activate.

Ole Mahrt, head of product at Monzo, says: “Our goal is to give people total visibility and control of their money, and everything that touches it. To do that, we’re working hard to understand how our users really live and use their money, and build a product that solves their problems and caters to their needs.

“But our products only part of it: we communicate clearly and transparently with our customers, provide them with fast, friendly support, involve them closely in important decision-making, and use their feedback to guide our product development.”

N26 CEO and founder Valentin Stalf speaks about the efforts made to provide a seamless experience for customers: “N26 has redesigned banking for the smartphone, making it fast, simple and contemporary. In addition, we offer a first-class web interface.

“In principle, we have reinvented banking – not just developed a new interface for an existing offering. Opening an account only takes eight minutes. Our customers are able to lock and unlock cards directly within the app and receive a real-time push notification every time a transaction is made.

“Our general aspiration towards our customers is very different. We have created a completely different brand experience and our customers are proud to bank with us, which is rather unusual in the banking industry. The source of our inspiration is not traditional banks, but brands like Spotify or Google which offer a great user experience.”

Falling behind are Atom, Pepper and ME Bank, all ranking under 3.0. Customers raise a variety of concerns about their experience with Atom’s mobile banking app, with some highlighting sluggish updates and poor interface. For branchless banks, the digital channel is the only way to engage with customers, so it is crucial that improvements are made to the apps in order to interact proactively.

Katy Ringsdore, head of PR and internal communications at Atom, responds to the rating, highlighting Atom’s commitment to great customer service: “Over the last 18 months, we have designed and implemented an award winning multi-channel voice of the Customer Programme that captures feedback across all customer touch points including Contact Centre, Website, In-App and social. In January 2017, we launched a Customer Panel, to ensure all changes we implement have been fully tested by verified Atom customers.

“Since we went live to the public with our first product in April 2016, we have implemented over a hundred incremental improvements to the App with many more planned in 2018. Our Trustpilot rating is 4 stars with a trust score of 8.8/10.”

Consumers are increasingly willing to make important financial decisions with a tap of an app and manage all aspects of their lives on the go. With standards already high, both traditional and digital banks will have to keep pushing digital innovation to keep up with the expectations of an ever- increasing, digitally focused population that now expects a unified experience on any smartphone or electronic device available.